Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3861

Pages:85

Published On:October 2025

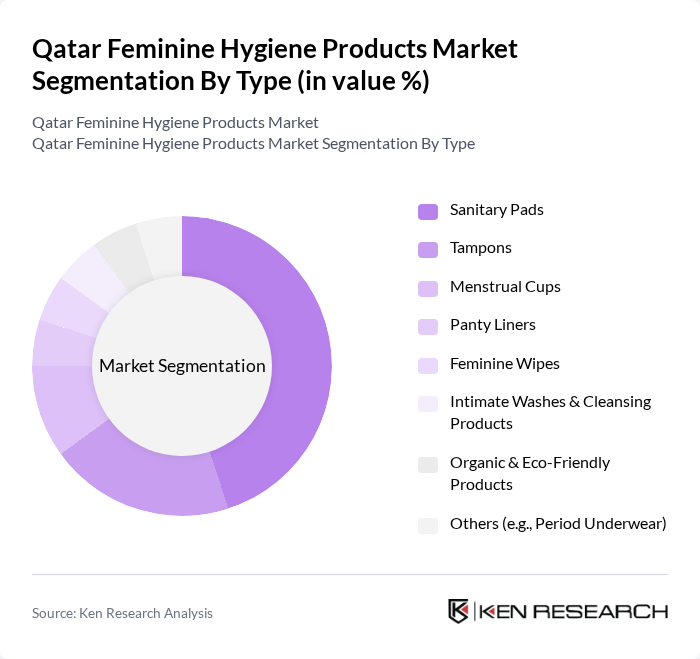

By Type:The market is segmented into various types of feminine hygiene products, including sanitary pads, tampons, menstrual cups, panty liners, feminine wipes, intimate washes & cleansing products, organic & eco-friendly products, and others such as period underwear. Among these, sanitary pads dominate the market due to their widespread acceptance and availability. The increasing awareness of menstrual health and hygiene has led to a surge in demand for these products, particularly among younger consumers.

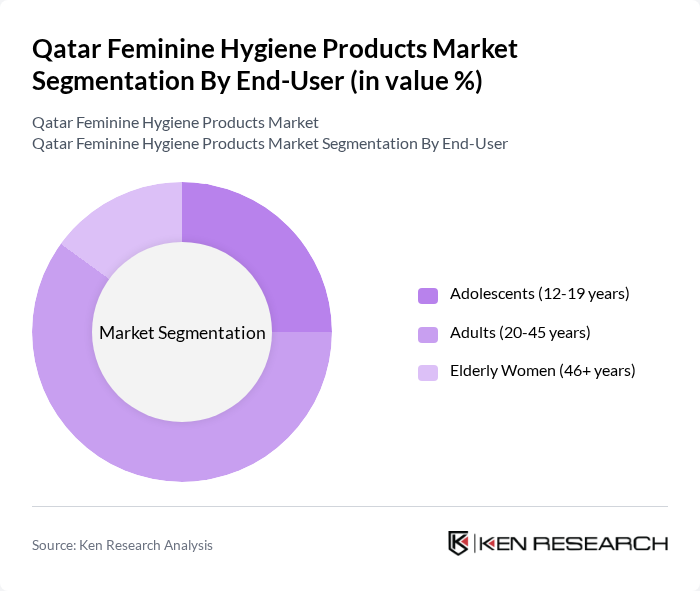

By End-User:The end-user segmentation includes adolescents (12-19 years), adults (20-45 years), and elderly women (46+ years). The adult segment is the largest consumer group, driven by the need for reliable and comfortable hygiene solutions. This demographic is increasingly aware of the importance of feminine hygiene, leading to higher consumption rates of various products tailored to their needs.

The Qatar Feminine Hygiene Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Always, Whisper), Kimberly-Clark Corporation (Kotex, Poise), Johnson & Johnson (Carefree, o.b.), Unicharm Corporation (Sofy), Edgewell Personal Care (Playtex, Stayfree), Essity AB (Libresse, Nana), Diva International Inc. (DivaCup), Natracare, The Honest Company, Corman S.p.A. (Organyc), Rael Inc., Saathi Eco Innovations, Thinx Inc., Ontex Group (Sisters, Helen Harper), Fine Hygienic Holding (Fine Baby, Fine Feminine) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the feminine hygiene products market in Qatar appears promising, driven by increasing consumer awareness and a shift towards sustainable products. As disposable incomes rise, consumers are likely to seek higher-quality, eco-friendly options. Additionally, the growth of e-commerce platforms will facilitate easier access to a wider range of products. Companies that innovate and adapt to these trends will likely thrive, while educational initiatives will further enhance market growth by breaking down cultural barriers.

| Segment | Sub-Segments |

|---|---|

| By Type | Sanitary Pads Tampons Menstrual Cups Panty Liners Feminine Wipes Intimate Washes & Cleansing Products Organic & Eco-Friendly Products Others (e.g., Period Underwear) |

| By End-User | Adolescents (12-19 years) Adults (20-45 years) Elderly Women (46+ years) |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies/Drugstores Online Retail/E-commerce Convenience Stores Health and Wellness Stores Others (e.g., Direct Sales) |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Formulation | Conventional Products Organic Products Hypoallergenic Products |

| By Packaging Type | Single-Use Packaging Bulk Packaging Eco-Friendly Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 80 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Female Consumers aged 18-45 |

| Healthcare Professional Insights | 100 | Gynecologists, Family Physicians |

| Distribution Channel Analysis | 60 | Wholesalers, Distributors |

| Brand Awareness Study | 90 | Marketing Executives, Brand Managers |

The Qatar Feminine Hygiene Products Market is valued at approximately USD 52 million, reflecting a significant growth driven by increased awareness of women's health issues, rising disposable incomes, and a shift towards modern hygiene products.