Region:Middle East

Author(s):Shubham

Product Code:KRAD5558

Pages:86

Published On:December 2025

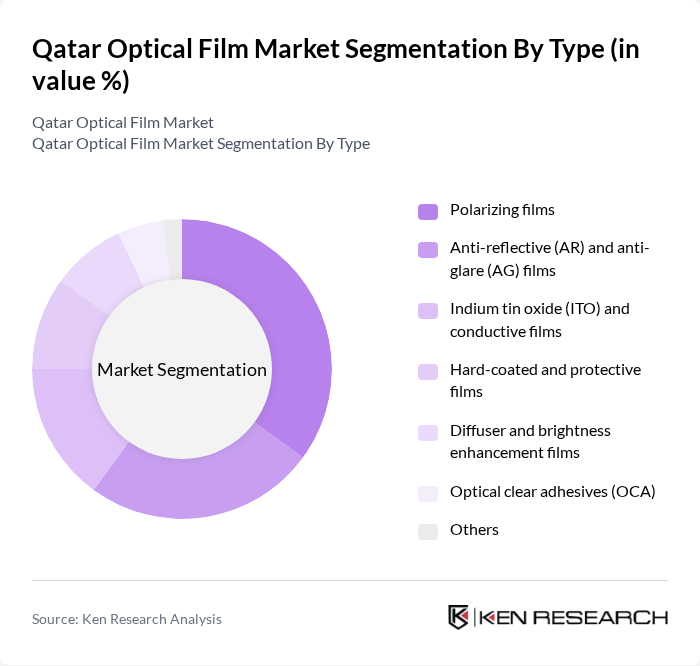

By Type:The optical film market can be segmented into various types, including polarizing films, anti-reflective (AR) and anti-glare (AG) films, indium tin oxide (ITO) and conductive films, hard-coated and protective films, diffuser and brightness enhancement films, optical clear adhesives (OCA), and others. This structure is consistent with global optical film segmentation, where polarizers, AR/AG, ITO/conductive, protective, diffuser, and brightness enhancement films are standard categories. Among these, polarizing films are currently leading the market due to their extensive use in consumer electronics, particularly in televisions, monitors, notebooks, and smartphones, which aligns with global demand patterns where smartphones and backlight/display applications dominate usage of polarizer films. The demand for high-definition and high-brightness displays, along with wider adoption of LCD and OLED panels in consumer and professional displays, has significantly increased the adoption of polarizing films, making them a crucial component in enhancing contrast, viewing angles, and overall visual quality.

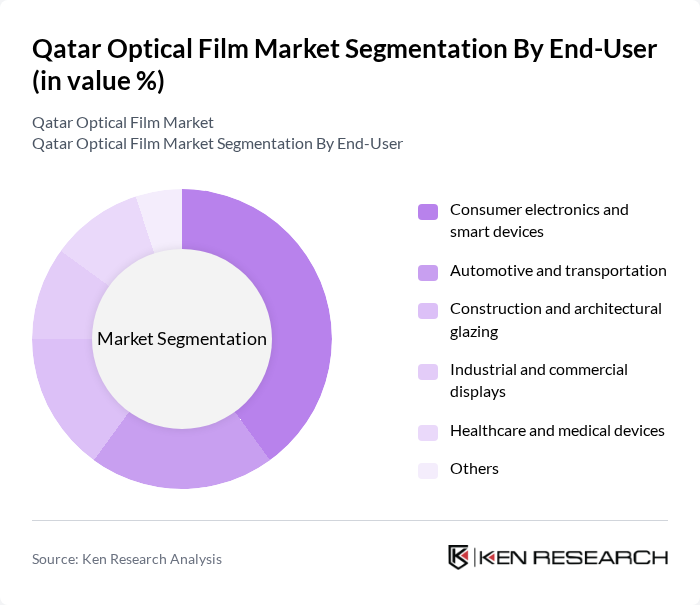

By End-User:The end-user segmentation includes consumer electronics and smart devices, automotive and transportation, construction and architectural glazing, industrial and commercial displays, healthcare and medical devices, and others. This aligns with the main global application clusters of optical films in smartphones, tablets, televisions, digital signage, automotive displays, and specialized equipment. The consumer electronics segment is the most significant contributor to the market, driven by the increasing demand for high-quality displays in smartphones, tablets, laptops, and televisions, as well as the ongoing replacement cycle toward larger and higher-resolution screens. The trend towards smart devices, wearables, and connected home displays, together with growth in digital signage and in-vehicle infotainment in the region, has further accelerated the need for advanced optical films with anti-glare, anti-fingerprint, and energy-saving properties, making this segment a key driver of market growth.

The Qatar Optical Film Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nitto Denko Corporation, 3M Company, Toray Industries, Inc., LG Chem Ltd., Samsung SDI Co., Ltd., Sumitomo Chemical Co., Ltd., Zeon Corporation, Hyosung Chemical Corporation, Mitsubishi Chemical Group Corporation, Teijin Limited, Qatar Petrochemical Company (QAPCO), Qatar Industrial Manufacturing Company Q.P.S.C., Qatar Advanced Materials Company, Major regional distributors of optical films in Qatar, Key systems integrators and display solution providers in Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar optical film market appears promising, driven by technological advancements and a shift towards sustainable materials. As manufacturers increasingly adopt eco-friendly practices, the demand for sustainable optical films is expected to rise. Additionally, the integration of optical films in smart devices will continue to expand, enhancing user experiences. Strategic partnerships among industry players will likely foster innovation, ensuring that the market remains competitive and responsive to evolving consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Polarizing films Anti-reflective (AR) and anti-glare (AG) films Indium tin oxide (ITO) and conductive films Hard-coated and protective films Diffuser and brightness enhancement films Optical clear adhesives (OCA) Others |

| By End-User | Consumer electronics and smart devices Automotive and transportation Construction and architectural glazing Industrial and commercial displays Healthcare and medical devices Others |

| By Application | TVs, monitors, and large-format displays Smartphones, tablets, and laptops Automotive infotainment and instrument clusters Solar and energy-efficient glazing Signage and digital signage Others |

| By Material | Polyethylene terephthalate (PET) Polycarbonate (PC) Triacetyl cellulose (TAC) Polyvinyl chloride (PVC) Others |

| By Region | Doha Al Rayyan Al Wakrah & Mesaieed industrial area Ras Laffan & northern Qatar Others |

| By Distribution Channel | Direct sales to OEMs and panel makers Local distributors and converters Project-based and B2B channels Online and specialized technical suppliers Others |

| By Technology | Coating and vacuum deposition technologies Laminating and multi-layer film technologies Printing and patterning technologies Sputtering and sputter-coated films Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 110 | Product Managers, R&D Directors |

| Automotive Component Suppliers | 85 | Supply Chain Managers, Quality Assurance Leads |

| Optical Film Distributors | 65 | Sales Executives, Distribution Managers |

| Research Institutions and Universities | 45 | Academic Researchers, Industry Analysts |

| End-User Companies in Various Sectors | 75 | Procurement Officers, Technical Managers |

The Qatar Optical Film Market is valued at approximately USD 140 million, reflecting a significant growth trajectory driven by increasing demand for high-quality display technologies across various sectors, including consumer electronics and automotive applications.