Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4150

Pages:89

Published On:December 2025

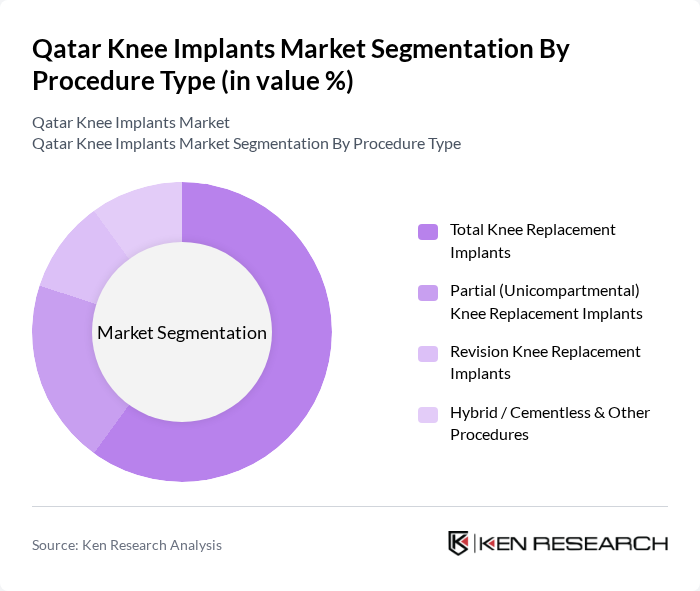

By Procedure Type:The procedure type segmentation includes Total Knee Replacement Implants, Partial (Unicompartmental) Knee Replacement Implants, Revision Knee Replacement Implants, and Hybrid / Cementless & Other Procedures. Among these, Total Knee Replacement Implants dominate the market due to the increasing incidence of osteoarthritis and the aging population, consistent with global procedure patterns where total knee arthroplasty accounts for the majority of knee replacement surgeries. The preference for total knee replacements is driven by their effectiveness in relieving pain and restoring mobility, high long-term success rates, and growing patient awareness of joint preservation and quality-of-life outcomes, making them a common choice for patients with severe knee damage.

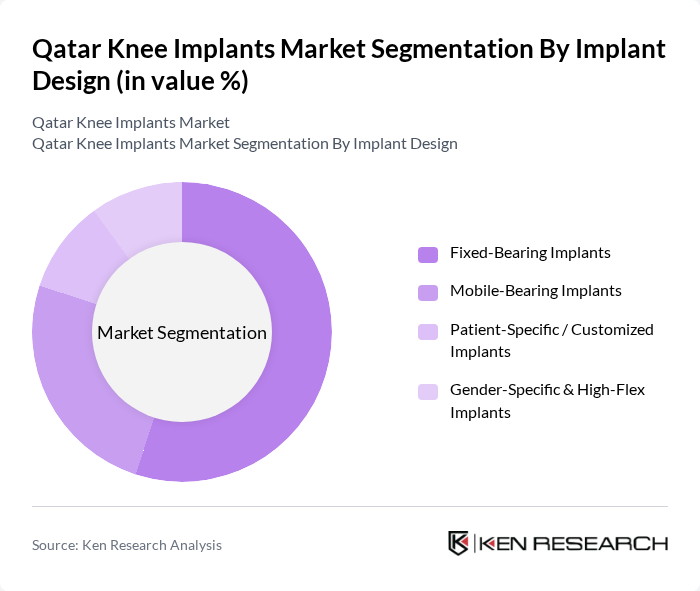

By Implant Design:This segmentation includes Fixed-Bearing Implants, Mobile-Bearing Implants, Patient-Specific / Customized Implants, and Gender-Specific & High-Flex Implants. The Fixed-Bearing Implants segment leads the market due to their widespread acceptance and proven performance in knee replacement surgeries, mirroring global trends where fixed-bearing designs hold the largest share of knee replacement procedures. Their design offers stability and durability, relatively lower complication rates, and compatibility with minimally invasive techniques, making them a preferred choice among orthopedic surgeons and patients alike.

The Qatar Knee Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson MedTech), Smith & Nephew plc, B. Braun Melsungen AG (Aesculap), Exactech, Inc., Conformis, Inc., Arthrex, Inc., MicroPort Orthopedics Inc. (MicroPort Scientific), Medacta International, LimaCorporate S.p.A., DJO Global (Enovis Corporation), Orthofix Medical Inc., OMNIlife science, Inc. (a Corin Group company), Local & Regional Distributors (Qatar and GCC-Focused Partners) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar knee implants market is poised for significant growth, driven by technological advancements and an increasing geriatric population. As healthcare infrastructure expands, more patients will gain access to innovative treatments. Additionally, the rise of medical tourism in Qatar, projected to attract over 500,000 international patients in future, will further stimulate demand for knee implants. The focus on minimally invasive procedures and personalized implants will likely shape the future landscape of the market, enhancing patient outcomes and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Procedure Type | Total Knee Replacement Implants Partial (Unicompartmental) Knee Replacement Implants Revision Knee Replacement Implants Hybrid / Cementless & Other Procedures |

| By Implant Design | Fixed-Bearing Implants Mobile-Bearing Implants Patient-Specific / Customized Implants Gender-Specific & High-Flex Implants |

| By Material | Metal-on-Polyethylene Implants Ceramic-on-Polyethylene Implants Oxidized Zirconium & Advanced Coated Implants Others (Polyether ether ketone, Hybrid Materials) |

| By End-User | Public Hospitals (HMC & Government Facilities) Private Hospitals Specialized Orthopedic & Sports Medicine Centers Ambulatory Surgical Centers & Day Surgery Clinics |

| By Distribution Channel | Direct Sales by Multinational Manufacturers Local Distributors / Agents Group Purchasing Organizations & Tender-Based Procurement Others |

| By Patient Profile | Osteoarthritis Patients Post-Traumatic & Sports Injury Patients Rheumatoid & Other Inflammatory Arthritis Patients Others |

| By Age & Demographics | Middle-Aged Adults (45–64 Years) Seniors (65 Years and Above) High BMI / Obese Patient Segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 100 | Consultant Orthopedic Surgeons, Knee Specialists |

| Hospital Procurement Managers | 80 | Procurement Managers, Supply Chain Managers |

| Patients with Knee Implants | 75 | Post-operative Patients |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Health Policy Analysts |

| Medical Device Distributors | 60 | Sales Representatives, Distribution Managers |

The Qatar Knee Implants Market is valued at approximately USD 25 million, reflecting a five-year historical analysis and recent estimates. This growth is driven by increasing knee-related disorders and advancements in healthcare technology.