Region:Middle East

Author(s):Shubham

Product Code:KRAC3710

Pages:87

Published On:January 2026

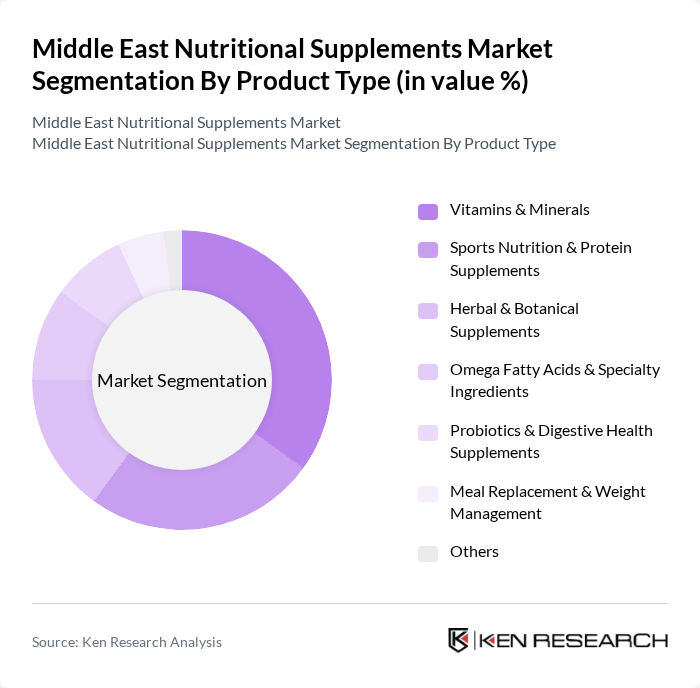

By Product Type:The product type segmentation includes various categories such as Vitamins & Minerals, Sports Nutrition & Protein Supplements, Herbal & Botanical Supplements, Omega Fatty Acids & Specialty Ingredients, Probiotics & Digestive Health Supplements, Meal Replacement & Weight Management, and Others. Among these, Vitamins & Minerals are the most dominant due to their essential role in daily health maintenance, strong consumer familiarity with multivitamins, and the increasing awareness of micronutrient deficiencies and immunity support among consumers.

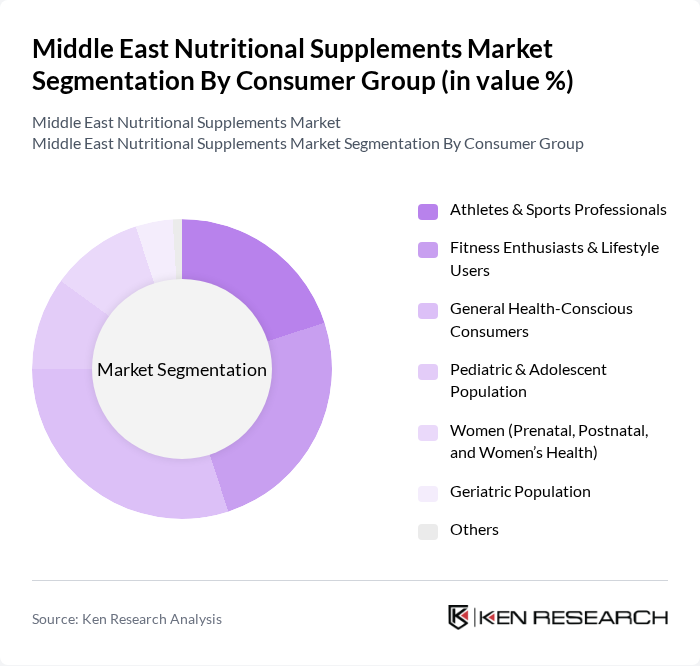

By Consumer Group:The consumer group segmentation includes Athletes & Sports Professionals, Fitness Enthusiasts & Lifestyle Users, General Health-Conscious Consumers, Pediatric & Adolescent Population, Women (Prenatal, Postnatal, and Women’s Health), Geriatric Population, and Others. The segment of General Health-Conscious Consumers is leading the market, driven by a growing trend towards preventive health measures, a strong focus on immunity and energy, and the increasing availability of information and recommendations through healthcare professionals, gyms, influencers, and digital channels regarding health benefits associated with nutritional supplements.

The Middle East Nutritional Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, LLC, Nestlé S.A., Abbott Laboratories, Glanbia plc, USANA Health Sciences, Inc., The Bountiful Company (Nature’s Bounty, Solgar, etc.), Blackmores Limited, Swisse Wellness Pty Ltd, Garden of Life LLC, NOW Health Group, Inc. (NOW Foods), DSM-Firmenich, Bayer AG (Consumer Health), Local & Regional Players (e.g., Jamjoom Pharma, Saudi Pharma, Julphar) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East nutritional supplements market appears promising, driven by increasing health consciousness and a shift towards preventive healthcare. Innovations in product formulations, particularly in plant-based and organic supplements, are expected to attract a broader consumer base. Additionally, the rise of personalized nutrition solutions will likely enhance consumer engagement, as brands tailor products to meet individual health needs, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Vitamins & Minerals Sports Nutrition & Protein Supplements Herbal & Botanical Supplements Omega Fatty Acids & Specialty Ingredients Probiotics & Digestive Health Supplements Meal Replacement & Weight Management Others |

| By Consumer Group | Athletes & Sports Professionals Fitness Enthusiasts & Lifestyle Users General Health-Conscious Consumers Pediatric & Adolescent Population Women (Prenatal, Postnatal, and Women’s Health) Geriatric Population Others |

| By Distribution Channel | Pharmacies & Drug Stores Supermarkets/Hypermarkets Specialty Health & Nutrition Stores Online & E-commerce Platforms Direct Selling Others |

| By Form | Tablets Capsules & Softgels Powders Liquids & Shots Gummies & Chewables Sachets & Effervescent Others |

| By Age Group | Infants & Toddlers (0-3 years) Children (4-12 years) Adolescents (13-19 years) Adults (20-59 years) Seniors (60+ years) |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Egypt Rest of Middle East |

| By Price Tier | Economy Mass-Market Premium Super-Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutritional Supplements | 120 | Store Managers, Product Buyers |

| Health and Wellness Clinics | 90 | Nutritionists, Health Coaches |

| Online Supplement Retailers | 70 | E-commerce Managers, Marketing Directors |

| Consumer Focus Groups | 60 | Health-Conscious Consumers, Fitness Enthusiasts |

| Pharmacies and Drugstores | 80 | Pharmacists, Inventory Managers |

The Middle East Nutritional Supplements Market is valued at approximately USD 3.4 billion, reflecting a significant growth trend driven by increasing health awareness and rising disposable incomes among consumers in the region.