Region:Middle East

Author(s):Rebecca

Product Code:KRAC8520

Pages:87

Published On:November 2025

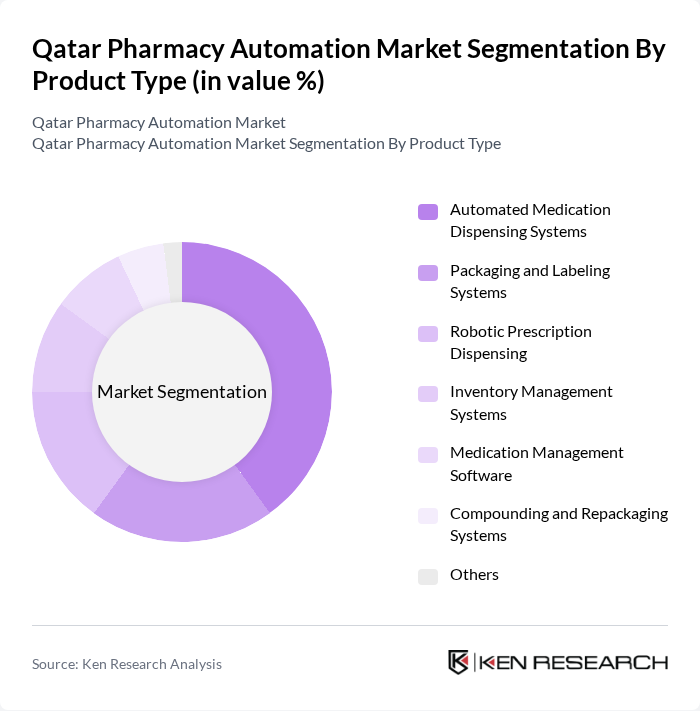

By Product Type:The product type segmentation includes various categories such as Automated Medication Dispensing Systems, Packaging and Labeling Systems, Robotic Prescription Dispensing, Inventory Management Systems, Medication Management Software, Compounding and Repackaging Systems, and Others. Among these, Automated Medication Dispensing Systems are leading the market due to their ability to enhance efficiency and accuracy in medication dispensing, which is crucial for patient safety and operational effectiveness. The adoption of robotic and AI-powered dispensing solutions is increasing, reflecting a broader trend toward digital transformation in Qatar’s healthcare sector .

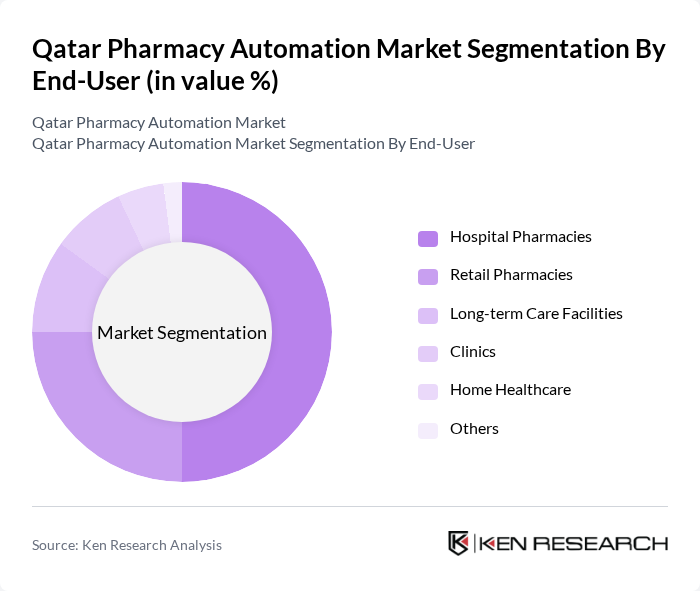

By End-User:The end-user segmentation encompasses Hospital Pharmacies, Retail Pharmacies, Long-term Care Facilities, Clinics, Home Healthcare, and Others. Hospital Pharmacies dominate this segment due to the increasing complexity of medication regimens and the need for efficient medication management systems in hospitals, which are critical for patient care and safety. Retail pharmacies are also experiencing rapid adoption of automation solutions, driven by higher prescription volumes and a focus on reducing wait times and errors .

The Qatar Pharmacy Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omnicell, Inc., Swisslog Healthcare, BD (Becton, Dickinson and Company), Cerner Corporation, McKesson Corporation, ScriptPro LLC, Capsa Healthcare, ARxIUM Inc., Talyst, LLC, Parata Systems, Yuyama Co., Ltd., CareFusion Corporation, Asteres, Inc., Health Robotics S.r.l., Medacist Solutions Group, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmacy automation market in Qatar appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the government continues to prioritize healthcare improvements, the integration of automation technologies will likely become more prevalent. Additionally, the growing emphasis on patient safety and error reduction will further accelerate the adoption of automated systems, positioning Qatar as a leader in pharmacy innovation within the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Automated Medication Dispensing Systems Packaging and Labeling Systems Robotic Prescription Dispensing Inventory Management Systems Medication Management Software Compounding and Repackaging Systems Others |

| By End-User | Hospital Pharmacies Retail Pharmacies Long-term Care Facilities Clinics Home Healthcare Others |

| By Application | Drug Dispensing and Packaging Inventory Control and Management Prescription Management Patient Safety Enhancements Centralized Operations Others |

| By Technology | Barcode Medication Administration (BCMA) RFID Technology Cloud-based Solutions Robotics and Automation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Doha Al Rayyan Umm Salal Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Pharmacy Automation | 100 | Pharmacy Owners, Store Managers |

| Hospital Pharmacy Systems | 80 | Pharmacy Directors, Clinical Pharmacists |

| Online Pharmacy Solutions | 60 | eCommerce Managers, IT Specialists |

| Pharmacy Technology Providers | 50 | Product Managers, Sales Executives |

| Healthcare Policy Makers | 40 | Government Officials, Healthcare Analysts |

The Qatar Pharmacy Automation Market is valued at approximately USD 5 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient medication management systems and the integration of advanced technologies in pharmacy operations.