Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3746

Pages:95

Published On:October 2025

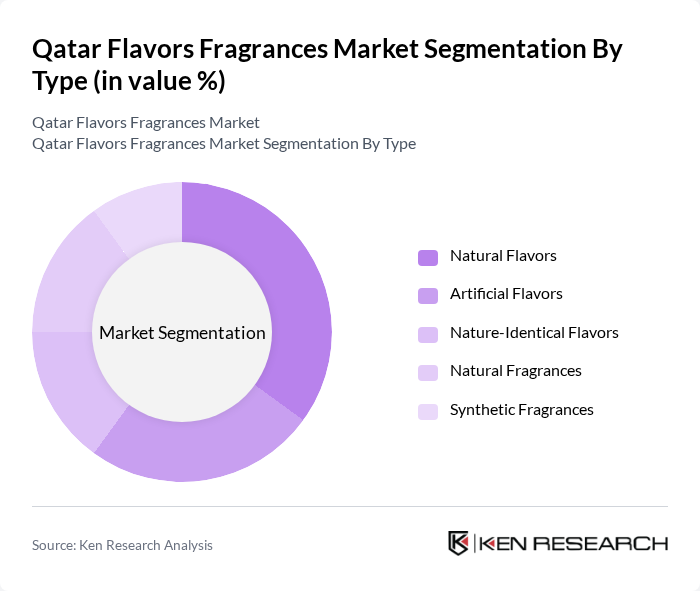

By Type:The market is segmented into various types, including Natural Flavors, Artificial Flavors, Nature-Identical Flavors, Natural Fragrances, and Synthetic Fragrances. Among these, Natural Flavors and Natural Fragrances are gaining significant traction due to increasing consumer preference for organic and clean-label products. The trend toward healthier eating and living, as well as a focus on sustainability and wellness, is driving demand for natural ingredients, which are perceived as safer and more beneficial compared to synthetic counterparts .

By Application:The applications of flavors and fragrances in Qatar include Food and Beverages, Personal Care and Cosmetics, Soaps and Detergents, Household Products, Fine Fragrances, and Others. The Food and Beverages segment is the largest, driven by the growing food industry and consumer demand for innovative flavors. The increasing trend of gourmet and artisanal food products, as well as the rise in premium personal care and household products, is contributing to the expansion of these segments .

The Qatar Flavors Fragrances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Givaudan SA, DSM-Firmenich AG, International Flavors & Fragrances Inc., Symrise AG, Takasago International Corporation, Mane SA, Robertet SA, Sensient Technologies Corporation, T. Hasegawa Co. Ltd., Kerry Group plc, Gulf Flavours & Food Ingredients FZCO, RFF International, Senovia, Global Flavours and Fragrances, and Bell Flavors & Fragrances contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar flavors and fragrances market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and eco-friendly products is expected to shape product development, with brands investing in green technologies. Additionally, the rise of e-commerce platforms will facilitate broader market access, allowing local artisans and small businesses to reach a wider audience, thereby enhancing market diversity and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Flavors Artificial Flavors Nature-Identical Flavors Natural Fragrances Synthetic Fragrances |

| By Application | Food and Beverages Personal Care and Cosmetics Soaps and Detergents Household Products Fine Fragrances Others |

| By End-User | Food and Beverage Manufacturers Personal Care Product Manufacturers Household Product Manufacturers Retail Consumers Foodservice Sector |

| By Distribution Channel | Direct Sales Specialty Stores Supermarkets/Hypermarkets Online Retail Perfume Boutiques |

| By Price Range | Luxury/Premium Mid-range Economy |

| By Origin | Plant-Derived Animal-Derived Microbial Synthetic/Aroma Chemicals |

| By Form | Liquid Powder Solid Gel |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fragrance Sales | 100 | Store Managers, Sales Associates |

| Consumer Preferences in Fragrances | 120 | Fragrance Consumers, Beauty Enthusiasts |

| Distribution Channel Insights | 80 | Distributors, Wholesalers |

| Market Trends and Innovations | 60 | Product Development Managers, Brand Strategists |

| Online vs. Offline Purchasing Behavior | 90 | E-commerce Managers, Digital Marketing Specialists |

The Qatar Flavors Fragrances Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by consumer preferences for natural and organic products, as well as the expansion of the food and beverage sector.