Region:Middle East

Author(s):Dev

Product Code:KRAD7798

Pages:92

Published On:December 2025

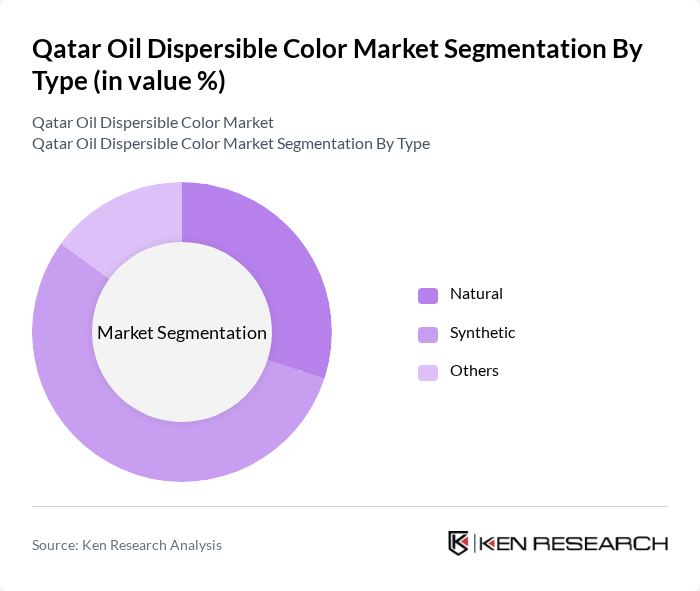

By Type:

The market is segmented into three types: Natural, Synthetic, and Others, consistent with global product categorization for oil dispersible colors. Among these, the Synthetic segment is currently dominating the market due to its cost-effectiveness, wider shade range, and superior stability in high-fat and heat-processed products, which is in line with global market behavior where synthetic oil dispersible colors retain a major share. Synthetic colors offer a broader range of shades and stability compared to many natural alternatives, making them a preferred choice for manufacturers in the confectionery, bakery, snacks, and processed food segments. At the same time, the increasing trend towards clean label and natural formulations in Qatar and across the GCC is supporting faster growth of the Natural segment, especially in premium beverages, bakery, dairy, and halal-compliant personal care products.

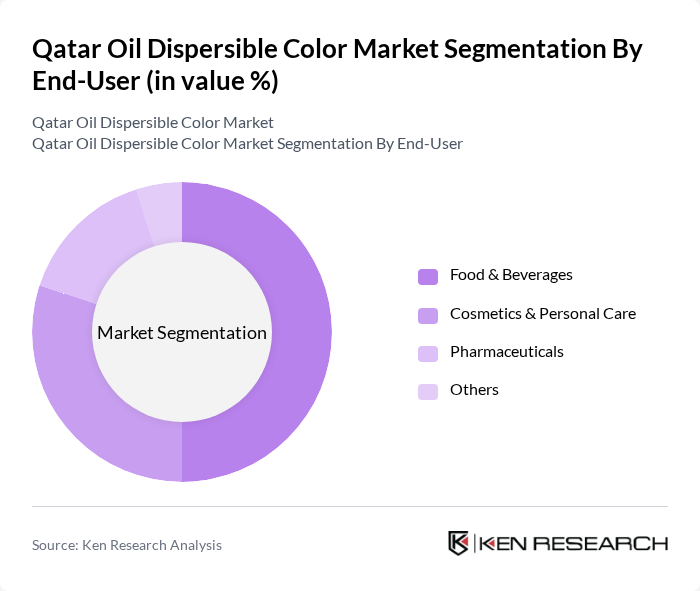

By End-User:

The end-user segmentation includes Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, and Others, which is aligned with standard application groupings used in regional and global oil dispersible color studies. The Food & Beverages segment is leading the market, driven by rising consumption of packaged foods, bakery and confectionery, snacks, flavored oils, and ready-to-drink beverages, all of which rely heavily on oil dispersible colors for visual appeal and brand differentiation. The trend towards healthier, clean-label, and natural-positioned food options in Qatar and the wider GCC has led to increased interest in natural oil dispersible colors and coloring foods, even as synthetic colors remain dominant in volume due to their affordability, shade intensity, and processing stability. The cosmetics and personal care industry is also witnessing a rise in demand for vibrant, long-lasting colors in lipsticks, foundations, skincare oils, and hair products, supporting additional uptake of oil dispersible pigments and colorants and contributing to the overall growth of the market.

The Qatar Oil Dispersible Color Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sensient Technologies Corporation, DDW The Color House, Chr. Hansen Holding A/S, Roha Dyechem Pvt. Ltd, GNT Group, Naturex (Givaudan), Symrise AG, Kalsec Inc., Jotun Paints (Qatar operations), Qatar Paints Company contribute to innovation, geographic expansion, and service delivery in this space, consistent with their established roles in the global oil dispersible color and broader food and cosmetic color markets.

The Qatar oil dispersible color market is poised for significant growth, driven by increasing consumer awareness of health and wellness. As the demand for natural and organic products continues to rise, manufacturers are likely to invest in innovative technologies that enhance color stability and application versatility. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, allowing consumers to make informed choices. This evolving landscape presents a promising future for the market, with opportunities for collaboration and product development.

| Segment | Sub-Segments |

|---|---|

| By Type | **Natural** **Synthetic** Others |

| By End-User | **Food & Beverages** Cosmetics & Personal Care Pharmaceuticals Others |

| By Application | Confectionery Bakery Products Sauces & Dressings Cosmetics Others |

| By Distribution Channel | Direct B2B Sales Distributors & Importers Online B2B Platforms Others |

| By Region | **Doha** Al Rayyan Umm Salal Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Production Companies | 100 | Production Managers, Chemical Engineers |

| Colorant Suppliers | 80 | Sales Directors, Product Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

| Research Institutions | 60 | Research Scientists, Industry Analysts |

| End-Users in Oil & Gas | 90 | Procurement Officers, Operations Managers |

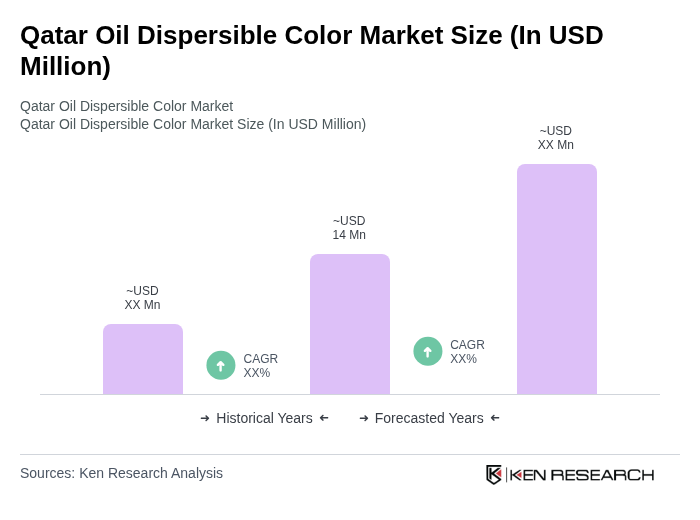

The Qatar Oil Dispersible Color Market is valued at approximately USD 14 million, reflecting a five-year historical analysis and triangulation from global and GCC natural and synthetic color markets.