Qatar Flue Gas Desulfurization Market Overview

- The Qatar Flue Gas Desulfurization Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by stringent environmental regulations, increasing adoption of advanced emission control technologies, and the rising need for cleaner energy solutions. The expansion of industrial activities and rapid urbanization in Qatar have further propelled the demand for flue gas desulfurization technologies to mitigate sulfur dioxide emissions from power plants, petrochemical complexes, and other industrial facilities .

- Doha remains the dominant city in the Qatar Flue Gas Desulfurization Market due to its role as the capital and the primary hub of industrial activities. The concentration of power generation facilities, oil refineries, and petrochemical plants in Doha significantly contributes to the market's growth. Al Rayyan and Al Wakrah are also notable, benefiting from their proximity to major industrial zones and ongoing infrastructure projects, which further drive the adoption of emission control solutions .

- The Environmental Protection Law No. 30 of 2002, issued by the Ministry of Municipality and Environment (MME), requires all new power plants and industrial facilities in Qatar to implement best available technologies for emission reduction, including flue gas desulfurization systems. This law mandates compliance with national air quality standards and sets operational thresholds for sulfur dioxide emissions, ensuring systematic monitoring and reporting by regulated entities .

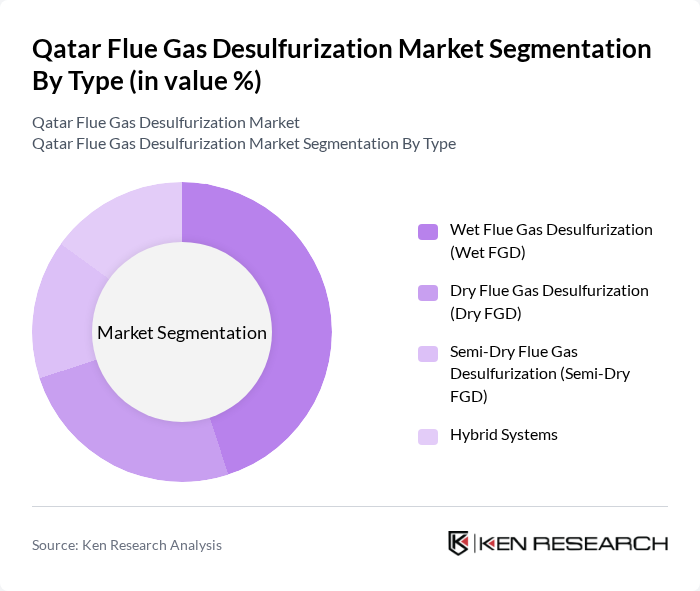

Qatar Flue Gas Desulfurization Market Segmentation

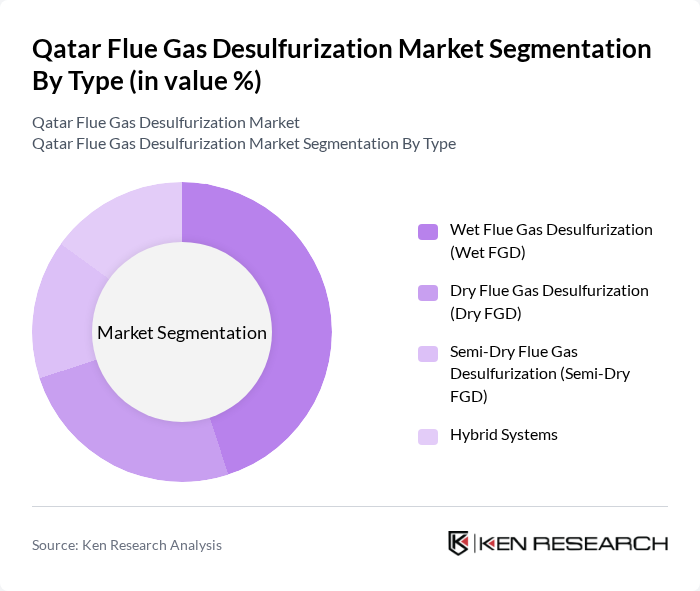

By Type:The market is segmented into various types of flue gas desulfurization technologies, including Wet Flue Gas Desulfurization (Wet FGD), Dry Flue Gas Desulfurization (Dry FGD), Semi-Dry Flue Gas Desulfurization (Semi-Dry FGD), and Hybrid Systems. Wet FGD is the most widely adopted due to its superior efficiency in removing sulfur dioxide from flue gases, especially in large-scale power and industrial plants. The increasing enforcement of environmental regulations and the need for compliance with stringent emission standards are driving the adoption of Wet FGD systems in Qatar .

