Region:Asia

Author(s):Geetanshi

Product Code:KRAD1163

Pages:98

Published On:November 2025

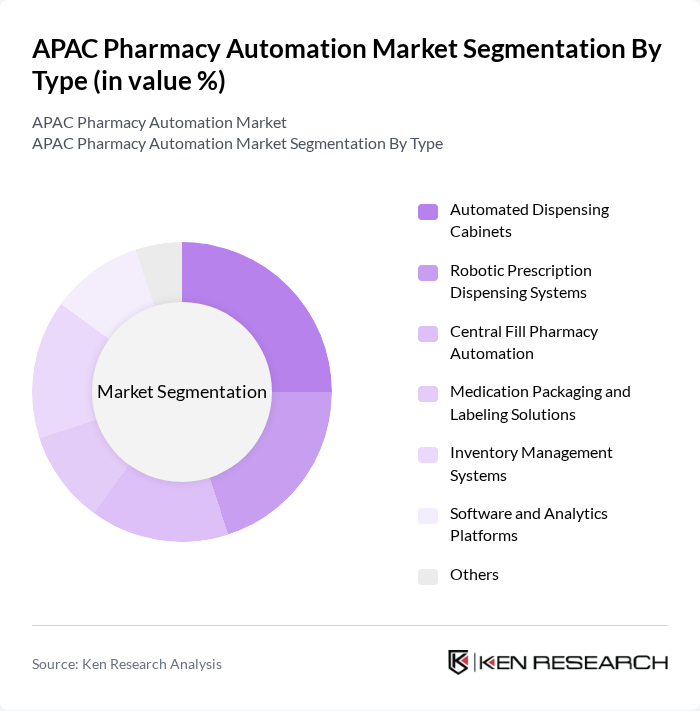

By Type:The market is segmented into various types of pharmacy automation solutions, including Automated Dispensing Cabinets, Robotic Prescription Dispensing Systems, Central Fill Pharmacy Automation, Medication Packaging and Labeling Solutions, Inventory Management Systems, Software and Analytics Platforms, and Others. Each sub-segment is instrumental in enhancing operational efficiency, reducing manual errors, and supporting scalable pharmacy operations across hospitals, retail chains, and independent pharmacies. Automated dispensing cabinets and robotic prescription systems are particularly prevalent in hospital and retail settings, while software and analytics platforms are rapidly gaining traction due to increasing digitalization .

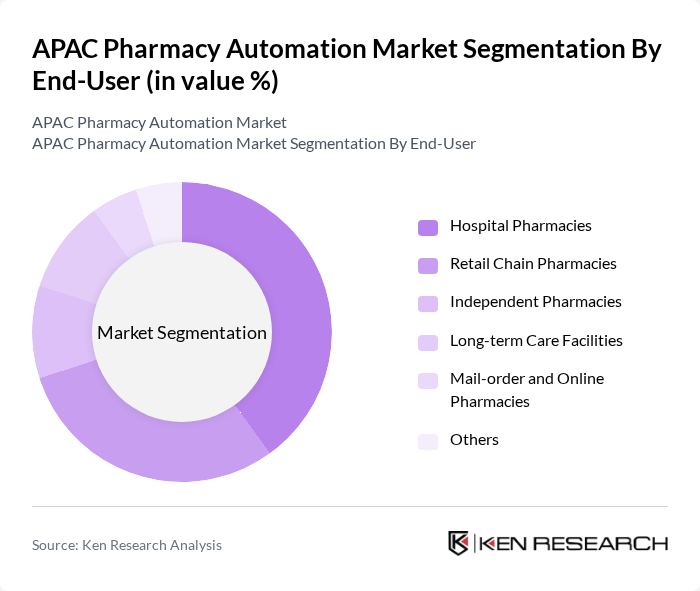

By End-User:The end-user segmentation includes Hospital Pharmacies, Retail Chain Pharmacies, Independent Pharmacies, Long-term Care Facilities, Mail-order and Online Pharmacies, and Others. Hospital pharmacies and retail chains are the primary adopters, driven by high prescription volumes and the need for stringent medication management. Independent pharmacies and online pharmacies are increasingly adopting automation to remain competitive and address workforce limitations. Long-term care facilities benefit from automation through improved medication adherence and reduced manual intervention .

The APAC Pharmacy Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omnicell, Inc., BD (Becton, Dickinson and Company), Swisslog Healthcare (A KUKA Company), ARxIUM Inc., Capsa Healthcare, McKesson Corporation, Yuyama Co., Ltd., TOSHO Co., Ltd., Parata Systems (A BD Company), ScriptPro LLC, Talyst, LLC (A Swisslog Healthcare Company), Cerner Corporation (Oracle Health), Philips Healthcare, Meditech, and Willach Pharmacy Solutions contribute to innovation, geographic expansion, and service delivery in this space .

The future of the APAC pharmacy automation market appears promising, driven by ongoing technological advancements and a growing emphasis on patient safety. As pharmacies increasingly adopt robotic systems and AI-driven solutions, operational efficiency is expected to improve significantly. Additionally, the integration of telepharmacy services is likely to expand, providing greater access to healthcare. These trends indicate a shift towards more automated, data-driven pharmacy operations, enhancing service delivery and patient outcomes across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Dispensing Cabinets Robotic Prescription Dispensing Systems Central Fill Pharmacy Automation Medication Packaging and Labeling Solutions Inventory Management Systems Software and Analytics Platforms Others |

| By End-User | Hospital Pharmacies Retail Chain Pharmacies Independent Pharmacies Long-term Care Facilities Mail-order and Online Pharmacies Others |

| By Region | China Japan India South Korea Southeast Asia Oceania Others |

| By Technology | Robotics Technology Automated Storage and Retrieval Systems Cloud-based Solutions AI and Machine Learning Applications Barcode and RFID Technology Others |

| By Application | Prescription Dispensing Medication Adherence and Compliance Inventory and Supply Chain Management Patient Safety and Error Reduction Workflow Optimization Others |

| By Pharmacy Size | Large Size Pharmacy Medium Size Pharmacy Small Size Pharmacy |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Venture Capital Others |

| By Policy Support | Subsidies for Automation Technologies Tax Incentives for Healthcare Providers Grants for Research and Development Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Community Pharmacies | 100 | Pharmacy Owners, Store Managers |

| Hospital Pharmacies | 80 | Pharmacy Directors, Clinical Pharmacists |

| Pharmacy Automation Vendors | 60 | Sales Executives, Product Managers |

| Healthcare IT Consultants | 50 | Consultants, Technology Advisors |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

The APAC Pharmacy Automation Market is valued at approximately USD 1.2 billion, driven by the increasing demand for efficient medication management and the adoption of advanced technologies in pharmacy operations across the region.