Region:Middle East

Author(s):Rebecca

Product Code:KRAC9813

Pages:83

Published On:November 2025

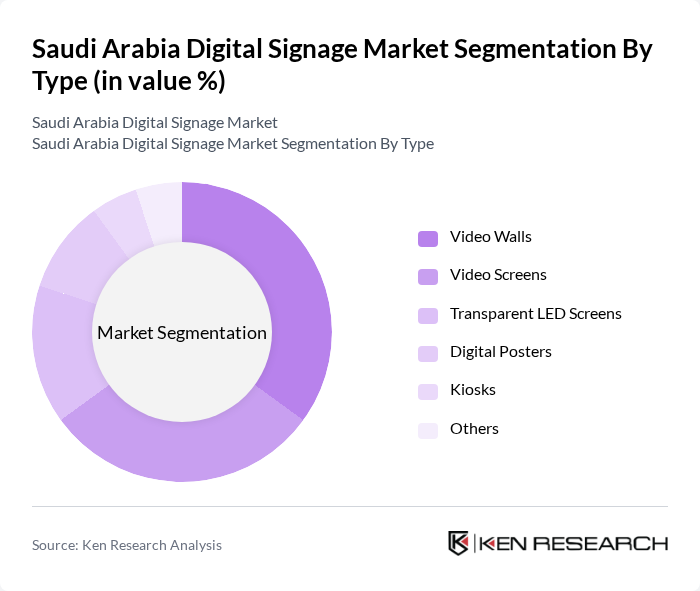

By Type:The market is segmented into Video Walls, Video Screens, Transparent LED Screens, Digital Posters, Kiosks, and Others. Video Walls are gaining significant traction due to their ability to deliver high-impact visuals in large formats, making them ideal for retail, entertainment, and corporate environments. Video Screens hold a substantial share, driven by their versatility and ease of installation across various settings, including transportation hubs and hospitality venues. Transparent LED Screens are increasingly popular for retail displays and showrooms, enabling creative advertising without obstructing visibility. Digital Posters are emerging as the fastest-growing segment, favored for dynamic content delivery in retail and public spaces.

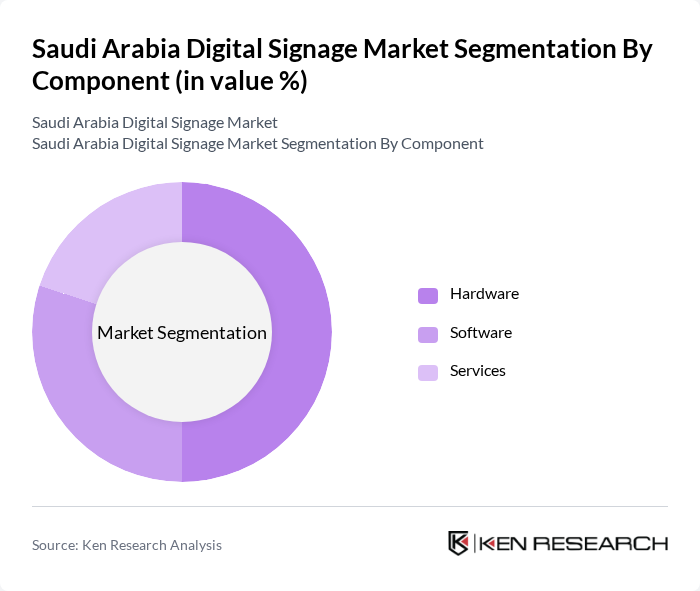

By Component:The market is further segmented into Hardware, Software, and Services. Hardware dominates the market, accounting for the largest share due to the essential role of advanced display technologies, interactive kiosks, and LED solutions in digital signage deployments. The demand for high-resolution, energy-efficient hardware continues to rise, especially in retail and entertainment venues. Software solutions are critical for content management, analytics, and remote control, supporting dynamic and targeted advertising strategies. Services, including installation, maintenance, and technical support, are vital for ensuring optimal system performance and customer satisfaction.

The Saudi Arabia Digital Signage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., NEC Corporation, Panasonic Corporation, Sharp Corporation, Sony Corporation, Christie Digital Systems USA, Inc., Daktronics, Inc., ViewSonic Corporation, Epson Corporation, Barco NV, Planar Systems, Inc., Leyard Optoelectronic Co., Ltd., AOTO Electronics Co., Ltd., Al Arabia OOH, Sahara Net, Smart Digital Solutions (SDS), Cisco Systems, Inc., Intel Corporation, Scala (Stratacache) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital signage market in Saudi Arabia appears promising, driven by ongoing technological innovations and increasing consumer engagement. As businesses increasingly recognize the value of interactive displays, the market is likely to see a shift towards more personalized and dynamic content. Additionally, the integration of AI and IoT technologies will enhance the functionality of digital signage, making it a vital tool for effective marketing strategies in various sectors, including retail and hospitality.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Walls Video Screens Transparent LED Screens Digital Posters Kiosks Others |

| By Component | Hardware Software Services |

| By Technology | LCD/LED Projection Media Players Others |

| By Location | Indoor Outdoor |

| By Application | Retail Hospitality Entertainment Education Healthcare Transport Corporate BFSI Others |

| By Size | Below 32 Inches –52 Inches Above 52 Inches |

| By Region | Central Region (Riyadh) Western Region (Jeddah, Medina, Mecca) Eastern Region (Dammam, Khobar) Northern Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Digital Signage Solutions | 100 | Marketing Managers, Store Operations Directors |

| Corporate Communication Displays | 70 | Corporate Communication Managers, IT Managers |

| Transportation Information Systems | 60 | Transport Managers, Public Relations Officers |

| Hospitality Digital Advertising | 50 | Hotel Managers, Marketing Executives |

| Event and Exhibition Signage | 60 | Event Coordinators, Exhibition Managers |

The Saudi Arabia Digital Signage Market is valued at approximately USD 620 million, reflecting significant growth driven by the increasing adoption of digital advertising solutions across various sectors, including retail, hospitality, and entertainment.