Region:Global

Author(s):Shubham

Product Code:KRAD3102

Pages:94

Published On:January 2026

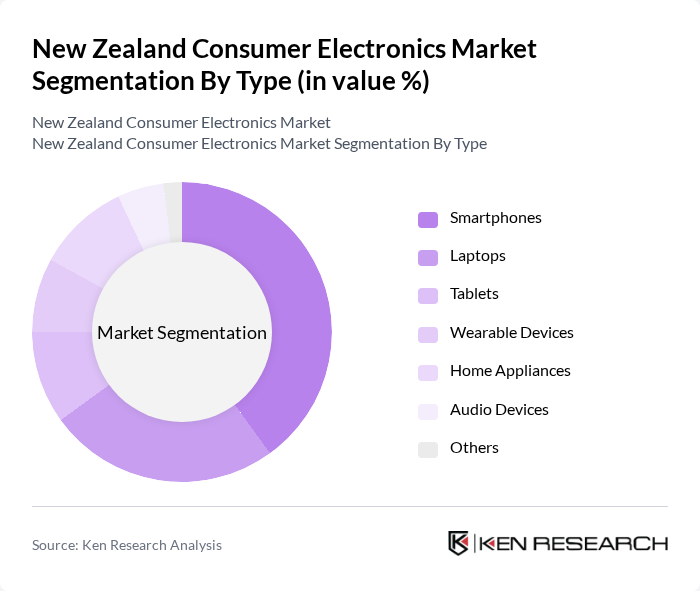

By Type:The consumer electronics market can be segmented into various types, including smartphones, laptops, tablets, wearable devices, home appliances, audio devices, and others. Each of these segments caters to different consumer needs and preferences, with smartphones and laptops being the most popular due to their multifunctionality and integration into daily life.

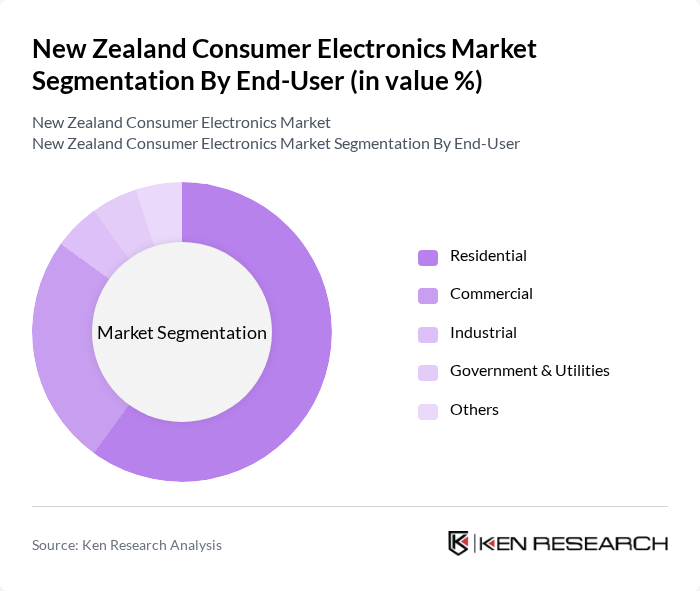

By End-User:The end-user segmentation includes residential, commercial, industrial, government & utilities, and others. The residential segment dominates the market as consumers increasingly invest in smart home technologies and personal electronics, while the commercial segment is growing due to the demand for technology in business operations.

The New Zealand Consumer Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics New Zealand, Sony New Zealand, Apple New Zealand, LG Electronics New Zealand, Panasonic New Zealand, Fisher & Paykel Appliances, Dell Technologies New Zealand, HP New Zealand, Microsoft New Zealand, Lenovo New Zealand, Google New Zealand, ASUS New Zealand, Xiaomi New Zealand, JBL New Zealand, Beats by Dre New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand consumer electronics market appears promising, driven by ongoing technological advancements and changing consumer preferences. As 5G technology becomes more widespread, it will enable faster connectivity and enhance the functionality of smart devices. Additionally, the growing trend towards eco-friendly products is likely to shape consumer choices, pushing brands to innovate sustainably. Companies that adapt to these trends will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartphones Laptops Tablets Wearable Devices Home Appliances Audio Devices Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | North Island South Island |

| By Technology | IoT Devices AI-Enabled Electronics Cloud-Based Solutions Others |

| By Application | Home Use Office Use Educational Use Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 45 | Store Managers, Sales Representatives |

| End-User Consumer Insights | 120 | General Consumers, Tech Enthusiasts |

| Online Electronics Marketplaces | 50 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Teams | 35 | Product Managers, R&D Engineers |

| Consumer Electronics Repair Services | 40 | Service Technicians, Business Owners |

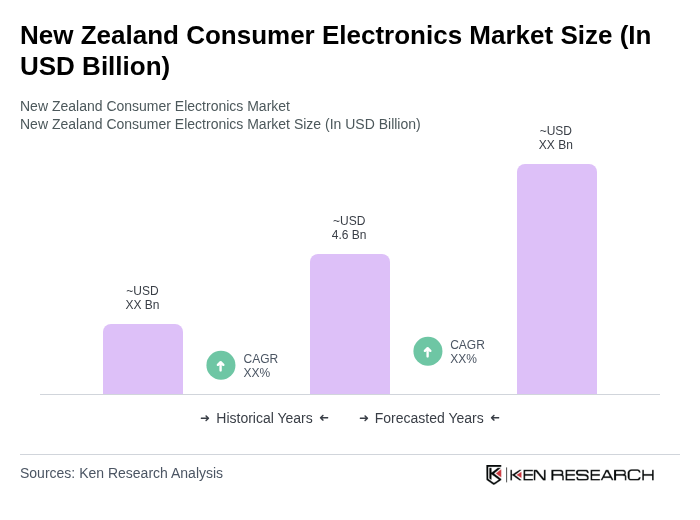

The New Zealand Consumer Electronics Market is valued at approximately USD 4.6 billion, reflecting a significant growth trend driven by the adoption of smart technologies and increasing consumer demand for innovative electronic solutions.