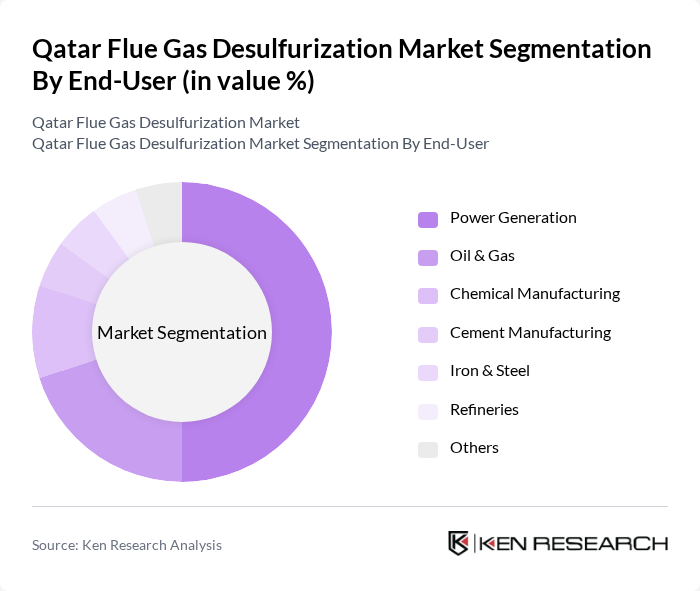

By End-User:The end-user segmentation includes Power Generation, Oil & Gas, Chemical Manufacturing, Cement Manufacturing, Iron & Steel, Refineries, and Others. The Power Generation sector is the leading end-user, driven by the need for compliance with environmental regulations and the increasing demand for electricity in Qatar. The oil and gas sector also significantly contributes to the market, as it requires effective desulfurization technologies to meet emission standards. Chemical and cement manufacturing, as well as refineries, are also adopting FGD systems to address emission control requirements .

Qatar Flue Gas Desulfurization Market Competitive Landscape

The Qatar Flue Gas Desulfurization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Mitsubishi Heavy Industries, Ltd., GE Vernova (formerly GE Power), Alstom S.A. (now part of GE Power for FGD business), Babcock & Wilcox Enterprises, Inc., Doosan Lentjes GmbH, FLSmidth & Co. A/S, Hitachi Zosen Corporation, Veolia Environnement S.A., thyssenkrupp AG, AECOM, Jacobs Solutions Inc., Fluor Corporation, KBR, Inc., SUEZ S.A., Qatar Electricity & Water Company (QEWC), Qatar Petroleum (QatarEnergy), Nebras Power, Gulf Organisation for Research & Development (GORD) contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Flue Gas Desulfurization Market Industry Analysis

Growth Drivers

- Increasing Environmental Regulations:Qatar's commitment to environmental sustainability is evident in its stringent regulations. The country aims to reduce sulfur dioxide emissions by 30% in the near future, aligning with global standards. The Qatar National Vision emphasizes sustainable development, driving industries to adopt flue gas desulfurization technologies. Recently, the Ministry of Environment and Climate Change reported a 15% increase in compliance inspections, indicating a robust regulatory framework that propels the demand for desulfurization solutions.

- Rising Industrial Emissions:Qatar's industrial sector, particularly in oil and gas, is projected to generate over 1.5 million tons of sulfur dioxide emissions annually in the near future. This alarming figure necessitates effective flue gas desulfurization systems to mitigate environmental impact. The Qatar Petroleum Authority has mandated emission reduction strategies, further driving the adoption of desulfurization technologies. As industries expand, the need for compliance with emission standards becomes critical, fueling market growth in this sector.

- Technological Advancements in Desulfurization:The flue gas desulfurization market in Qatar is witnessing significant technological innovations, with investments exceeding $200 million in advanced desulfurization technologies recently. These advancements enhance efficiency and reduce operational costs, making them attractive to industries. The integration of AI and machine learning in monitoring systems is expected to improve performance and compliance rates. As technology evolves, it presents a compelling case for industries to adopt these solutions, driving market growth.

Market Challenges

- High Initial Investment Costs:The implementation of flue gas desulfurization systems requires substantial capital investment, often exceeding $5 million per facility. This high upfront cost poses a significant barrier for many companies, particularly small and medium enterprises. Despite the long-term savings on operational costs and compliance, the initial financial burden can deter investment in necessary technologies. As a result, many industries may delay or forgo adopting these essential systems, hindering market growth.

- Regulatory Compliance Complexity:The regulatory landscape in Qatar is intricate, with multiple agencies overseeing environmental compliance. Companies often face challenges navigating these regulations, which can vary significantly across sectors. Recently, over 40% of industrial firms reported difficulties in understanding compliance requirements, leading to potential fines and operational delays. This complexity can discourage investment in flue gas desulfurization technologies, as firms may fear non-compliance and its associated penalties, impacting market dynamics.

Qatar Flue Gas Desulfurization Market Future Outlook

The future of the Qatar flue gas desulfurization market appears promising, driven by increasing environmental awareness and regulatory pressures. As industries strive to meet stringent emission standards, the demand for advanced desulfurization technologies is expected to rise. Furthermore, the integration of AI and automation in these systems will enhance efficiency and compliance. With ongoing government support for clean technologies, the market is poised for significant growth, fostering innovation and sustainability in the industrial sector.

Market Opportunities

- Government Incentives for Clean Technologies:The Qatari government is actively promoting clean technology adoption through financial incentives, including grants and tax breaks. Recently, the government allocated $50 million for clean technology initiatives, encouraging industries to invest in flue gas desulfurization systems. This support not only reduces financial burdens but also accelerates the transition to sustainable practices, creating a favorable environment for market growth.

- Increasing Investment in Renewable Energy:Qatar's commitment to diversifying its energy portfolio includes significant investments in renewable energy, projected to reach $1 billion in the near future. This shift creates opportunities for integrating flue gas desulfurization technologies with renewable energy systems. As industries adopt cleaner energy sources, the demand for effective desulfurization solutions will rise, positioning the market for substantial growth in the coming years.