Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9043

Pages:85

Published On:November 2025

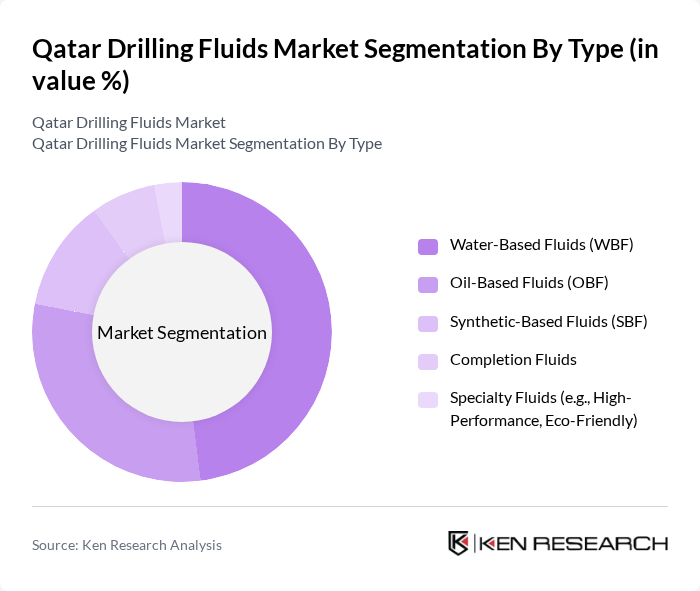

By Type:The market is segmented into Water-Based Fluids (WBF), Oil-Based Fluids (OBF), Synthetic-Based Fluids (SBF), Completion Fluids, and Specialty Fluids. Water-Based Fluids are the most widely used, accounting for the largest market share due to their cost-effectiveness, operational safety, and environmental advantages. Oil-Based Fluids are preferred for high-temperature and high-pressure drilling environments, providing superior lubrication and stability. Synthetic-Based Fluids offer enhanced performance and lower toxicity, while Specialty Fluids—including high-performance and eco-friendly formulations—are gaining traction as operators prioritize sustainability and regulatory compliance .

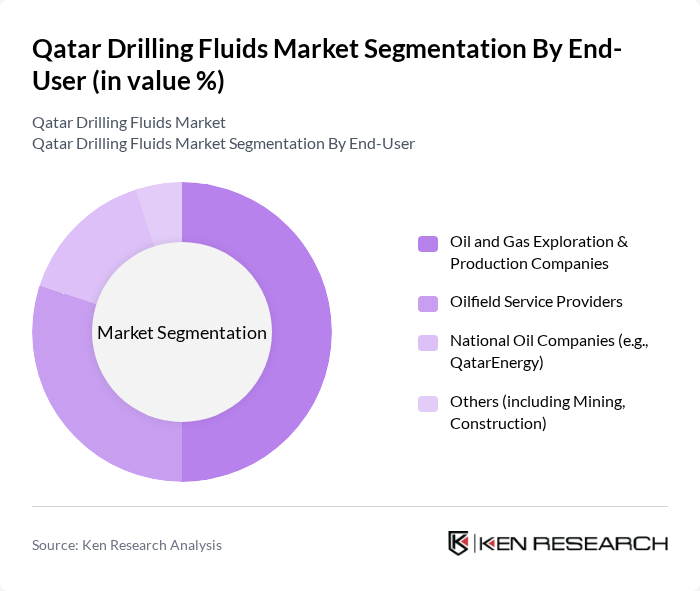

By End-User:The end-user segment includes Oil and Gas Exploration & Production Companies, Oilfield Service Providers, National Oil Companies (e.g., QatarEnergy), and others such as mining and construction sectors. Oil and Gas Exploration & Production Companies dominate this segment, driven by extensive drilling operations and the need for specialized fluids to enhance efficiency, safety, and regulatory compliance. Oilfield Service Providers play a critical role in delivering advanced fluid solutions and technical services, while National Oil Companies and other sectors contribute to demand through ongoing infrastructure and development projects .

The Qatar Drilling Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger, Halliburton, Baker Hughes, Weatherford International, Newpark Resources, M-I SWACO (A Schlumberger Company), Tetra Technologies, QMax Solutions, Fluid Dynamics Inc., PetroChem Solutions Ltd., Qatar Drilling Company (QDC), Gulf Drilling International (GDI), AlMansoori Specialized Engineering, Baroid Industrial Drilling Products (A Halliburton Company), CES Energy Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar drilling fluids market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As the demand for oil and gas exploration continues to rise, companies are likely to invest in innovative drilling solutions that enhance efficiency and minimize environmental impact. Additionally, the shift towards eco-friendly drilling fluids will create new market segments, fostering growth opportunities for suppliers who can meet these evolving demands while adhering to regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-Based Fluids (WBF) Oil-Based Fluids (OBF) Synthetic-Based Fluids (SBF) Completion Fluids Specialty Fluids (e.g., High-Performance, Eco-Friendly) |

| By End-User | Oil and Gas Exploration & Production Companies Oilfield Service Providers National Oil Companies (e.g., QatarEnergy) Others (including Mining, Construction) |

| By Application | Onshore Drilling Offshore Drilling Directional & Horizontal Drilling Enhanced Oil Recovery (EOR) Others |

| By Fluid Properties | Viscosity Density Filtration Control Lubricity Environmental Compatibility Others |

| By Region | Doha Al Rayyan Al Wakrah Dukhan Ras Laffan Others |

| By Supply Chain | Raw Material Suppliers Drilling Fluid Manufacturers Service Providers Distributors/Logistics End Users Others |

| By Regulatory Compliance | Local Regulations (Qatar Ministry of Energy & Industry) International Standards (API, ISO) Environmental Compliance (Qatar Ministry of Municipality and Environment) Health & Safety Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drilling Fluid Suppliers | 45 | Sales Managers, Product Development Leads |

| Oil Exploration Companies | 52 | Operations Managers, Project Engineers |

| Regulatory Bodies | 28 | Policy Makers, Environmental Compliance Officers |

| Research Institutions | 35 | Research Scientists, Industry Analysts |

| Drilling Contractors | 40 | Field Supervisors, Technical Directors |

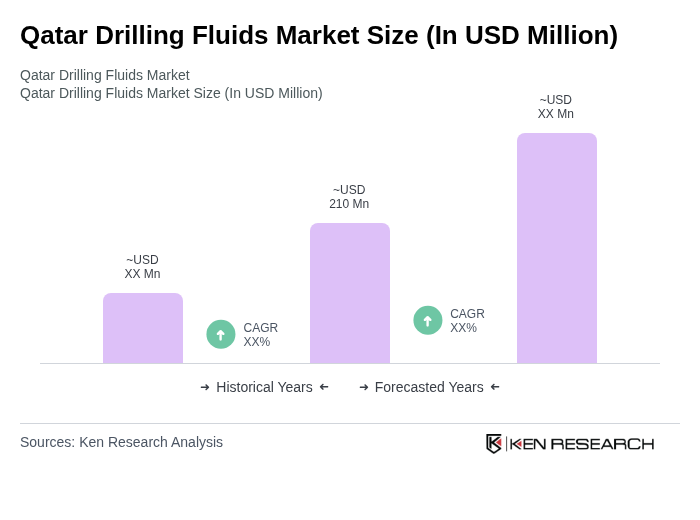

The Qatar Drilling Fluids Market is valued at approximately USD 210 million, driven by the increasing demand for oil and gas exploration and the expansion of drilling activities in major fields like Al Shaheen and Dukhan.