Region:Middle East

Author(s):Rebecca

Product Code:KRAA9366

Pages:86

Published On:November 2025

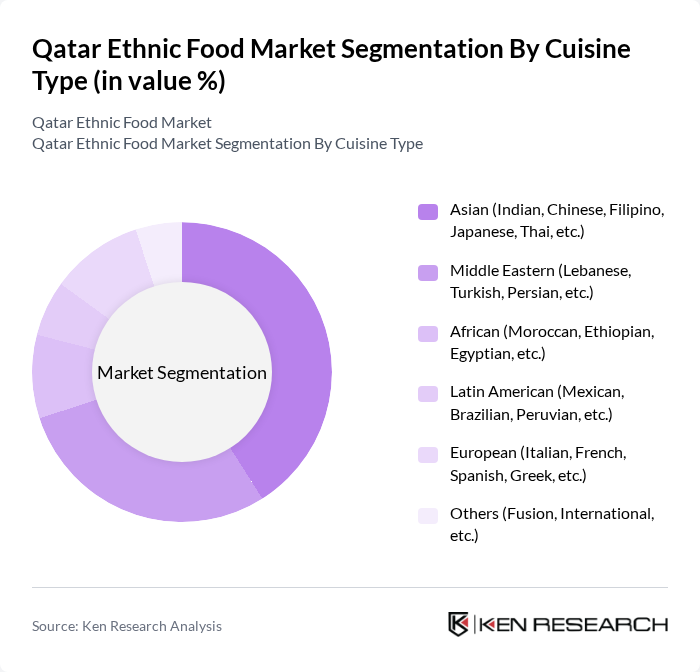

By Cuisine Type:The ethnic food market in Qatar is characterized by a diverse range of cuisines, reflecting the multicultural fabric of the nation. The major subsegments include Asian (Indian, Chinese, Filipino, Japanese, Thai, etc.), Middle Eastern (Lebanese, Turkish, Persian, etc.), African (Moroccan, Ethiopian, Egyptian, etc.), Latin American (Mexican, Brazilian, Peruvian, etc.), European (Italian, French, Spanish, Greek, etc.), and Others (Fusion, International, etc.). Among these, Asian cuisine dominates the market due to the significant South Asian population in Qatar, which drives demand for Indian and Pakistani foods. The popularity of Middle Eastern cuisine also remains strong, appealing to both locals and expatriates.

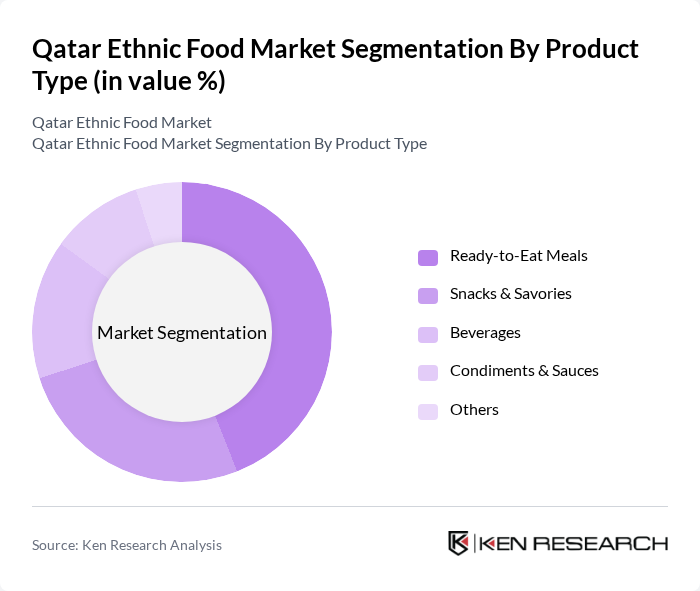

By Product Type:The product types in the ethnic food market include Ready-to-Eat Meals, Snacks & Savories, Beverages, Condiments & Sauces, and Others. Ready-to-Eat Meals are the leading subsegment, driven by the busy lifestyles of consumers who prefer convenient meal options. Snacks & Savories also hold a significant share, appealing to both locals and expatriates looking for quick and flavorful snacks. The demand for ethnic beverages and condiments is growing, reflecting the increasing interest in authentic culinary experiences.

The Qatar Ethnic Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Meera Consumer Goods Company, Carrefour Qatar, Lulu Hypermarket, Monoprix Qatar, Safari Hypermarket, Nasser Bin Khaled Group, Qatar National Food Company (QNF), Al Watania Poultry, Al Jazeera Foods, Al Fardan Group, Qatar Meat Production Company, Al Sraiya Holding Group, Al Khor Group, Qatar Food Company (QAFCO), Doha Food Centre, Talabat Qatar, Turkish Kebab Restaurant Group, Bombay Sweets & Restaurant, Zaatar w Zeit Qatar, Papa John's Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar ethnic food market appears promising, driven by evolving consumer preferences and increasing globalization. As the expatriate population continues to grow, the demand for authentic ethnic cuisines will likely rise, encouraging local businesses to innovate and diversify their offerings. Additionally, the integration of technology in food delivery and retail will enhance accessibility, making ethnic foods more mainstream. This dynamic environment presents opportunities for businesses to capitalize on emerging trends and cater to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Cuisine Type | Asian (Indian, Chinese, Filipino, Japanese, Thai, etc.) Middle Eastern (Lebanese, Turkish, Persian, etc.) African (Moroccan, Ethiopian, Egyptian, etc.) Latin American (Mexican, Brazilian, Peruvian, etc.) European (Italian, French, Spanish, Greek, etc.) Others (Fusion, International, etc.) |

| By Product Type | Ready-to-Eat Meals Snacks & Savories Beverages Condiments & Sauces Others |

| By End-User | Households Restaurants Catering Services Food Trucks Hotels & Hospitality Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Specialty Stores Direct Sales Foodservice Platforms (e.g., Talabat, Deliveroo, Carriage) Others |

| By Packaging Type | Ready-to-Eat Frozen Canned Dried Others |

| By Price Range | Premium Mid-range Budget Others |

| By Consumer Demographics | Age Group Income Level Ethnic Background Others |

| By Occasion | Festivals and Celebrations Daily Meals Special Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Ethnic Foods | 120 | Qatari Nationals, Expatriates from South Asia, Middle Eastern Communities |

| Restaurant Industry Insights | 60 | Restaurant Owners, Head Chefs, Food Service Managers |

| Retail Market Trends | 50 | Store Managers, Buyers, Ethnic Food Distributors |

| Food Import/Export Dynamics | 40 | Import Managers, Trade Compliance Officers, Logistics Coordinators |

| Cultural Food Events and Festivals | 40 | Event Organizers, Cultural Representatives, Community Leaders |

The Qatar Ethnic Food Market is valued at approximately USD 1.1 billion, driven by a multicultural population and increasing demand for diverse culinary options. This growth is supported by the expansion of food tourism and international restaurant chains.