Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7230

Pages:93

Published On:December 2025

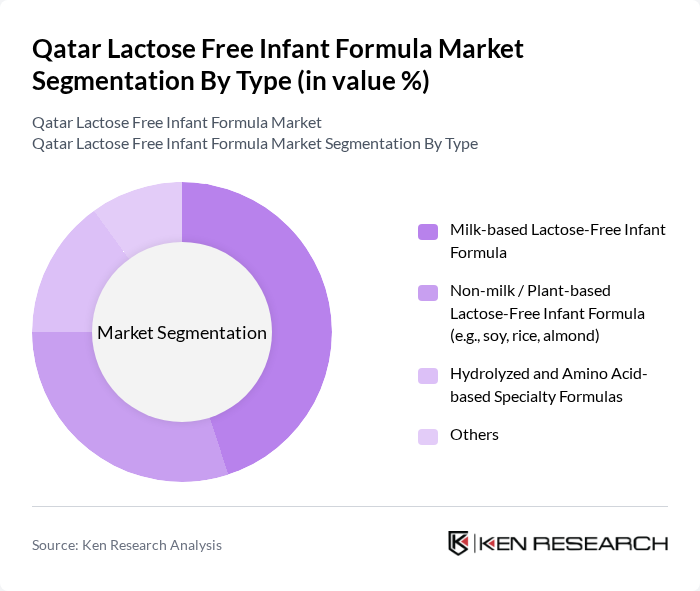

By Type:The market is segmented into various types of lactose-free infant formulas, including Milk-based Lactose-Free Infant Formula, Non-milk / Plant-based Lactose-Free Infant Formula (e.g., soy, rice, almond), Hydrolyzed and Amino Acid-based Specialty Formulas, and Others. Milk-based Lactose-Free Infant Formula remains the most dominant segment, in line with global patterns where conventional milk-protein–based lactose-free products account for the majority of demand due to their closer similarity to standard formulas and strong endorsement by healthcare professionals for common lactose intolerance or transient malabsorption. The increasing availability of these products in supermarkets, hypermarkets, and organized pharmacy chains in Qatar, combined with strong brand recognition of leading international players, has further solidified their market position.

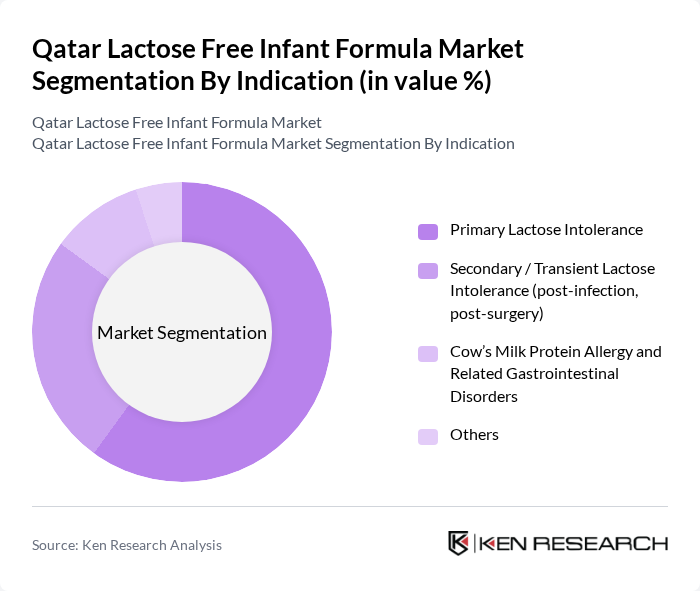

By Indication:The market is categorized based on indications such as Primary Lactose Intolerance, Secondary / Transient Lactose Intolerance (post-infection, post-surgery), Cow’s Milk Protein Allergy and Related Gastrointestinal Disorders, and Others. The Primary Lactose Intolerance segment leads the market in terms of labeled usage, supported by increased parental awareness of symptoms such as bloating, diarrhea, and irritability and the growing tendency of pediatricians to recommend lactose-free or low?lactose formulas as a first-line dietary adjustment when lactose-related discomfort is suspected. At the same time, hydrolyzed and amino-acid based products targeted at cow’s milk protein allergy and complex gastrointestinal disorders also form a meaningful niche, reflecting global growth in specialized formulas for medically managed conditions.

