Region:Asia

Author(s):Shubham

Product Code:KRAD6787

Pages:96

Published On:December 2025

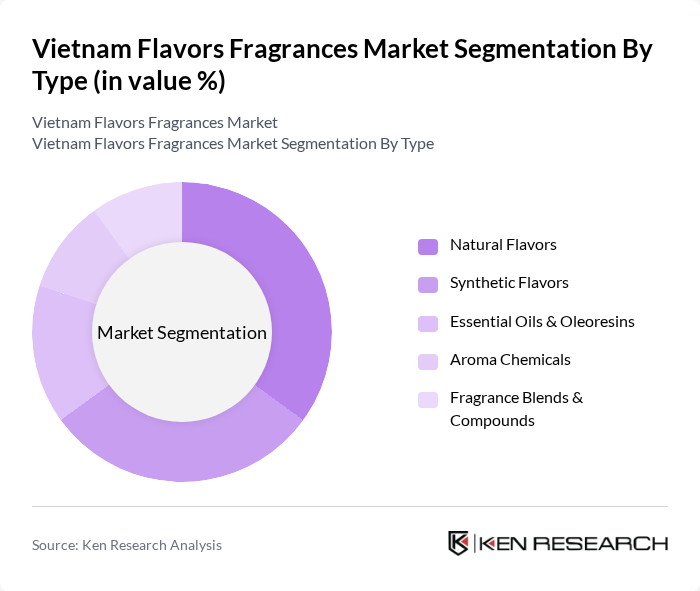

By Type:The market is segmented into various types, including Natural Flavors, Synthetic Flavors, Essential Oils & Oleoresins, Aroma Chemicals, and Fragrance Blends & Compounds. Natural Flavors are gaining significant traction, in line with the broader Asia Pacific trend where natural flavors and fragrances represent the largest and fastest-growing product segment, supported by consumer preference for clean-label, organic, and plant-based formulations. The demand for Essential Oils & Oleoresins is also on the rise, driven by their applications in aromatherapy, spa and wellness, natural personal care, and premium food and beverage products. Synthetic Flavors continue to hold a substantial market share due to their cost-effectiveness, stability, and versatility in large-scale food, beverage, and confectionery applications, particularly for mass-market products.

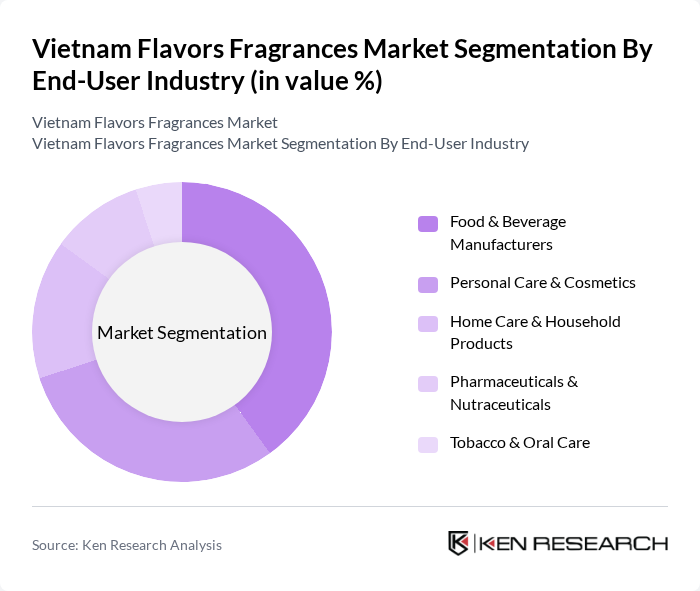

By End-User Industry:The market is further segmented by end-user industries, including Food & Beverage Manufacturers, Personal Care & Cosmetics, Home Care & Household Products, Pharmaceuticals & Nutraceuticals, and Tobacco & Oral Care. The Food & Beverage Manufacturers segment is the largest, consistent with regional dynamics where food and beverages are the leading application for flavors and fragrances, driven by strong growth in processed foods, beverages, dairy, snacks, and instant products in Vietnam. Personal Care & Cosmetics also represent a significant portion of the market, supported by rising expenditure on perfumes, deodorants, skincare, and color cosmetics, as well as the popularity of premium and niche fragrances among young urban consumers. Home Care & Household Products, including detergents, fabric conditioners, air care, and surface cleaners, are an important and steadily growing user of fragrance compounds, while Pharmaceuticals & Nutraceuticals and Tobacco & Oral Care utilize flavors to improve palatability, adherence, and consumer acceptance of functional and regulated products.

The Vietnam Flavors Fragrances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Givaudan SA, International Flavors & Fragrances Inc. (IFF), Symrise AG, Firmenich SA (dsm-firmenich), Takasago International Corporation, Sensient Technologies Corporation, MANE SA, Robertet Group, Bell Flavors & Fragrances Inc., Kerry Group plc, T. Hasegawa Co., Ltd., Huong Viet Group (Vietnam Flavors & Fragrances), Saigon Cosmetics Corporation (SCC), Y25 – Artisan de Parfum (Vietnam), Other Emerging Local Flavor & Fragrance Blenders contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam flavors and fragrances market appears promising, driven by increasing consumer demand for natural and sustainable products. As the market evolves, companies are likely to invest more in research and development to create innovative offerings that cater to changing consumer preferences. Additionally, the rise of e-commerce platforms will facilitate greater access to fragrance products, enabling brands to reach a broader audience and enhance their market presence in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Flavors Synthetic Flavors Essential Oils & Oleoresins Aroma Chemicals Fragrance Blends & Compounds |

| By End-User Industry | Food & Beverage Manufacturers Personal Care & Cosmetics Home Care & Household Products Pharmaceuticals & Nutraceuticals Tobacco & Oral Care |

| By Application | Flavors for Food & Beverages Fragrances for Personal Care Fragrances for Home & Fabric Care Industrial & Institutional Fragrances Others |

| By Sales / Distribution Channel | Direct Sales to Manufacturers (B2B) Local Distributors & Agents Importers / Trading Companies Online / E-procurement Portals Others |

| By Region | Northern Vietnam (including Hanoi) Central Vietnam Southern Vietnam (including Ho Chi Minh City) Mekong Delta & Other Provinces |

| By Product Form | Liquid Concentrates Powder / Spray-dried Encapsulated / Microencapsulated Pastes & Emulsions |

| By Customer Type | Multinational FMCG & F&B Companies Local / Regional Brand Owners Contract Manufacturers & OEMs Artisan / Niche & SMEs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fragrance Retailers | 100 | Store Managers, Category Buyers |

| Manufacturers of Flavors and Fragrances | 80 | Production Managers, R&D Directors |

| Consumers of Personal Care Products | 120 | General Consumers, Brand Loyalists |

| Distributors in the Fragrance Sector | 70 | Logistics Coordinators, Sales Representatives |

| Market Analysts and Experts | 50 | Industry Analysts, Market Researchers |

The Vietnam Flavors Fragrances Market is valued at approximately USD 1.1 billion. This valuation reflects a comprehensive analysis of the country's role in the Asia Pacific and global flavors and fragrances industry, highlighting its significant contribution to regional revenues.