Region:Middle East

Author(s):Dev

Product Code:KRAD6387

Pages:88

Published On:December 2025

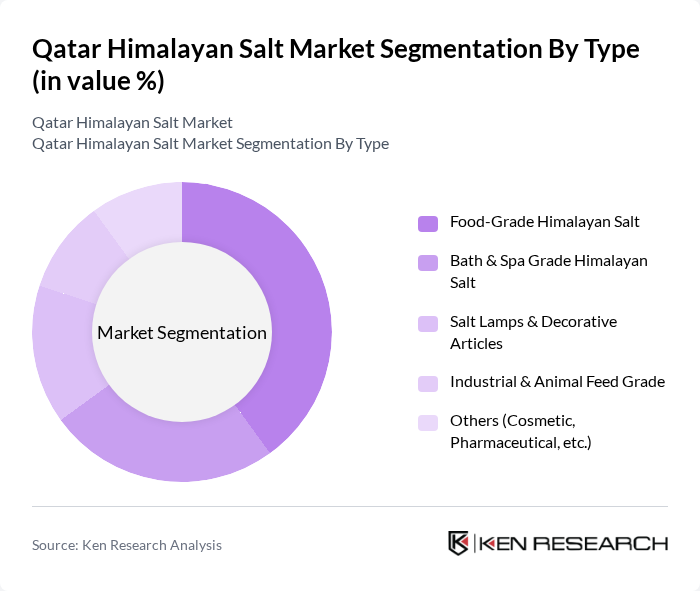

By Type:The market is segmented into various types of Himalayan salt products, including Food-Grade Himalayan Salt, Bath & Spa Grade Himalayan Salt, Salt Lamps & Decorative Articles, Industrial & Animal Feed Grade, and Others (Cosmetic, Pharmaceutical, etc.). Among these, Food-Grade Himalayan Salt is the leading subsegment, driven by its increasing use in culinary applications and health-conscious consumer preferences. Bath & Spa Grade Himalayan Salt is also gaining traction due to the rising popularity of wellness and spa treatments.

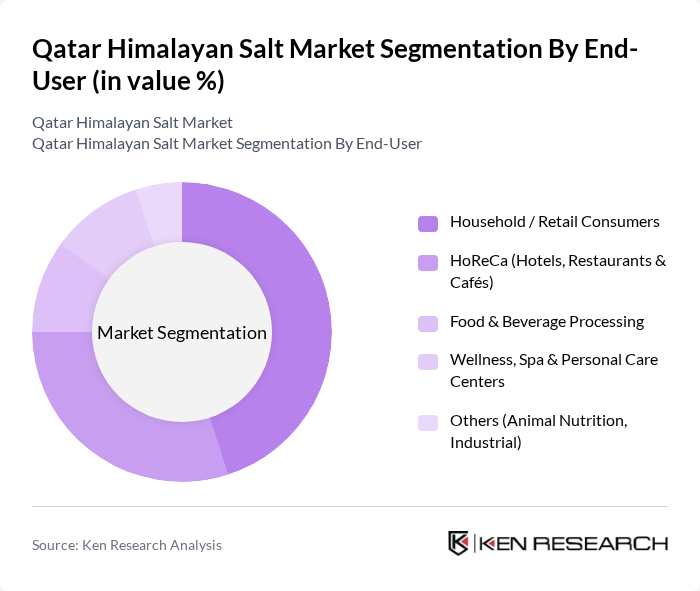

By End-User:The end-user segmentation includes Household / Retail Consumers, HoReCa (Hotels, Restaurants & Cafés), Food & Beverage Processing, Wellness, Spa & Personal Care Centers, and Others (Animal Nutrition, Industrial). The Household / Retail Consumers segment is the most significant, driven by the growing trend of using Himalayan salt in everyday cooking and health applications. The HoReCa segment is also expanding, as restaurants and cafes increasingly incorporate Himalayan salt into their menus.

