Region:Middle East

Author(s):Dev

Product Code:KRAA9619

Pages:89

Published On:November 2025

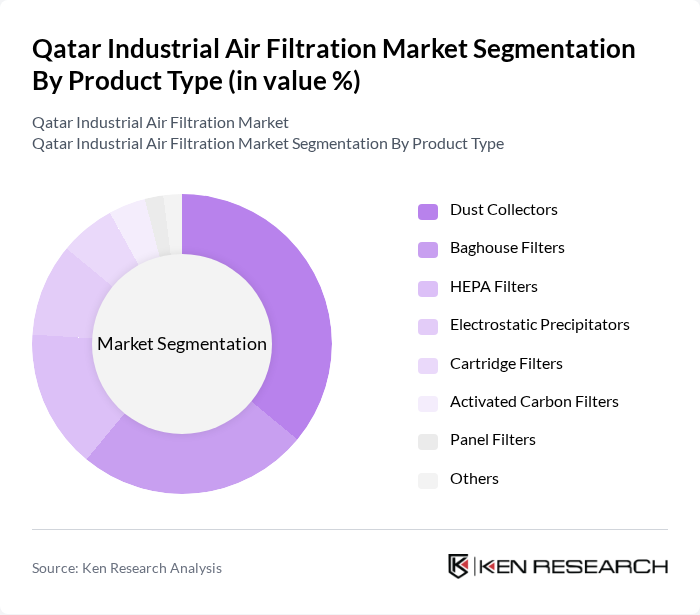

By Product Type:The product types in the Qatar Industrial Air Filtration Market include a range of filtration solutions tailored to meet specific industrial requirements. The dominant sub-segment is Dust Collectors, widely used in industries to manage particulate emissions effectively. Other significant product types include HEPA Filters and Baghouse Filters, which are essential for ensuring compliance with stringent air quality regulations .

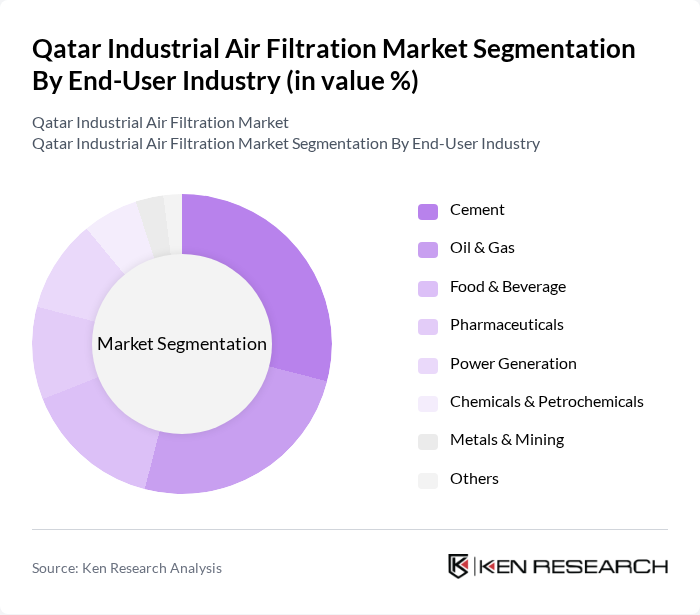

By End-User Industry:The end-user industries in the Qatar Industrial Air Filtration Market encompass a wide range of sectors, with the Cement and Oil & Gas industries being the most significant. These industries require robust air filtration solutions to manage emissions and comply with environmental regulations. The Pharmaceuticals and Food & Beverage sectors also contribute to the demand, driven by the need for clean air in production processes .

The Qatar Industrial Air Filtration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Camfil, Donaldson Company, Inc., AAF International (A Member of Daikin Group), 3M Company, Parker Hannifin Corporation, Filtration Group, Nederman Holding AB, Honeywell International Inc., Daikin Industries, Ltd., Trolex Ltd., Swegon Group AB, Air Products and Chemicals, Inc., MANN+HUMMEL, Lennox International Inc., Siemens AG, K&N Engineering, Sefar AG, Freudenberg Filtration Technologies, Al Suwaidi Equipment & Transport Co. LLC (Qatar Distributor), Al Jaber Group (Qatar Distributor/Integrator) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar Industrial Air Filtration Market is poised for significant growth as industrialization accelerates and environmental regulations tighten. The integration of smart technologies and IoT in filtration systems is expected to enhance efficiency and monitoring capabilities. Additionally, the increasing focus on sustainability will drive demand for eco-friendly filtration solutions. As the construction and healthcare sectors expand, the need for effective air filtration will become more pronounced, presenting opportunities for innovation and market entry for new players.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dust Collectors Baghouse Filters HEPA Filters Electrostatic Precipitators Cartridge Filters Activated Carbon Filters Panel Filters Others |

| By End-User Industry | Cement Oil & Gas Food & Beverage Pharmaceuticals Power Generation Chemicals & Petrochemicals Metals & Mining Others |

| By Application | Particulate Removal Gas & Odor Control Fume & Smoke Extraction Indoor Air Quality Management Dust Control Others |

| By Technology | Mechanical Filtration Electrostatic Filtration Chemical Filtration Biological Filtration Others |

| By Material | Fiberglass Synthetic Media Metal Mesh Polypropylene Others |

| By Country (GCC Context) | Qatar Saudi Arabia UAE Kuwait Oman Bahrain |

| By Regulatory Compliance | National Environmental Standards ISO/EN Certifications Industry-Specific Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Air Filtration | 60 | Environmental Managers, Operations Managers |

| Manufacturing Industry Filtration Needs | 50 | Production Managers, Quality Assurance Managers |

| Construction Site Air Quality Management | 40 | Site Managers, Health & Safety Officers |

| Food Processing Air Filtration Systems | 40 | Compliance Officers, Facility Managers |

| Pharmaceutical Industry Filtration Requirements | 40 | R&D Managers, Production Supervisors |

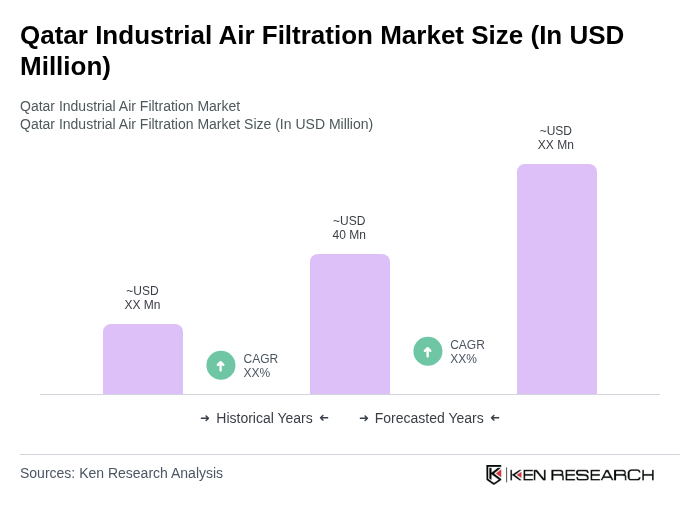

The Qatar Industrial Air Filtration Market is valued at approximately USD 40 million, reflecting a significant growth driven by increasing industrial activities, stricter environmental regulations, and heightened awareness of air quality issues among businesses and the public.