Region:Middle East

Author(s):Rebecca

Product Code:KRAC8398

Pages:100

Published On:November 2025

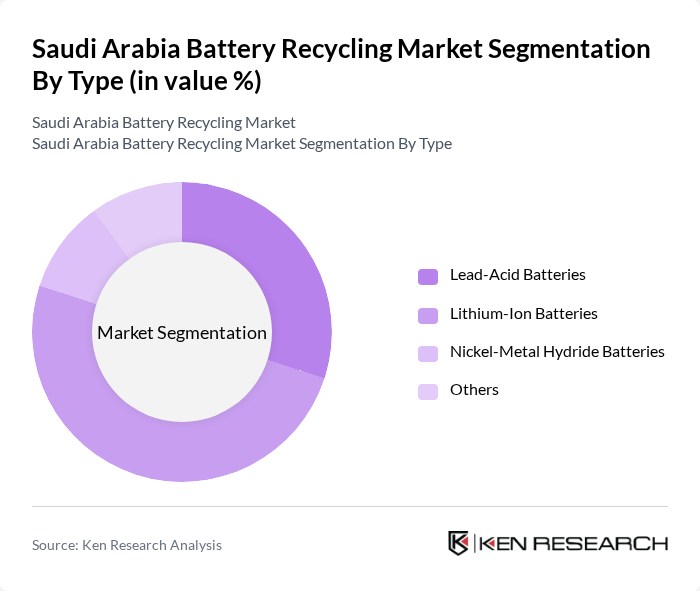

By Type:The battery recycling market can be segmented into various types, including Lead-Acid Batteries, Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, and Others. Among these, Lithium-Ion Batteries are currently the most dominant segment, driven by the rapid growth of electric vehicles, grid-scale energy storage, and portable electronics, which significantly increases the demand for efficient recycling processes. Lead-Acid Batteries also maintain a substantial share due to their widespread use in automotive and industrial backup applications .

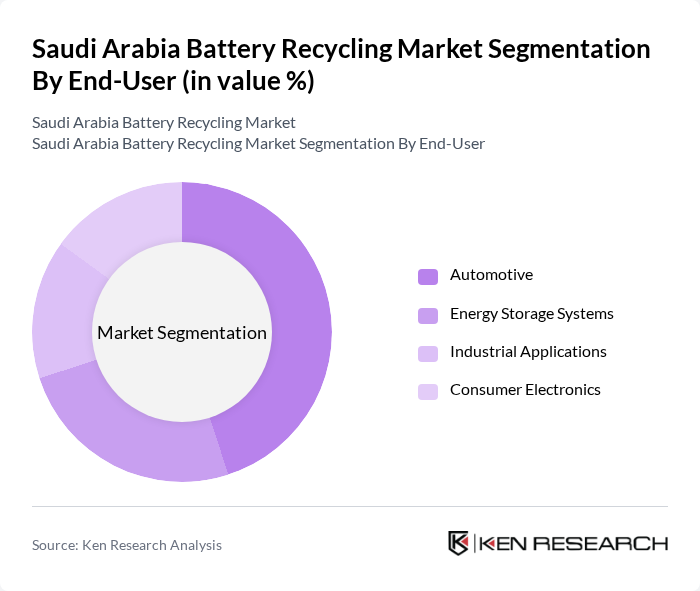

By End-User:The end-user segmentation includes Automotive, Energy Storage Systems, Industrial Applications, and Consumer Electronics. The Automotive sector is the leading end-user, propelled by the increasing production and adoption of electric vehicles and the need for sustainable battery disposal. Energy Storage Systems are also gaining traction as renewable energy sources become more prevalent, necessitating efficient battery recycling solutions to manage waste and recover valuable materials .

The Saudi Arabia Battery Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Investment Recycling Company (SIRC), Veolia Middle East, Al-Saad Recycling Technologies, Arabian Eco-Recovery Systems (AERS), Gulf Lead Solutions (GLS), Riyadh Metal Tech (RMT), EcoLead, ACWA Power, BYD, Sungrow, Alfanar, Algihaz, Envision Energy, Jinko, Huawei FusionSolar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the battery recycling market in Saudi Arabia appears promising, driven by increasing environmental regulations and a growing emphasis on sustainability. As the government continues to invest in recycling infrastructure, the market is expected to witness significant advancements in technology and processes. Additionally, the rise of electric vehicles will create a larger pool of recyclable materials, enhancing the economic viability of recycling operations. Overall, the market is poised for growth, with a focus on innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Lead-Acid Batteries Lithium-Ion Batteries Nickel-Metal Hydride Batteries Others |

| By End-User | Automotive Energy Storage Systems Industrial Applications Consumer Electronics |

| By Collection Method | Drop-off Centers Mobile Collection Units Retail Partnerships Manufacturer Take-back Programs |

| By Recycling Process | Pyrometallurgical Hydrometallurgical Biotechnological Others |

| By Material Recovered | Lithium Cobalt Nickel Lead |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Subsidies Tax Exemptions Grants for R&D Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturers | 100 | Production Managers, R&D Directors |

| Recycling Facility Operators | 80 | Operations Managers, Technical Directors |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| End-Users (Automotive, Electronics) | 70 | Supply Chain Managers, Sustainability Coordinators |

| Research Institutions | 60 | Academic Researchers, Industry Analysts |

The Saudi Arabia Battery Recycling Market is valued at approximately USD 155 million, driven by the increasing adoption of electric vehicles, renewable energy storage systems, and public-private investments in sustainable waste management practices.