The Qatar Himalayan Salt Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Meera Consumer Goods Company (Private Label Himalayan Salt), Carrefour Qatar (Majid Al Futtaim) – Imported Himalayan Salt Range, LuLu Hypermarket Qatar – LuLu Private Label & Imported Himalayan Salt, Spinneys Qatar – Gourmet & Health-Focused Himalayan Salt Portfolio, Monoprix Qatar – Premium International Himalayan Salt Brands, Quality Hypermarket & Department Store – Ethnic & Bulk Himalayan Salt, MegaMart Qatar – Specialty & Imported Himalayan Salt SKUs, Al Rawabi Group (Retail & Wholesale Distribution of Himalayan Salt), Talabat, Snoonu & Other Q-Commerce Platforms (Online Himalayan Salt Sales), GMG (Gulf Marketing Group) – Regional Himalayan Pink Salt Manufacturer & Supplier, Shan Foods – Branded Himalayan Salt & Seasoning Supplier to Qatar, National Foods Limited – Himalayan Salt & Blends Distributed in Qatar, Humza Foods / Batla Group – Ethnic Food Importer Including Himalayan Salt, Local HoReCa Distributors (Bidfood Qatar, Abela & Co) – Bulk Himalayan Salt Supply, Online Specialty Stores & Wellness Boutiques (e.g., organic shops retailing Himalayan Salt Lamps & Bath Salts) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Himalayan salt market appears promising, driven by increasing health consciousness and a growing culinary scene. As consumers continue to prioritize natural and organic products, the demand for Himalayan salt is expected to rise in future. Additionally, the expansion of e-commerce platforms will facilitate direct sales, making Himalayan salt more accessible. Collaborations with health and wellness brands will further enhance market visibility, positioning Himalayan salt as a staple in health-oriented diets and gourmet cooking.

| Segment | Sub-Segments |

|---|---|

| By Type | Food-Grade Himalayan Salt Bath & Spa Grade Himalayan Salt Salt Lamps & Decorative Articles Industrial & Animal Feed Grade Others (Cosmetic, Pharmaceutical, etc.) |

| By End-User | Household / Retail Consumers HoReCa (Hotels, Restaurants & Cafés) Food & Beverage Processing Wellness, Spa & Personal Care Centers Others (Animal Nutrition, Industrial) |

| By Packaging Type | Flexible Pouches & Bags Jars, Glass & Rigid Containers Bulk Sacks (B2B) Premium / Gift & HoReCa Packs |

| By Distribution Channel | Supermarkets / Hypermarkets Convenience & Grocery Stores Specialty Gourmet & Health Stores Online Retail (Marketplaces & D2C) HoReCa & Institutional Direct Supply |

| By Region | Doha Al Rayyan Al Wakrah Others |

| By Application | Culinary & Gourmet Uses Decorative & Lighting (Lamps, Bricks) Bath, Spa & Therapeutic Uses Others (Cosmetics, Inhalation, Ritual) |

| By Price Range | Premium Imported & Branded Mid-Range Branded Economy / Private Label HoReCa & Bulk Value Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 90 | Store Managers, Category Buyers |

| Health and Wellness Professionals | 70 | Nutritionists, Fitness Trainers |

| Consumer Preferences Survey | 140 | Health-Conscious Consumers, Home Chefs |

| Distribution Channel Analysis | 80 | Wholesalers, Importers |

| Market Trend Evaluation | 60 | Market Analysts, Industry Experts |

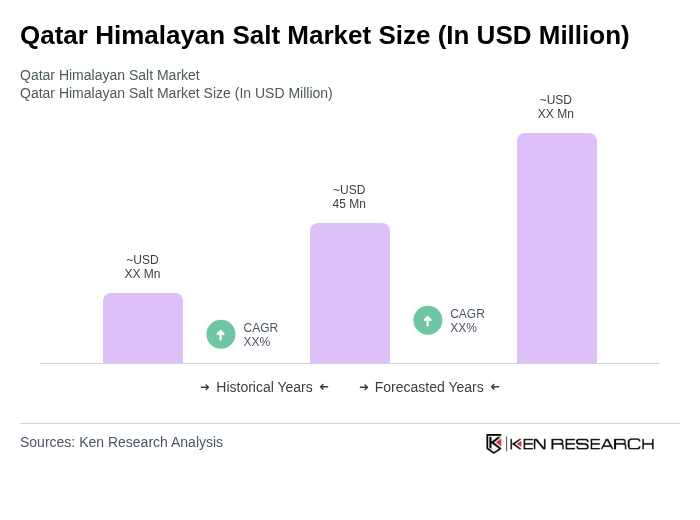

The Qatar Himalayan Salt Market is valued at approximately USD 45 million, reflecting a growing consumer interest in the health benefits of Himalayan salt and its increasing use in culinary and wellness applications.