Region:Middle East

Author(s):Shubham

Product Code:KRAD6611

Pages:83

Published On:December 2025

By Type:The market is segmented into various types of air filtration systems, including HEPA Filters, Electrostatic Precipitators, Activated Carbon Filters, Baghouse / Fabric Filters, Cartridge Dust Collectors, Cyclone Separators, Panel & Pocket Filters, and Others (EPA/ULPA, Metal & Specialty Filters). Each type serves specific applications and industries, catering to the diverse needs of the market.

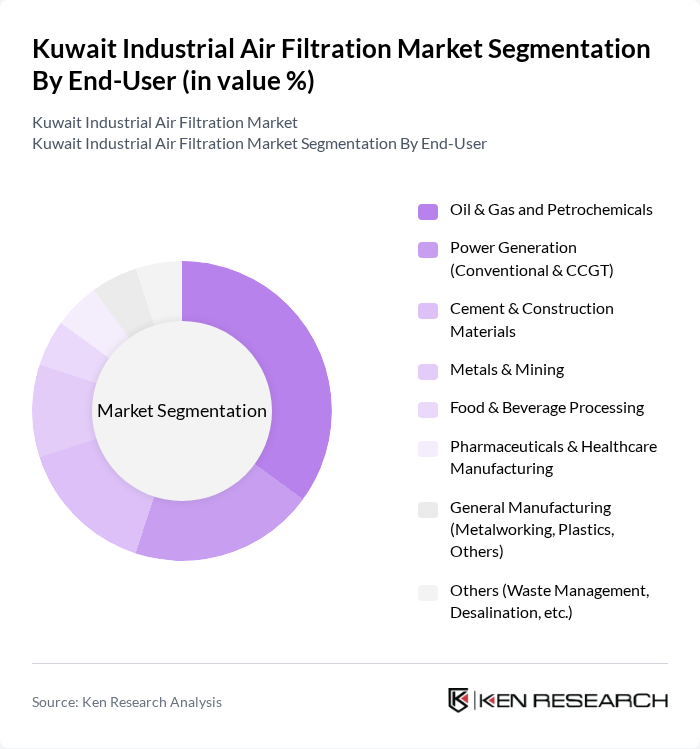

By End-User:The end-user segmentation includes Oil & Gas and Petrochemicals, Power Generation (Conventional & CCGT), Cement & Construction Materials, Metals & Mining, Food & Beverage Processing, Pharmaceuticals & Healthcare Manufacturing, General Manufacturing (Metalworking, Plastics, Others), and Others (Waste Management, Desalination, etc.). Each sector has unique requirements for air filtration, influencing the choice of technology and system design.

The Kuwait Industrial Air Filtration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Camfil AB, Donaldson Company, Inc., AAF International (Daikin Industries, Ltd.), 3M Company, Parker Hannifin Corporation, Filtration Group Corporation, Nederman Holding AB, Honeywell International Inc., Daikin Industries, Ltd., MANN+HUMMEL Group, Freudenberg Filtration Technologies SE & Co. KG, Hamon & Cie (International) S.A., Keller Lufttechnik GmbH + Co. KG, Absolent Air Care Group, Local & Regional Players (e.g., Gulf Air Filtration Co., Kuwait Filter Manufacturing & Supplies) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait industrial air filtration market is poised for significant transformation, driven by technological advancements and increasing regulatory pressures. By in future, the integration of smart technologies and IoT in filtration systems is expected to enhance operational efficiency and monitoring capabilities. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly filtration solutions, aligning with global trends. As industries adapt to these changes, the market is expected to witness a shift towards more innovative and efficient air filtration technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | HEPA Filters Electrostatic Precipitators Activated Carbon Filters Baghouse / Fabric Filters Cartridge Dust Collectors Cyclone Separators Panel & Pocket Filters Others (EPA/ULPA, Metal & Specialty Filters) |

| By End-User | Oil & Gas and Petrochemicals Power Generation (Conventional & CCGT) Cement & Construction Materials Metals & Mining Food & Beverage Processing Pharmaceuticals & Healthcare Manufacturing General Manufacturing (Metalworking, Plastics, Others) Others (Waste Management, Desalination, etc.) |

| By Application | Process Dust Collection Fume & Smoke Extraction Mist & Oil Aerosol Collection HVAC & Cleanroom Air Quality Control Turbine Inlet & Compressor Filtration Odor & VOC Control Others |

| By Technology | Mechanical Filtration Electrostatic Filtration Chemical / Adsorption Filtration Biological Filtration Hybrid & Multi-Stage Systems Others |

| By Industry Standards | ISO 16890 / EN 779 ASHRAE Standards NFPA & Local Environmental Regulations GMP / Cleanroom Standards (ISO 14644) Others |

| By Distribution Channel | Direct Sales to Industrial End-Users EPC Contractors & System Integrators Local Distributors & Dealers Online & E-Procurement Portals Others |

| By Policy Support | Government Environmental Regulations & Compliance Energy Efficiency & Emission Reduction Incentives Grants and Support for R&D and Localization PPP & Industrial Zone Initiatives (e.g., Shuaiba, Al-Zour) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Filtration Needs | 100 | Environmental Managers, Operations Directors |

| Manufacturing Industry Air Quality Compliance | 80 | Production Managers, Safety Officers |

| Food Processing Air Filtration Systems | 70 | Quality Assurance Managers, Facility Engineers |

| Pharmaceutical Industry Filtration Standards | 60 | Regulatory Affairs Specialists, Plant Managers |

| General Industrial Air Filtration Trends | 90 | Supply Chain Managers, Environmental Compliance Officers |

The Kuwait Industrial Air Filtration Market is valued at approximately USD 140 million, driven by increasing industrial activities, stringent environmental regulations, and heightened awareness of air quality among consumers and businesses.