Region:Middle East

Author(s):Shubham

Product Code:KRAD5544

Pages:87

Published On:December 2025

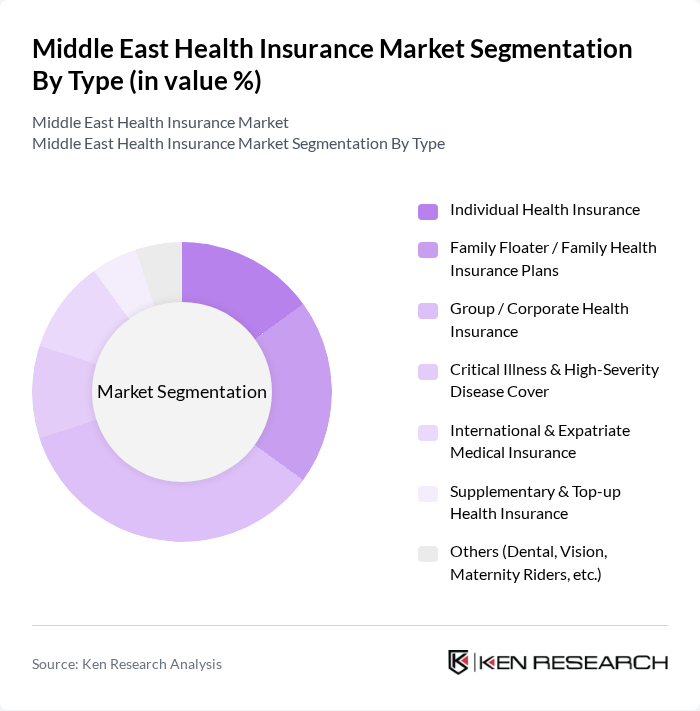

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Floater / Family Health Insurance Plans, Group / Corporate Health Insurance, Critical Illness & High-Severity Disease Cover, International & Expatriate Medical Insurance, Supplementary & Top-up Health Insurance, and Others (Dental, Vision, Maternity Riders, etc.). Among these, Group / Corporate Health Insurance is the leading sub-segment due to the increasing number of employers providing health benefits to attract and retain talent. The trend towards comprehensive employee wellness programs has further fueled the demand for corporate health insurance.

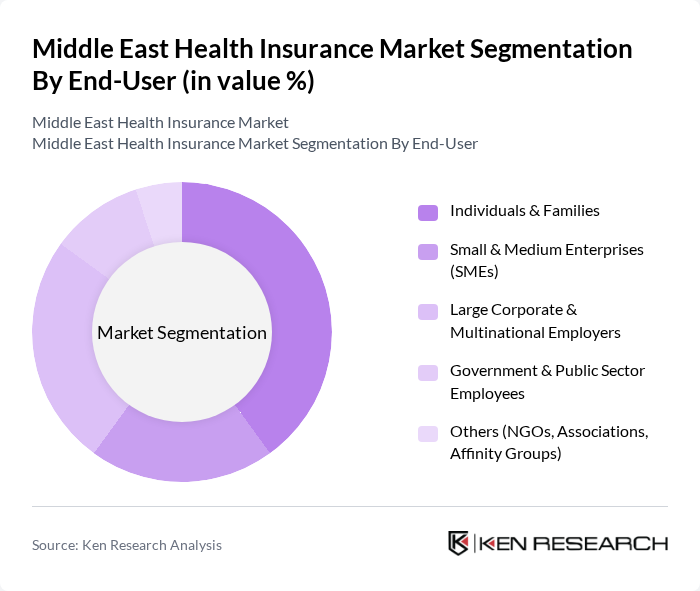

By End-User:The end-user segmentation includes Individuals & Families, Small & Medium Enterprises (SMEs), Large Corporate & Multinational Employers, Government & Public Sector Employees, and Others (NGOs, Associations, Affinity Groups). The Individuals & Families segment is currently the most significant due to the growing awareness of health insurance benefits among the general population. This trend is driven by rising healthcare costs and the increasing prevalence of chronic diseases, prompting families to seek comprehensive health coverage.

The Middle East Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bupa Arabia for Cooperative Insurance, National Health Insurance Company – Daman (UAE), Abu Dhabi National Insurance Company (ADNIC), Tawuniya – The Company for Cooperative Insurance (Saudi Arabia), AXA Cooperative Insurance Company (Saudi Arabia), GIG Gulf (formerly AXA Gulf), Allianz Partners & Allianz Care, Oman Insurance Company (Sukoon), Qatar Insurance Company (QIC), Emirates Insurance Company, Gulf Insurance Group (GIG), Arabia Insurance Company, MedGulf Cooperative Insurance Company, Saudi Enaya Cooperative Insurance Company, Jordan Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East health insurance market appears promising, driven by technological advancements and evolving consumer preferences. The integration of digital health solutions is expected to enhance service delivery and customer engagement. Additionally, the increasing demand for personalized insurance plans will likely lead to innovative product offerings. As governments continue to support health insurance initiatives, the market is poised for significant growth, addressing the healthcare needs of a diverse population in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Floater / Family Health Insurance Plans Group / Corporate Health Insurance Critical Illness & High-Severity Disease Cover International & Expatriate Medical Insurance Supplementary & Top-up Health Insurance Others (Dental, Vision, Maternity Riders, etc.) |

| By End-User | Individuals & Families Small & Medium Enterprises (SMEs) Large Corporate & Multinational Employers Government & Public Sector Employees Others (NGOs, Associations, Affinity Groups) |

| By Region | Gulf Cooperation Council (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant (Jordan, Lebanon, Palestine, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia) Rest of Middle East |

| By Insurance Provider Type | Public / Social Health Insurance Schemes Private Health Insurance Companies Standalone Health Insurers & Health Insurance TPAs Others (Regional Reinsurers, Captive & Niche Providers) |

| By Coverage Type | Inpatient & Hospitalization Coverage Outpatient & Primary Care Coverage Maternity & Newborn Coverage Emergency & Ambulance Coverage Preventive, Wellness & Ancillary Benefits |

| By Payment / Reimbursement Model | Fee-for-Service (Indemnity) Capitation & Managed Care Models (HMO, PPO, POS) Value-Based & Outcome-Linked Payment Models Others |

| By Policy Duration | Short-term Policies (? 1 Year) Long-term & Multi-year Policies Others (Seasonal, Visitor & Event-based Covers) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private Health Insurance Providers | 120 | CEOs, Product Managers, Underwriters |

| Public Health Insurance Schemes | 90 | Policy Makers, Program Directors, Health Economists |

| Healthcare Providers (Hospitals & Clinics) | 110 | Administrators, Financial Officers, Medical Directors |

| Consumer Insights on Health Insurance | 140 | Policyholders, Potential Buyers, Healthcare Advocates |

| Insurance Brokers and Agents | 80 | Insurance Brokers, Sales Managers, Client Relationship Managers |

The Middle East Health Insurance Market is valued at approximately USD 86 billion, reflecting significant growth driven by increasing healthcare expenditures, rising awareness of health insurance benefits, and government initiatives aimed at enhancing healthcare access.