Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4193

Pages:98

Published On:December 2025

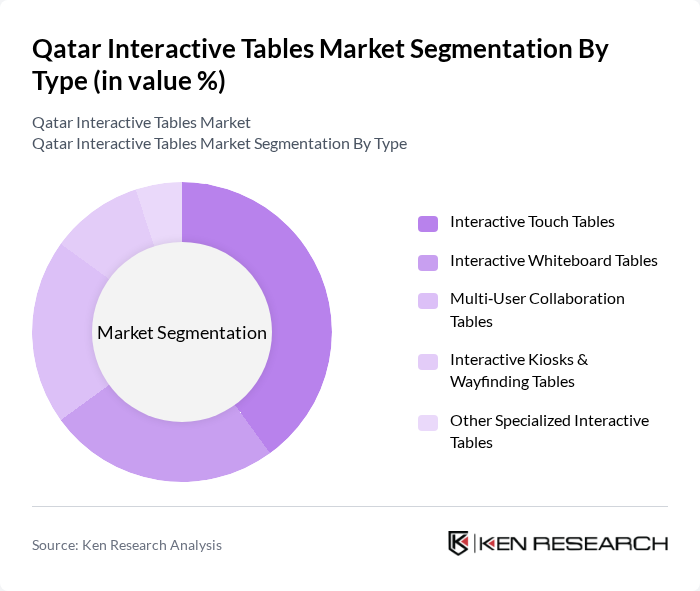

By Type:The market is segmented into various types of interactive tables, including Interactive Touch Tables, Interactive Whiteboard Tables, Multi-User Collaboration Tables, Interactive Kiosks & Wayfinding Tables, and Other Specialized Interactive Tables. This typology is consistent with global interactive tables segmentation, which differentiates by hardware form factor and use case. Among these, Interactive Touch Tables are leading the market due to their versatility, multi-touch capabilities, and user-friendly interface, making them popular in educational, corporate, and public engagement settings. The demand for Multi-User Collaboration Tables is also rising as organizations, universities, and innovation hubs seek to enhance teamwork, design thinking workshops, and collaborative meetings through shared digital workspaces.

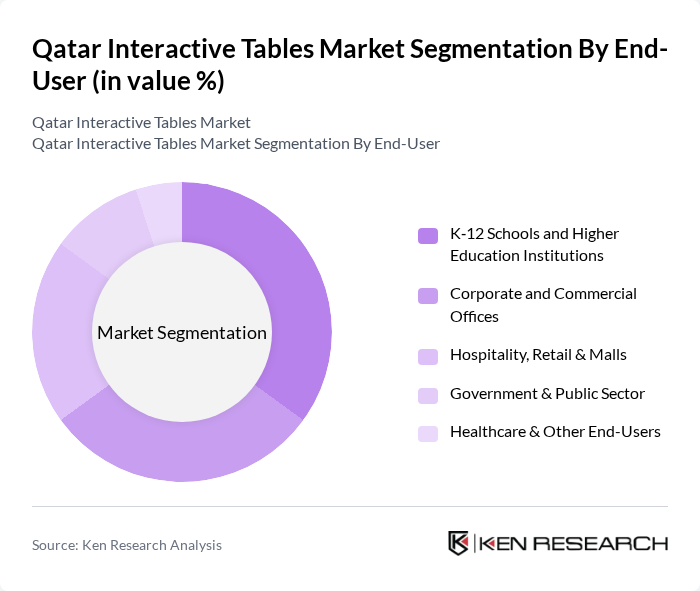

By End-User:The end-user segmentation includes K-12 Schools and Higher Education Institutions, Corporate and Commercial Offices, Hospitality, Retail & Malls, Government & Public Sector, and Healthcare & Other End-Users. This structure mirrors global demand patterns, where education, corporate, and hospitality are the primary adopters of interactive tables and related interactive display solutions. K-12 Schools and Higher Education Institutions dominate the market, driven by national strategies to enhance educational technology, deployment of smart classrooms, and increased use of interactive content and collaboration tools in teaching. Corporate and Commercial Offices are also significant users, as businesses increasingly adopt interactive tables for meeting rooms, training centers, and client-facing spaces to improve collaboration, visualization, and productivity.

