Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7918

Pages:84

Published On:December 2025

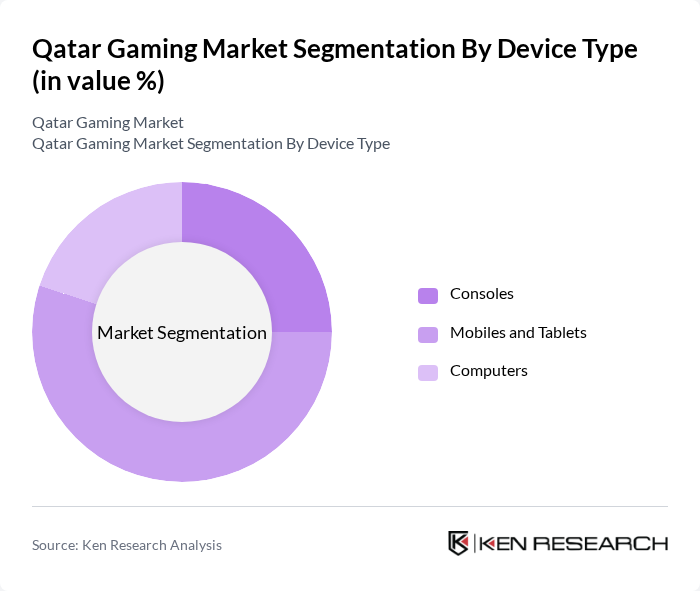

By Device Type:The gaming market is segmented by device type into consoles, mobiles and tablets, and computers. Among these, mobile and tablet gaming has emerged as the leading segment due to the widespread availability of smartphones and the convenience they offer. The increasing number of mobile gaming applications and the popularity of casual gaming have significantly contributed to this segment's dominance. Mobile games represent the largest market segment within esports, with a market volume of USD 47.24 million in 2024. Consoles and computers also hold substantial market shares, particularly among hardcore gamers who prefer high-performance gaming experiences.

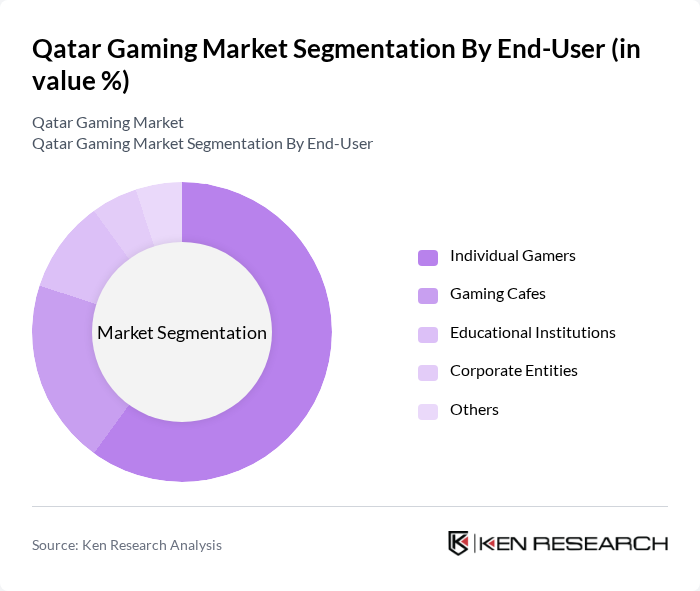

By End-User:The end-user segmentation includes individual gamers, gaming cafes, educational institutions, corporate entities, and others. Individual gamers dominate the market, driven by the increasing number of casual gamers and the accessibility of gaming platforms. Gaming cafes also play a significant role, particularly in urban areas where social gaming experiences are sought. Educational institutions are beginning to adopt gaming for educational purposes, while corporate entities are exploring gamification for training and engagement.

The Qatar Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as **Qatar Gaming Company (QGC)**, **Wega eSports**, **Qatar Esports Federation (QESF)**, **Team Nigma**, **Pubg Mobile Qatar Club**, **Tencent (Riot Games)**, **Epic Games**, **Activision Blizzard**, **Electronic Arts (EA)**, **Nintendo**, **Sony Interactive Entertainment**, **Microsoft (Xbox)**, **Supercell**, **Garena**, **Mojang Studios (Minecraft)** contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar gaming market appears promising, driven by increasing disposable incomes and government initiatives aimed at enhancing entertainment options. As mobile gaming continues to rise, the integration of advanced technologies such as AR and VR is expected to reshape user experiences. Additionally, the anticipated growth in eSports and gaming hubs will likely attract both local and international investments, fostering a vibrant gaming ecosystem that aligns with Qatar's vision for economic diversification and tourism enhancement.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Consoles Mobiles and Tablets Computers |

| By End-User | Individual Gamers Gaming Cafes Educational Institutions Corporate Entities Others |

| By Demographics | Age Groups Gender Income Levels Others |

| By Distribution Channel | Online Platforms Retail Stores Mobile Applications Others |

| By Game Genre | Action Adventure Strategy Simulation Others |

| By Technology | Cloud Gaming Augmented Reality Virtual Reality Others |

| By Market Segment | Casual Gaming Hardcore Gaming Social Gaming Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 120 | Casual Gamers, Mobile Game Developers |

| Console Gaming Enthusiasts | 100 | Console Gamers, Retail Managers |

| PC Gaming Community | 80 | PC Gamers, eSports Organizers |

| Game Development Insights | 60 | Game Designers, Marketing Executives |

| Regulatory Impact Assessment | 50 | Legal Advisors, Policy Makers |

The Qatar Gaming Market is valued at approximately USD 489 million, reflecting significant growth driven by smartphone penetration, eSports popularity, and mobile gaming expansion, alongside government support for digital infrastructure development.