Region:Europe

Author(s):Geetanshi

Product Code:KRAA3285

Pages:96

Published On:September 2025

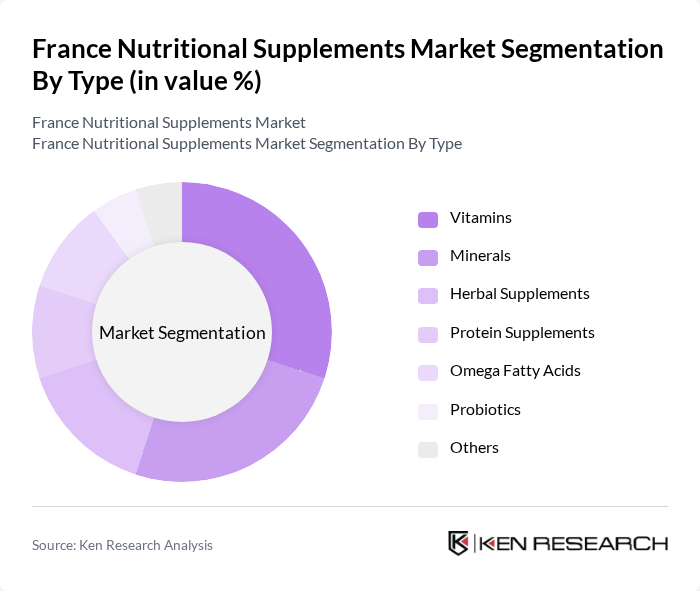

By Type:The nutritional supplements market can be segmented into various types, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Each of these subsegments caters to specific consumer needs and preferences, reflecting the diverse landscape of health and wellness products available in the market. The market is witnessing increased demand for plant-based, vegan, and personalized supplement formulations, as well as innovative delivery formats such as gummies and liquid blends, which appeal to a broad demographic seeking convenience and targeted health benefits .

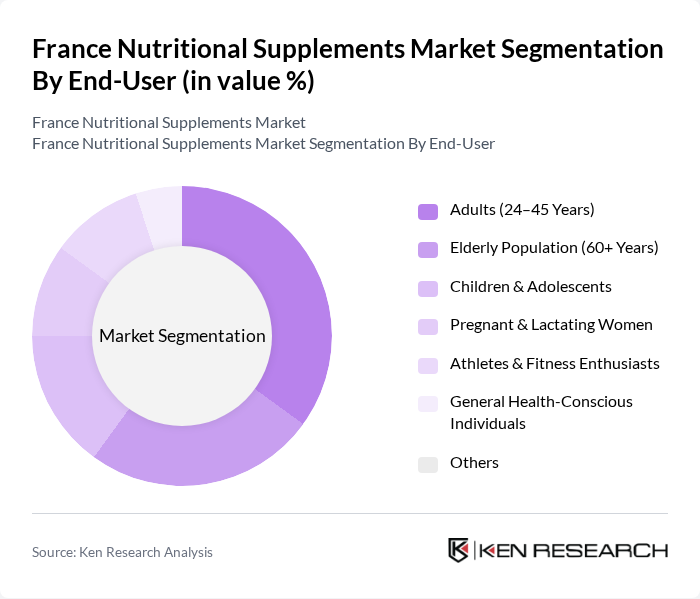

By End-User:The end-user segmentation includes adults (24–45 years), elderly population (60+ years), children & adolescents, pregnant & lactating women, athletes & fitness enthusiasts, general health-conscious individuals, and others. This segmentation highlights the diverse consumer base for nutritional supplements, each with unique health needs and preferences. Notably, the elderly population and adults are the largest consumer groups, driven by concerns about bone health, immunity, and preventive care, while younger consumers are increasingly adopting supplements for fitness and wellness routines .

The France Nutritional Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arkopharma Laboratoires Pharmaceutiques, Laboratoire Nutergia, PiLeJe Laboratoire, Les Laboratoires Vitarmonyl, NHCO Nutrition, Nutrisanté, Laboratoires Juva Santé, Laboratoires Forté Pharma, Nestlé Health Science, Danone S.A., Herbalife Nutrition Ltd., DSM-Firmenich, Solgar Inc., Nature's Way Products, LLC, Swisse Wellness Pty Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France nutritional supplements market appears promising, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, companies are expected to leverage data analytics to tailor products to individual health needs. Additionally, the rise of plant-based supplements aligns with the growing demand for sustainable and ethical products, indicating a shift towards more environmentally friendly options. These trends will likely shape the market landscape in the coming years, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By End-User | Adults (24–45 Years) Elderly Population (60+ Years) Children & Adolescents Pregnant & Lactating Women Athletes & Fitness Enthusiasts General Health-Conscious Individuals Others |

| By Distribution Channel | Pharmacies & Drug Stores Supermarkets/Hypermarkets Health Food Stores Online Retailers Direct Sales Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies & Jellies Softgels Others |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels Generic Brands |

| By Packaging Type | Bottles Blister Packs Pouches Sachets Others |

| By Product Nature | Conventional Organic/Natural |

| By Application | Immunity Bone & Joint Health Energy & Weight Management Digestive Health Cardiac Health Diabetes Management Anti-Aging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Nutritional Supplements | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Distribution Channels for Supplements | 60 | Retail Managers, Category Buyers |

| Healthcare Professionals' Recommendations | 50 | Nutritionists, Dietitians, General Practitioners |

| Market Trends in Online Supplement Sales | 70 | E-commerce Managers, Digital Marketing Specialists |

| Regulatory Impact on Supplement Formulations | 40 | Regulatory Affairs Specialists, Quality Assurance Managers |

The France Nutritional Supplements Market is valued at approximately USD 5.3 billion, reflecting a significant growth trend driven by increasing health awareness and preventive healthcare measures among consumers.