Region:Middle East

Author(s):Shubham

Product Code:KRAD2438

Pages:95

Published On:January 2026

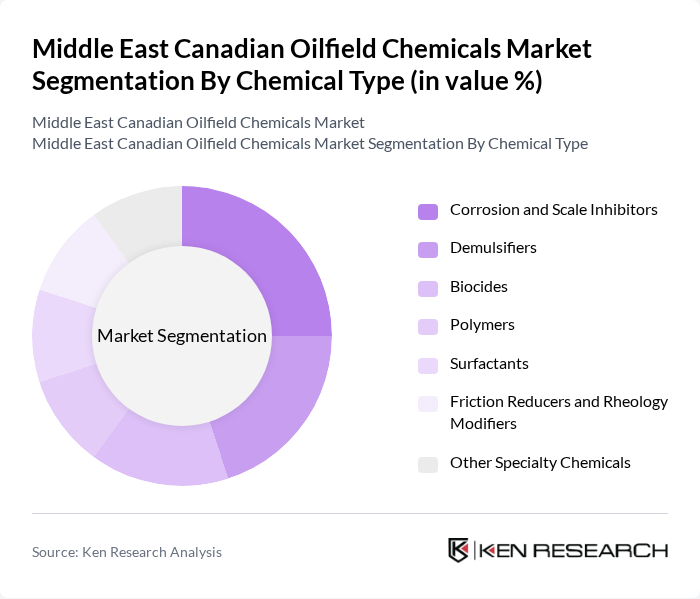

By Chemical Type:The market is segmented into various chemical types, including corrosion and scale inhibitors, demulsifiers, biocides, polymers, surfactants, friction reducers and rheology modifiers, and other specialty chemicals. Each of these subsegments plays a crucial role in enhancing oilfield operations, with specific applications tailored to meet the diverse needs of the industry, such as flow assurance, well integrity, microbial control, and emulsion breaking across drilling, production, and enhanced oil recovery stages.

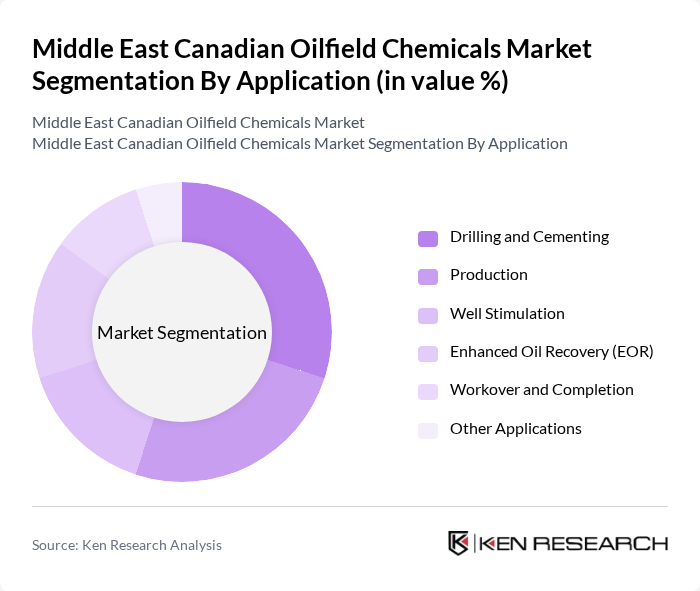

By Application:The applications of oilfield chemicals include drilling and cementing, production, well stimulation, enhanced oil recovery (EOR), workover and completion, and other applications. Each application requires specific chemical formulations to optimize performance and ensure safety in oilfield operations, with drilling fluids and cement additives supporting well construction, production chemicals maintaining flow and integrity, stimulation chemicals improving well productivity, and EOR chemicals increasing recovery from mature and unconventional reservoirs.

The Middle East Canadian Oilfield Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton, SLB (Schlumberger), Baker Hughes Company, BASF SE, Ecolab Inc. (Nalco Champion), Clariant AG, Arkema S.A., Nouryon, Innospec Inc., Huntsman Corporation, Solvay S.A., Croda International Plc, Afton Chemical Corporation, and Newpark Resources Inc. contribute to innovation, geographic expansion, and service delivery in this space, with a strong focus on product performance, cost optimization, and compliance with increasingly stringent environmental and operational standards in major producing regions including the Middle East.

The future of the Middle East Canadian oilfield chemicals market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt digital technologies, operational efficiencies are expected to improve significantly. Furthermore, the shift towards integrated service providers will likely enhance collaboration across the supply chain, fostering innovation. This evolving landscape presents opportunities for companies to develop customized solutions that meet the specific needs of oilfield operations, ensuring long-term growth and competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Chemical Type | Corrosion and Scale Inhibitors Demulsifiers Biocides Polymers Surfactants Friction Reducers and Rheology Modifiers Other Specialty Chemicals |

| By Application | Drilling and Cementing Production Well Stimulation Enhanced Oil Recovery (EOR) Workover and Completion Other Applications |

| By Location | Onshore Offshore |

| By Function | Flow Assurance Corrosion and Scale Control Wellbore Cleaning and Drilling Support Emulsion and Water Management Environmental Protection and HSE Compliance Other Functions |

| By End-User | National Oil Companies (NOCs) International Oil Companies (IOCs) Oilfield Service Companies Drilling Contractors Other Industrial and Midstream Users |

| By Country/Region | GCC Countries Iran Iraq Levant North Africa Other Middle East Countries |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Chemical Suppliers | 90 | Sales Managers, Product Development Leads |

| Oil and Gas Operators | 80 | Procurement Officers, Operations Managers |

| Regulatory Bodies | 50 | Policy Makers, Environmental Compliance Officers |

| Research Institutions | 40 | Research Scientists, Industry Analysts |

| Consulting Firms | 60 | Market Analysts, Strategic Advisors |

The Middle East Canadian Oilfield Chemicals Market is valued at approximately USD 1.7 billion, reflecting the increasing demand for oil and gas exploration and production activities in the region, particularly in unconventional resources and offshore developments.