Region:Middle East

Author(s):Shubham

Product Code:KRAC2194

Pages:98

Published On:October 2025

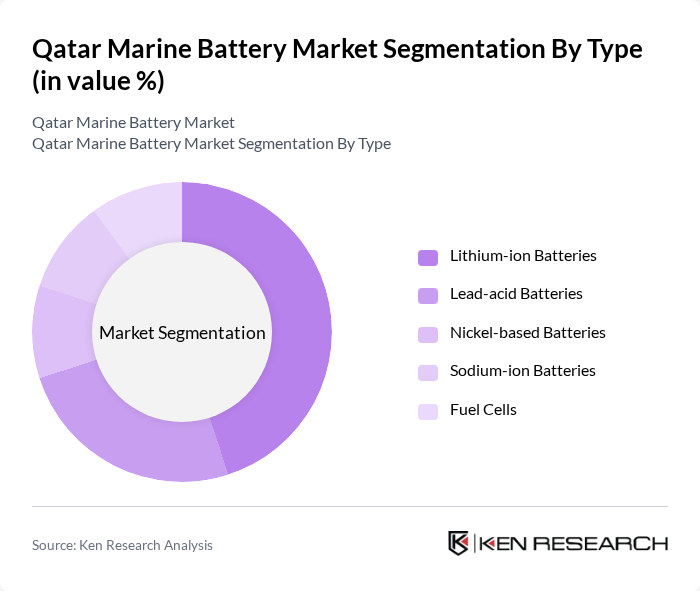

By Type:The market is segmented into various battery types, including Lithium-ion Batteries, Lead-acid Batteries, Nickel-based Batteries, Sodium-ion Batteries, and Fuel Cells. Among these, Lithium-ion Batteries continue to lead due to their high energy density, longer lifespan, and declining costs, making them the preferred choice for marine applications. The demand for Lithium-ion technology is driven by its efficiency, rapid charging capabilities, and the growing trend towards electrification in marine vessels, especially in commercial and hybrid propulsion systems .

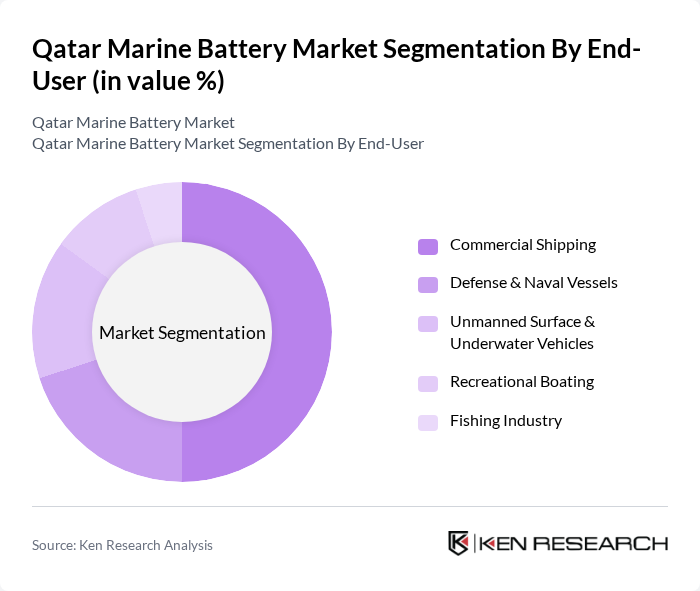

By End-User:The end-user segmentation includes Commercial Shipping, Defense & Naval Vessels, Unmanned Surface & Underwater Vehicles, Recreational Boating, and the Fishing Industry. The Commercial Shipping segment remains the most significant, driven by increasing global trade, the need for efficient energy solutions in large vessels, and the adoption of hybrid and fully electric propulsion systems. The shift towards sustainable practices in shipping operations, supported by regulatory mandates and international decarbonization targets, is also contributing to the growth of this segment .

The Qatar Marine Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Leclanché SA, Corvus Energy, Siemens Energy, Spear Power Systems (Sensata Technologies), EST-Floattech, Rolls-Royce (MTU), Wärtsilä Corporation, Toshiba Corporation, GS Yuasa Corporation, Saft Groupe S.A., CATL (Contemporary Amperex Technology Co. Limited), Exide Technologies, PowerTech Batteries, ABB Group, EnerSys contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar marine battery market appears promising, driven by increasing investments in renewable energy and technological advancements. As the government continues to promote sustainable practices, the adoption of electric and hybrid marine vessels is expected to rise. Furthermore, the development of battery recycling initiatives will enhance sustainability efforts. With a focus on innovation and regional expansion, the market is poised for significant growth, attracting both local and international players to invest in this evolving sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium-ion Batteries Lead-acid Batteries Nickel-based Batteries Sodium-ion Batteries Fuel Cells |

| By End-User | Commercial Shipping Defense & Naval Vessels Unmanned Surface & Underwater Vehicles Recreational Boating Fishing Industry |

| By Application | Marine Propulsion Auxiliary Power Systems Energy Storage for Renewable Integration Emergency Backup Systems |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket Distributors Online Retail |

| By Price Range | Budget Mid-range Premium |

| By Battery Capacity | Below 100 Ah –250 Ah Above 250 Ah |

| By Technology | Smart Battery Technology Traditional Battery Technology Hybrid Systems |

| By Energy Density | Below 100 Wh/kg –500 Wh/kg Above 500 Wh/kg |

| By Function | Starting Batteries Deep-cycle Batteries Dual-Purpose Batteries |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Shipping Operators | 100 | Fleet Managers, Operations Directors |

| Recreational Boating Enthusiasts | 60 | Boat Owners, Marina Managers |

| Offshore Energy Projects | 50 | Project Managers, Energy Consultants |

| Battery Technology Developers | 40 | R&D Managers, Product Development Engineers |

| Regulatory Bodies and Policy Makers | 40 | Energy Policy Analysts, Environmental Regulators |

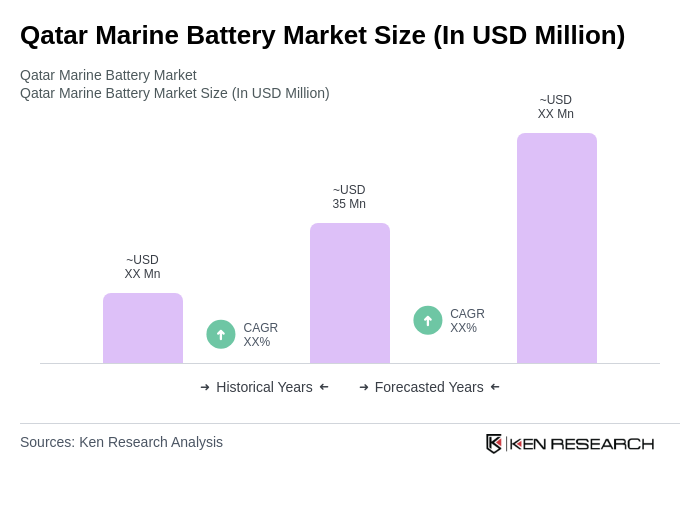

The Qatar Marine Battery Market is valued at approximately USD 35 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for sustainable energy solutions and advancements in battery technology.