Region:Middle East

Author(s):Rebecca

Product Code:KRAD4936

Pages:83

Published On:December 2025

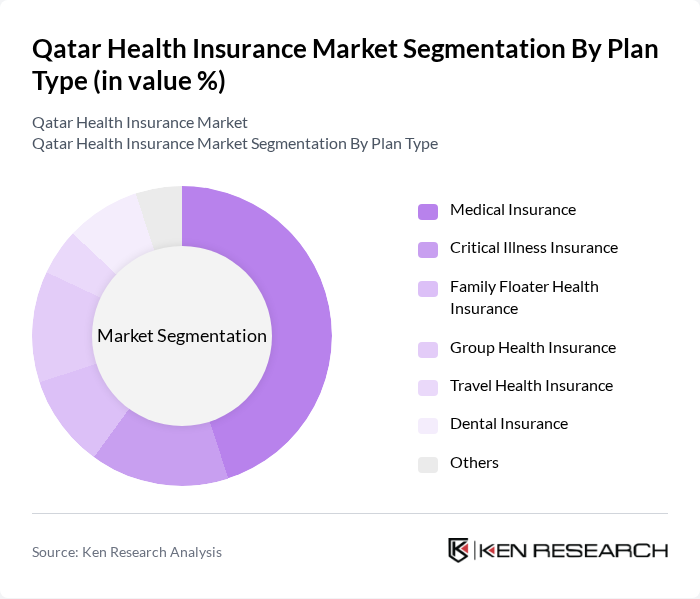

By Plan Type:The market is segmented into various plan types, including Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Group Health Insurance, Travel Health Insurance, Dental Insurance, and Others. Among these, Medical Insurance is the most dominant segment, supported by mandatory coverage requirements for residents and visitors and the growing use of private medical insurance to complement public services. The increasing need for comprehensive health coverage among individuals and families, rising healthcare costs, and broader benefit designs that include outpatient, maternity, and preventive services have led consumers and employers to prioritize medical insurance, making it a crucial component of their financial and employee-benefits planning.

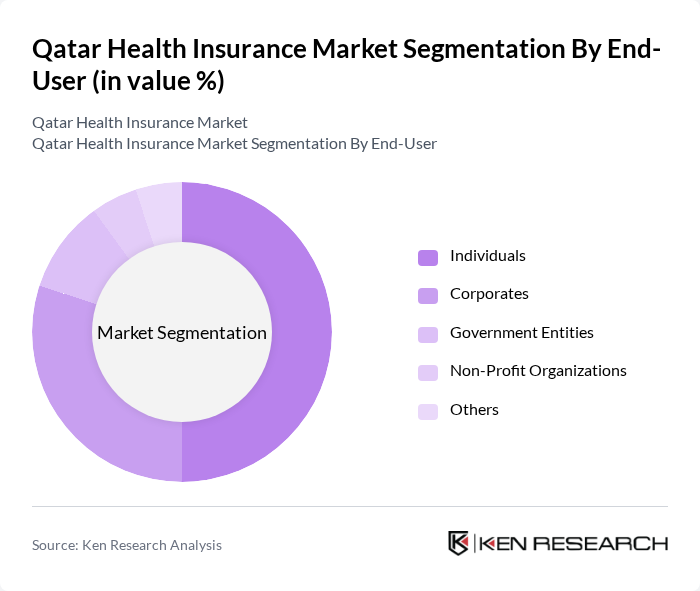

By End-User:The end-user segmentation includes Individuals, Corporates, Government Entities, Non-Profit Organizations, and Others. The Individual segment is a significant contributor to the market, as more people seek personal health coverage due to rising healthcare costs, lifestyle-related diseases, and the need for financial security against medical expenses. Corporates also play a vital role, as many companies provide health insurance as part of employee benefits, and mandatory employer coverage is reinforcing the importance of group and corporate plans, further driving the market.

The Qatar Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Insurance Company Q.S.P.C. (QIC), Qatar General Insurance & Reinsurance Company Q.P.S.C., Doha Insurance Group Q.P.S.C., Al Khaleej Takaful Insurance Company Q.P.S.C., Qatar Islamic Insurance Company Q.P.S.C., Damaan Islamic Insurance Company (Beema), QLM Life & Medical Insurance Company Q.P.S.C., Gulf Insurance Group – Qatar, AXA – Gulf Operations in Qatar (now part of Gulf Insurance Group), Allianz Partners Qatar, MetLife Qatar Takaful E.C., Aetna International – Qatar Operations, Cigna Healthcare – Qatar Operations, Bupa Global – Qatar Portfolio, National Health Insurance Company – Daman (serving Qatar-based corporates via cross-border programs) contribute to innovation, geographic expansion, and service delivery in this space, with growing emphasis on digital platforms, insurtech collaborations, and wellness-linked products.

The Qatar health insurance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of digital health solutions, such as telemedicine and AI-driven claims processing, is expected to enhance service delivery and operational efficiency. Additionally, as the government continues to promote health coverage, insurers will likely focus on innovative products tailored to diverse consumer needs, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Plan Type | Medical Insurance Critical Illness Insurance Family Floater Health Insurance Group Health Insurance Travel Health Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Profit Organizations Others |

| By Demographics | Minors Adults Senior Citizens Others |

| By Coverage Type | Inpatient Coverage Outpatient Coverage Maternity Coverage Preventive Care Coverage Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Bancassurance Others |

| By Policy Duration | Short-term Policies Long-term Policies Others |

| By Health Condition | Pre-existing Conditions Chronic Illnesses General Health Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policyholders | 150 | Policyholders aged 25-60, diverse income levels |

| Corporate Health Insurance Clients | 120 | HR Managers, Benefits Coordinators from SMEs and Corporates |

| Healthcare Providers | 90 | Hospital Administrators, Clinic Managers |

| Insurance Brokers and Agents | 70 | Insurance Agents, Brokers specializing in health insurance |

| Regulatory Bodies | 40 | Officials from the Ministry of Public Health, Qatar Central Bank |

The Qatar Health Insurance Market is valued at approximately USD 4.0 billion, driven by increasing healthcare demands, a growing expatriate population, and government initiatives aimed at improving healthcare accessibility and quality.