Region:Middle East

Author(s):Shubham

Product Code:KRAC2258

Pages:93

Published On:October 2025

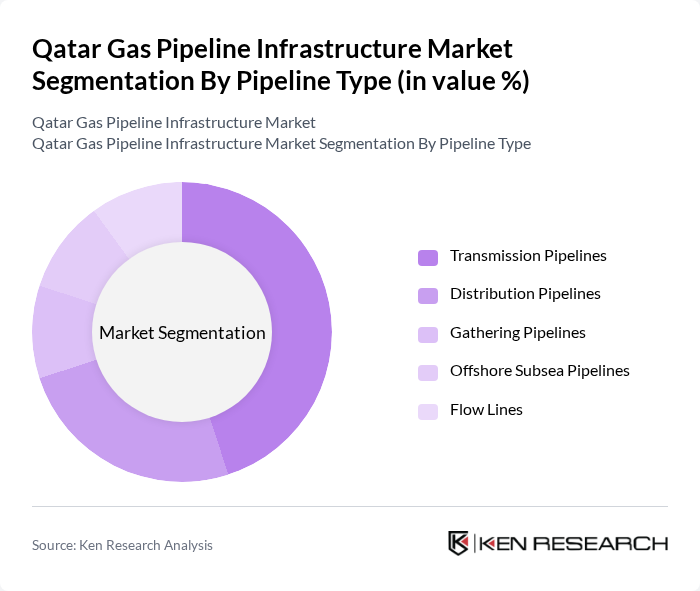

By Pipeline Type:The pipeline type segmentation includes Transmission Pipelines, Distribution Pipelines, Gathering Pipelines, Offshore Subsea Pipelines, and Flow Lines. Transmission Pipelines dominate the market, reflecting their critical role in transporting large volumes of natural gas over long distances from production fields to processing and export terminals. The expansion of Qatar’s gas network—driven by LNG export growth, industrial demand, and integration with new processing facilities—has led to significant investments in this segment. Offshore subsea pipelines are also gaining importance due to increased offshore gas extraction and deepwater projects, while distribution and gathering pipelines support domestic supply and industrial clusters .

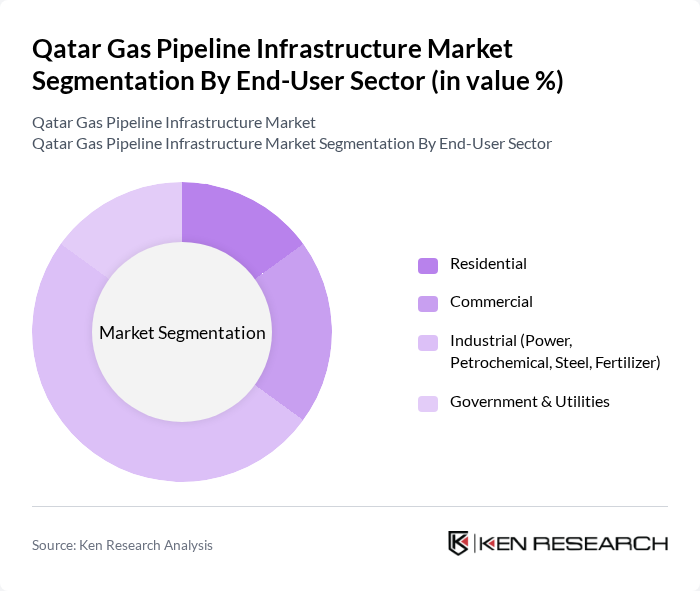

By End-User Sector:The end-user sector segmentation includes Residential, Commercial, Industrial (Power, Petrochemical, Steel, Fertilizer), and Government & Utilities. The Industrial sector is the leading segment, driven by high demand for natural gas in power generation, petrochemical manufacturing, and heavy industries. Qatar’s industrial growth and government initiatives to diversify the economy have significantly increased natural gas consumption in this sector, supported by dedicated pipeline networks to major industrial zones and export terminals. The commercial and residential segments are expanding, supported by urban development and infrastructure modernization, while government and utilities play a key role in public service and energy security .

The Qatar Gas Pipeline Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as QatarEnergy, Qatargas Operating Company Limited, Dolphin Energy Limited, Oryx GTL, Qatar Gas Transport Company (Nakilat), Gulf International Services Q.S.C., Qatar Engineering & Construction Company (Qcon), Qatar Industrial Manufacturing Company (QIMC), Qatar Electricity & Water Company (QEWC), Qatar Petrochemical Company (QAPCO), Qatar Fuel (WOQOD), Qatar National Cement Company (QNCC), Qatar Fertiliser Company (QAFCO), Qatar Petroleum Development Company (Japan) Ltd., and Qatar Shell GTL contribute to innovation, geographic expansion, and service delivery in this space .

The future of Qatar's gas pipeline infrastructure market appears promising, driven by increasing energy demands and government initiatives. The focus on sustainable practices and technological advancements will likely enhance operational efficiency and safety. Additionally, the integration of renewable energy sources into the existing infrastructure is expected to gain momentum, aligning with global energy transition trends. As Qatar continues to expand its LNG export capabilities, the pipeline sector will play a crucial role in supporting economic growth and energy security.

| Segment | Sub-Segments |

|---|---|

| By Pipeline Type | Transmission Pipelines Distribution Pipelines Gathering Pipelines Offshore Subsea Pipelines Flow Lines |

| By End-User Sector | Residential Commercial Industrial (Power, Petrochemical, Steel, Fertilizer) Government & Utilities |

| By Application | Natural Gas Supply LNG Export & Transmission Petrochemical Feedstock Power Generation Water Desalination Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits Others |

| By Distribution Mode | Direct Supply Third-Party Logistics Integrated Supply Chains |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Cost-Plus Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gas Transmission Projects | 100 | Project Managers, Engineers |

| Pipeline Maintenance and Operations | 80 | Operations Managers, Safety Officers |

| Regulatory Compliance in Pipeline Construction | 60 | Regulatory Affairs Specialists, Compliance Managers |

| Local Contractor Engagement | 50 | Business Development Managers, Procurement Officers |

| Gas Distribution Networks | 70 | Network Planners, Distribution Managers |

The Qatar Gas Pipeline Infrastructure Market is valued at approximately USD 3.2 billion. This valuation reflects Qatar's significant role as a leading liquefied natural gas (LNG) exporter and its ongoing investments in pipeline development to meet rising energy demands.