The Qatar Interactive Tables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Microsoft Corporation, LG Electronics Inc., NEC Corporation, BenQ Corporation, ViewSonic Corporation, Panasonic Corporation, Huawei Technologies Co., Ltd., SMART Technologies ULC, Promethean Limited, Cisco Systems, Inc., InFocus Corporation, Clevertouch Technologies (Boxlight Corporation), Newline Interactive Inc., Ricoh Company, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the interactive tables market in Qatar appears promising, driven by ongoing technological advancements and a growing emphasis on digital education. As educational institutions and corporate environments increasingly adopt interactive solutions, the demand for customized and user-friendly products is expected to rise. Additionally, the integration of AI and machine learning into interactive tables will enhance their functionality, making them more appealing to a broader audience. This evolution will likely lead to increased investment and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Interactive Touch Tables Interactive Whiteboard Tables Multi?User Collaboration Tables Interactive Kiosks & Wayfinding Tables Other Specialized Interactive Tables |

| By End-User | K?12 Schools and Higher Education Institutions Corporate and Commercial Offices Hospitality, Retail & Malls Government & Public Sector Healthcare & Other End-Users |

| By Application | Classroom & Training Room Collaboration Meeting Room & Conference Collaboration Customer Experience, Wayfinding & Self?Service Command & Control / Data Visualization Exhibitions, Museums & Entertainment |

| By Technology | Capacitive Touch Technology Infrared (IR) Touch Technology Optical & Camera?Based Touch Technology Projection & Other Emerging Technologies |

| By Distribution Channel | Direct Enterprise & Government Sales System Integrators & Value?Added Resellers Online & IT Retail Channels Local Distributors & Project?Based Tendering |

| By Region | Doha Al Rayyan Al Wakrah & Al Daayen Other Municipalities (Umm Salal, Al Khor, Al Shamal, Al Shahaniya) |

| By Customer Segment | Large Enterprises & Conglomerates Small & Medium?Sized Enterprises (SMEs) Government Ministries & Public Agencies Education Groups, Healthcare Networks & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitality Sector Adoption | 90 | Hotel Managers, Restaurant Owners |

| Retail Environment Utilization | 70 | Store Managers, Retail Technology Specialists |

| Consumer Experience Feedback | 120 | End-users, Shoppers, Restaurant Patrons |

| Technology Provider Insights | 50 | Product Managers, Sales Directors |

| Market Trend Analysis | 60 | Industry Analysts, Market Researchers |

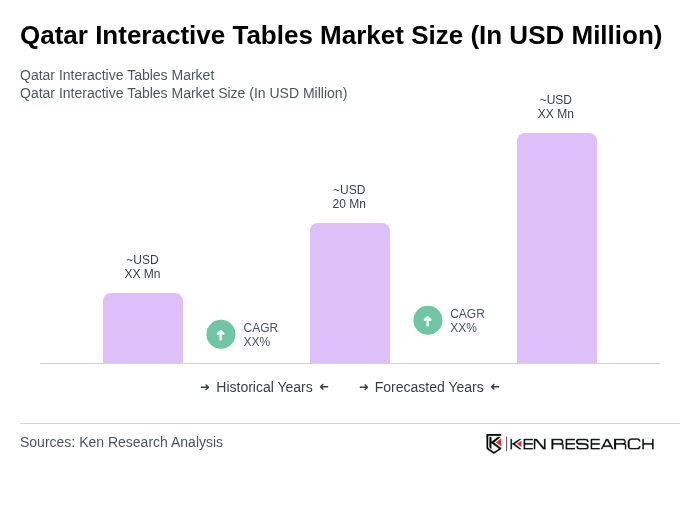

The Qatar Interactive Tables Market is valued at approximately USD 20 million, reflecting a historical analysis of interactive display adoption in the country and its contribution to the global market.