Region:Middle East

Author(s):Rebecca

Product Code:KRAB7041

Pages:88

Published On:October 2025

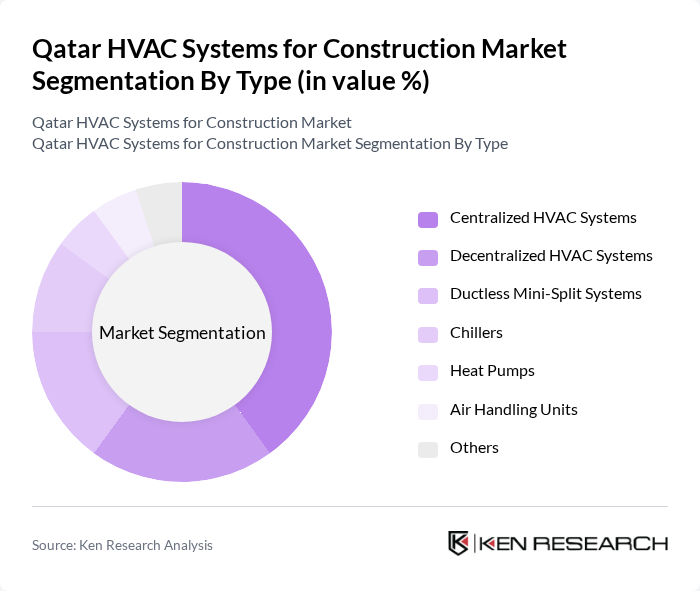

By Type:The HVAC systems market is segmented into various types, including Centralized HVAC Systems, Decentralized HVAC Systems, Ductless Mini-Split Systems, Chillers, Heat Pumps, Air Handling Units, and Others. Among these, Centralized HVAC Systems are leading the market due to their efficiency in large buildings and commercial spaces, where they provide consistent temperature control and energy savings. The trend towards energy-efficient solutions is driving the adoption of these systems, making them a preferred choice for new constructions.

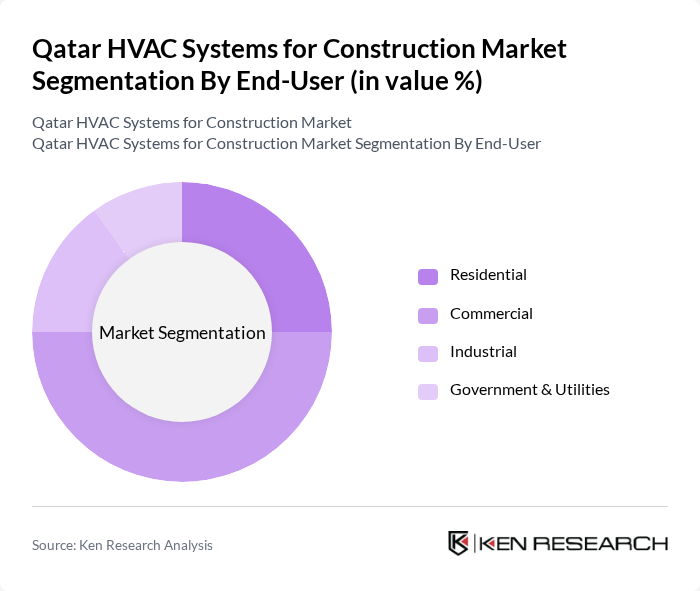

By End-User:The market is segmented by end-user into Residential, Commercial, Industrial, and Government & Utilities. The Commercial segment dominates the market, driven by the rapid growth of commercial infrastructure, including office buildings, shopping malls, and hotels. The increasing focus on energy efficiency and indoor air quality in commercial spaces is propelling the demand for advanced HVAC systems, making this segment a key driver of market growth.

The Qatar HVAC Systems for Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Cooling Company, Gulf Air Conditioning Company, Qatari HVAC Solutions, Al-Futtaim Engineering, Trane Qatar, Daikin Qatar, Carrier Qatar, Johnson Controls Qatar, Siemens Qatar, Honeywell Qatar, Mitsubishi Electric Qatar, LG Electronics Qatar, Schneider Electric Qatar, Emerson Climate Technologies, York International Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the HVAC systems market in Qatar appears promising, driven by ongoing construction projects and a strong emphasis on energy efficiency. As the government continues to invest in infrastructure and sustainable development, the demand for innovative HVAC solutions is expected to rise. Additionally, the integration of smart technologies and renewable energy sources will likely shape the market landscape, fostering a more energy-efficient and environmentally friendly approach to building management in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Centralized HVAC Systems Decentralized HVAC Systems Ductless Mini-Split Systems Chillers Heat Pumps Air Handling Units Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New Construction Renovation Maintenance & Repair |

| By Component | Compressors Condensers Evaporators Expansion Valves Controls & Sensors |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential HVAC Installations | 100 | Homeowners, HVAC Contractors |

| Commercial HVAC Systems | 80 | Facility Managers, Building Owners |

| Industrial HVAC Applications | 70 | Operations Managers, Plant Engineers |

| Energy Efficiency Initiatives | 60 | Sustainability Officers, Energy Consultants |

| HVAC Maintenance Services | 90 | Maintenance Supervisors, Service Technicians |

The Qatar HVAC Systems for Construction Market is valued at approximately USD 1.2 billion, driven by rapid urbanization, infrastructural development, and a growing demand for energy-efficient systems in the construction sector.