Region:Middle East

Author(s):Rebecca

Product Code:KRAC3253

Pages:96

Published On:October 2025

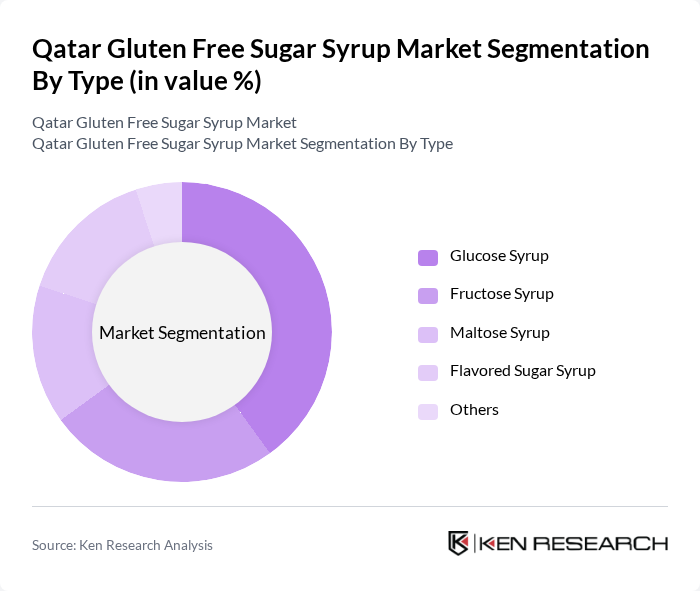

By Type:The market is segmented into various types of gluten-free sugar syrups, including glucose syrup, fructose syrup, maltose syrup, flavored sugar syrup, and others. Among these, glucose syrup is the most dominant due to its widespread use in food manufacturing and beverage production. The increasing preference for natural and clean-label sweeteners has also led to a rise in the demand for flavored and specialty sugar syrups, catering to evolving consumer tastes and dietary needs .

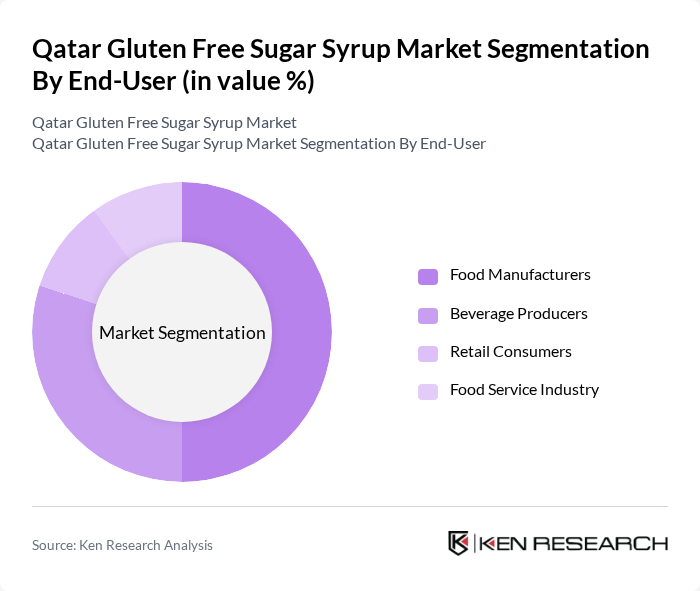

By End-User:The end-user segmentation includes food manufacturers, beverage producers, retail consumers, and the food service industry. Food manufacturers are the leading segment, driven by the increasing incorporation of gluten-free sugar syrups in bakery, confectionery, and processed food products. The beverage industry is also witnessing robust growth as consumers seek healthier and allergen-free alternatives, further boosting the demand for gluten-free options in both retail and food service channels .

The Qatar Gluten Free Sugar Syrup Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill Inc., Monin Inc., Wholesome Sweeteners Inc., Canadian Organic Maple Co. Ltd., B&G Foods Inc., Torani & Co. Inc., Whole Earth Brands, Skinny Mixes, Al Meera Consumer Goods Company, Qatar National Food Company, Al Jazeera Food Products Co., Gulf Sugar Company, Qatar Food Industries Company, Qatar International Food Company, and Doha Food Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar gluten-free sugar syrup market appears promising, driven by increasing health awareness and a growing preference for gluten-free products. As the food and beverage industry continues to expand, manufacturers are likely to innovate and diversify their offerings. Additionally, the government's support for healthier food alternatives will further enhance market growth. With the right marketing strategies and consumer education, gluten-free sugar syrups can gain significant traction in the Qatari market, catering to health-conscious consumers and those with dietary restrictions.

| Segment | Sub-Segments |

|---|---|

| By Type | Glucose Syrup Fructose Syrup Maltose Syrup Flavored Sugar Syrup Others |

| By End-User | Food Manufacturers Beverage Producers Retail Consumers Food Service Industry |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales |

| By Packaging Type | Bottles Tetra Packs Bulk Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| By Application | Baking Confectionery Beverages Nutrition Bars Dressings Dairy Products Others |

| By Region | Doha Al Rayyan Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Gluten-Free Products | 60 | Store Managers, Category Buyers |

| Health Food Distributors | 50 | Distribution Managers, Sales Representatives |

| Consumer Insights on Gluten-Free Syrups | 100 | Health-Conscious Consumers, Dietitians |

| Food Manufacturers' Perspectives | 40 | Product Development Managers, Quality Assurance Officers |

| Market Trends and Innovations | 40 | Industry Analysts, Market Researchers |

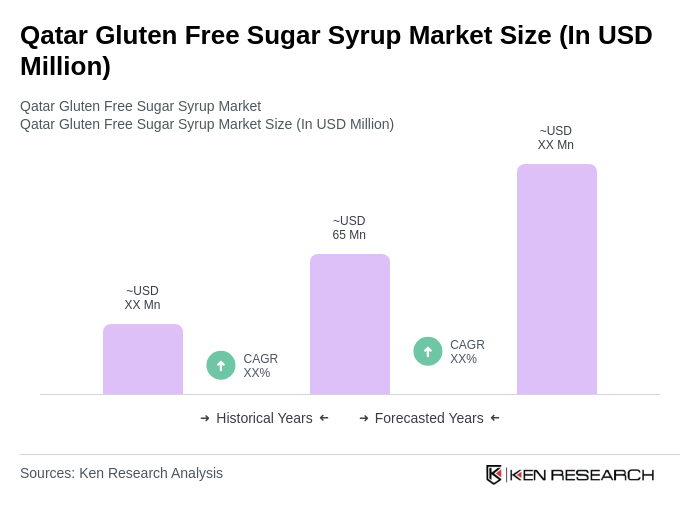

The Qatar Gluten Free Sugar Syrup Market is valued at approximately USD 65 million, reflecting a growing demand for gluten-free products driven by health-conscious consumers and the trend towards natural sweeteners.