The Qatar Lactose Free Infant Formula Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Nan Lactose Free, NAN Comfort, NAN Sensitive), Danone S.A. (Aptamil Lactose Free, Nutricia), Abbott Laboratories (Similac Total Comfort, Similac Sensitive, Isomil), Mead Johnson Nutrition (Enfamil A+ Lactose Free / Gentlease), FrieslandCampina N.V. (Friso Gold, specialty lactose-free variants), Hero Group (Hero Baby, lactose-free and sensitive formulas), Arla Foods amba (Baby&Me Organic, specialty and lactose-free lines), Holle baby food AG (Holle Organic specialty / lactose-reduced formulas), Bubs Australia Ltd (Bubs Goat & specialty lactose-free/low-lactose formulas), Perrigo Company plc (store-brand lactose-free and sensitive infant formulas), The Hain Celestial Group, Inc. (Earth’s Best Organic specialty infant formulas), Nature’s One, LLC (Baby’s Only Organic, sensitive and lactose-free options), Almarai Company (Regional infant nutrition portfolio, including sensitive / lactose-free), Qatar National Import & Export Co. (QNIE) – Key importer/distributor of international infant formula brands, Al Meera Consumer Goods Company & Other Leading Retail-led Private Labels (lactose-free and sensitive baby formula offerings) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lactose-free infant formula market in Qatar appears promising, driven by increasing health awareness and changing consumer preferences. As more parents recognize the importance of specialized nutrition, the demand for lactose-free products is expected to rise significantly in future. Additionally, advancements in product formulations and distribution channels will likely enhance accessibility, particularly in underserved areas. The market is poised for growth, with innovative marketing strategies and collaborations with healthcare professionals further supporting this upward trend.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk-based Lactose-Free Infant Formula Non-milk / Plant-based Lactose-Free Infant Formula (e.g., soy, rice, almond) Hydrolyzed and Amino Acid-based Specialty Formulas Others |

| By Indication | Primary Lactose Intolerance Secondary / Transient Lactose Intolerance (post-infection, post-surgery) Cow’s Milk Protein Allergy and Related Gastrointestinal Disorders Others |

| By Age Group | Starting Formula (0–6 months) Follow-on Formula (6–12 months) Toddler / Growing-up Formula (1–3 years) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies & Drug Stores Hospital & Clinic Pharmacies Online Retail (e-commerce platforms, brand webshops) Specialty Baby Stores Others |

| By Nutritional & Positioning Attributes | Halal-certified Lactose-Free Infant Formula Fortified with Vitamins, Minerals & Functional Ingredients (e.g., DHA/ARA, prebiotics) Organic and Clean-label Lactose-Free Options Hypoallergenic / Medical Nutrition Formulas Others |

| By Packaging Type | Metal Cans / Tins Composite / Paperboard Cannisters Tetra Packs & Bottles (ready-to-feed / liquid) Sachets & Pouches Others |

| By Consumer Profile | Qatari Nationals Expatriate Families Premium / Health-conscious Households Price-sensitive Households Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Pediatricians, Nutritionists |

| Parents of Infants | 120 | New Parents, Expecting Parents |

| Retailers and Distributors | 80 | Pharmacy Managers, Grocery Store Buyers |

| Market Analysts | 50 | Industry Analysts, Market Researchers |

| Health Policy Makers | 30 | Government Officials, Health Advocates |

The Qatar Lactose Free Infant Formula market is valued at approximately USD 35 million, reflecting a significant share of the overall infant formula milk powder market in Qatar, driven by increasing awareness of lactose intolerance and dietary needs among parents.