Region:Middle East

Author(s):Dev

Product Code:KRAD3425

Pages:82

Published On:November 2025

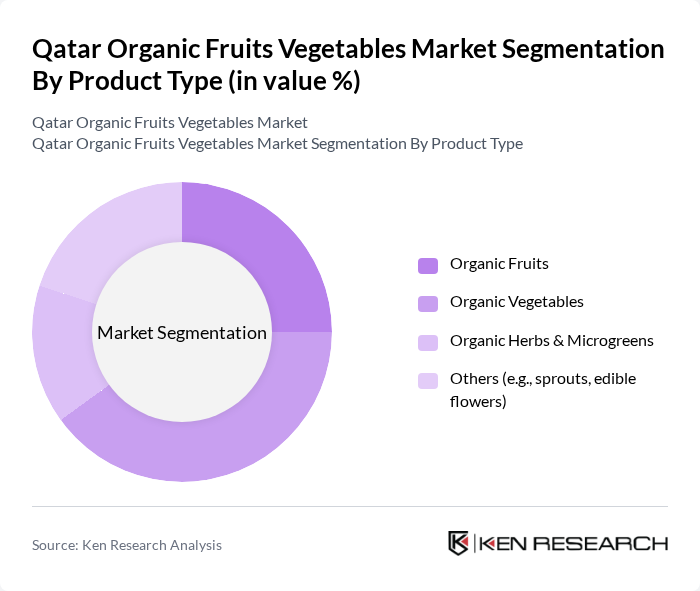

By Product Type:The market is segmented into various product types, including organic fruits, organic vegetables, organic herbs & microgreens, and others such as sprouts and edible flowers. Among these, organic vegetables are currently dominating the market due to their high consumption rates and the increasing trend of health-conscious eating. Consumers are increasingly opting for fresh, locally sourced organic vegetables, which are perceived as healthier alternatives to conventional options .

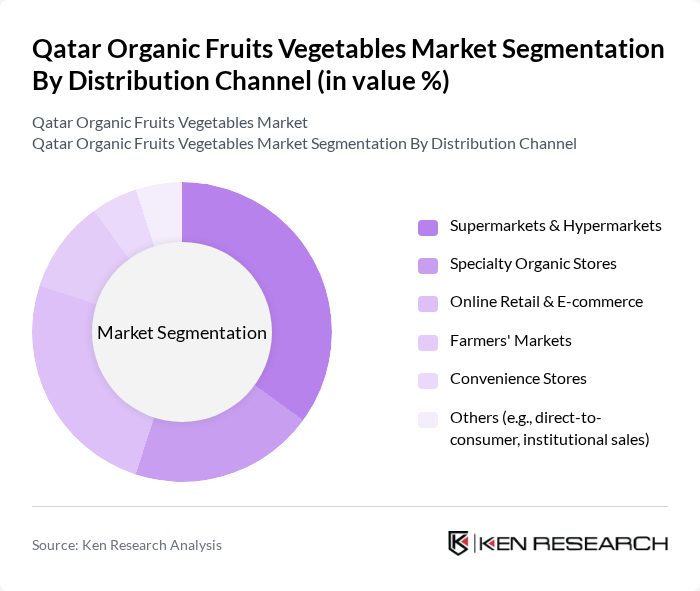

By Distribution Channel:The distribution channels for organic products include supermarkets & hypermarkets, specialty organic stores, online retail & e-commerce, farmers' markets, convenience stores, and others such as direct-to-consumer sales. Supermarkets & hypermarkets are leading the market due to their extensive reach and the convenience they offer to consumers. The growing trend of online shopping has also contributed significantly to the distribution of organic products, allowing consumers to access a wider variety of organic options .

The Qatar Organic Fruits Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agrico Organic Farm, Al Meera Consumer Goods Company, Baladna Food Industries, Qatar National Import & Export Co., Torba Farmers Market, Mahaseel for Marketing and Agri Services, Qatari Organic Agriculture Company, Al Jazeera Agricultural Company, Qatar Greenhouse Company, Sidra Agriculture Company, Organic Qatar, Al Fardan Group, Qatar Agricultural Development Company (QADCO), Al Khor Organic Farms, Qatar Organic Produce contribute to innovation, geographic expansion, and service delivery in this space.

The future of the organic fruits and vegetables market in Qatar appears promising, driven by increasing health awareness and government initiatives. As consumer preferences shift towards sustainable products, the market is likely to witness significant growth. Additionally, advancements in technology and distribution channels will enhance accessibility to organic produce. The focus on local production and partnerships with farmers will further strengthen the market, positioning Qatar as a key player in the regional organic sector in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Organic Fruits Organic Vegetables Organic Herbs & Microgreens Others (e.g., sprouts, edible flowers) |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Organic Stores Online Retail & E-commerce Farmers' Markets Convenience Stores Others (e.g., direct-to-consumer, institutional sales) |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Certification Type | Qatar Organic Certification USDA Organic EU Organic Others (e.g., Halal Organic, GlobalG.A.P.) |

| By End User | Households Foodservice Providers (Hotels, Restaurants, Cafés) Food Processing Industry Others (e.g., schools, hospitals) |

| By Price Range | Premium Mid-range Budget Others |

| By Region | Doha Al Rayyan Al Wakrah Al Khor Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Organic Produce Sales | 120 | Store Managers, Category Buyers |

| Organic Farm Production Insights | 100 | Farm Owners, Agricultural Consultants |

| Consumer Preferences for Organic Products | 150 | Health-Conscious Consumers, Organic Product Shoppers |

| Distribution Channel Effectiveness | 80 | Logistics Managers, Supply Chain Coordinators |

| Market Trends and Growth Drivers | 120 | Market Analysts, Industry Experts |

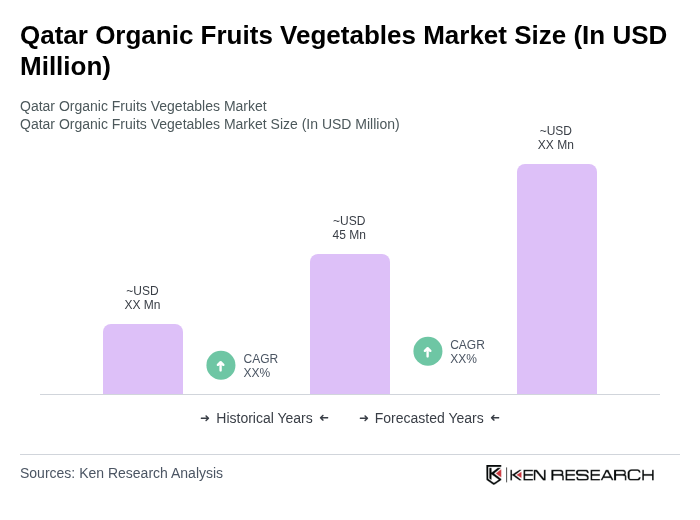

The Qatar Organic Fruits and Vegetables Market is valued at approximately USD 45 million, reflecting a growing trend towards organic produce driven by health awareness and government support for sustainable agriculture.