Region:Middle East

Author(s):Shubham

Product Code:KRAC1540

Pages:82

Published On:October 2025

By Type:The market is segmented into various types of outdoor furniture, including lounge furniture, dining sets, daybeds and sectionals, fire pits and heating solutions, garden accessories and decorative pieces, and umbrellas and shade structures. Among these, lounge furniture is currently the leading sub-segment, driven by consumer preferences for relaxation and socializing in outdoor settings. The trend towards creating comfortable outdoor living spaces has significantly increased the demand for stylish and functional lounge furniture. Weather resistance, modularity, and innovative designs are increasingly influencing purchasing decisions .

By End-User:The end-user segmentation includes residential (villas and apartments), hospitality (hotels and resorts), F&B establishments (restaurants and cafes), and corporate and commercial offices. The residential segment is the most significant contributor to the market, as homeowners increasingly invest in outdoor spaces for leisure and entertainment. This trend is fueled by the growing popularity of outdoor living areas, particularly in affluent neighborhoods. The hospitality sector is also a major driver, with hotels, resorts, and F&B venues investing in premium outdoor furniture to enhance guest experiences .

The Qatar Premium Outdoor Furniture Boutiques Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pottery Barn Qatar, IKEA Qatar, Pan Home (formerly PanEmirates), Home Centre Qatar, ACE Hardware Qatar, Danube Home Qatar, Stefan Trading, Almuftah Center, New Garden Trading, Al-Fiore Rosso (Premium Showroom), Cambridge Trading Qatar, Home Box Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar premium outdoor furniture market appears promising, driven by evolving consumer preferences and increasing investments in outdoor living spaces. As disposable incomes rise and tourism flourishes, retailers are likely to see a surge in demand for luxury outdoor products. Additionally, the integration of sustainable materials and technology in furniture design will play a pivotal role in attracting environmentally conscious consumers, shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Lounge Furniture Dining Sets Daybeds and Sectionals Fire Pits and Heating Solutions Garden Accessories and Decorative Pieces Umbrellas and Shade Structures |

| By End-User | Residential (Villas and Apartments) Hospitality (Hotels and Resorts) F&B Establishments (Restaurants and Cafes) Corporate and Commercial Offices |

| By Sales Channel | Specialty Boutique Showrooms Online Retail Platforms Department Store Outlets Direct B2B Supply to Contractors and Designers |

| By Material | Premium Wood (Teak, Cedar) Rust-Proof Aluminum UV-Protected Wicker and Rattan Weather-Resistant Fabrics and Cushions |

| By Price Range | Luxury (QAR 8,000 - QAR 25,000+) Premium (QAR 2,000 - QAR 8,000) Mid-Range (QAR 500 - QAR 2,000) |

| By Design Style | Contemporary and Scandinavian Modern Minimalist Mediterranean and Tropical Traditional and Heritage Designs |

| By Brand Positioning | Luxury Premium Brands Mid-Tier Established Brands Value-Focused Local Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Outdoor Furniture Purchasers | 50 | Affluent Homeowners, Interior Designers |

| Mid-range Outdoor Furniture Buyers | 60 | Middle-income Families, Retail Managers |

| Budget Outdoor Furniture Consumers | 50 | First-time Homebuyers, Students |

| Commercial Outdoor Furniture Buyers | 40 | Restaurant Owners, Hotel Managers |

| Online Outdoor Furniture Shoppers | 50 | E-commerce Users, Digital Marketing Professionals |

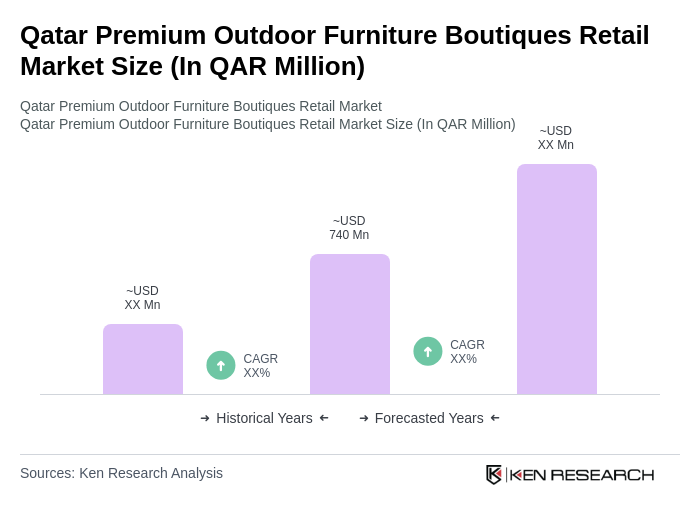

The Qatar Premium Outdoor Furniture Boutiques Retail Market is valued at approximately QAR 740 million, driven by increasing disposable incomes, a trend towards outdoor living spaces, and robust demand from the hospitality sector.