Region:Middle East

Author(s):Shubham

Product Code:KRAC1557

Pages:92

Published On:October 2025

By Type:The market is segmented into lounge furniture, dining sets, umbrellas and shade structures, fire pits and heaters, accessories, eco-friendly furniture, and others. Lounge furniture remains the leading sub-segment, driven by consumer demand for comfort, style, and modularity in outdoor living spaces. The trend toward luxurious outdoor environments has led to increased investments in lounge furniture, especially for residential patios and hospitality terraces, with modular and weather-resistant designs gaining popularity.

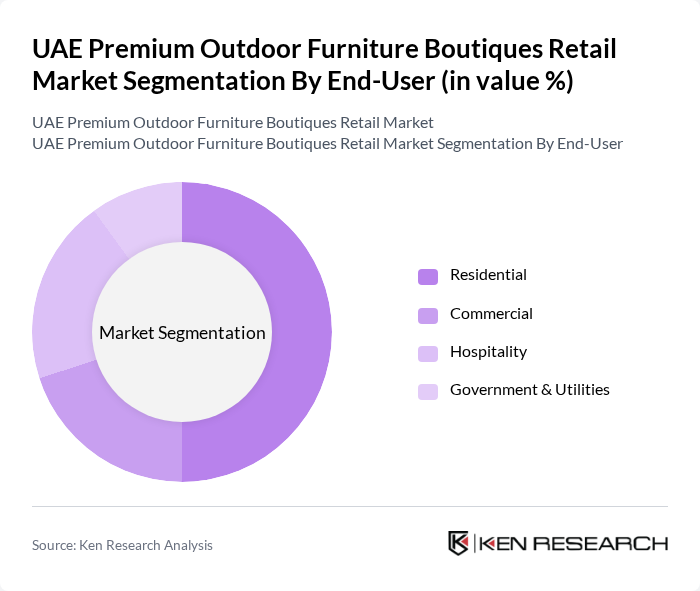

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government & utilities. The residential segment is the largest, as homeowners invest in outdoor spaces for relaxation and entertainment. The trend toward creating outdoor living areas has led to a surge in demand for premium outdoor furniture among residential consumers, with a strong emphasis on aesthetics, comfort, and durability. Commercial and hospitality segments also show robust growth, driven by investments in luxury resorts, restaurants, and recreational spaces.

The UAE Premium Outdoor Furniture Boutiques Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as DEDON, Gloster, Ethimo, RODA, Gandia Blasco, Paola Lenti, Quantum Bazaar, Maze Outdoor, and Business & Pleasure Co. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE premium outdoor furniture market is poised for dynamic growth, driven by evolving consumer preferences and lifestyle changes. As more individuals prioritize outdoor living, the demand for innovative and multifunctional furniture is expected to rise. Additionally, the integration of smart technology into outdoor products will likely attract tech-savvy consumers. Retailers must adapt to these trends by offering customizable solutions and enhancing their online presence to capture a broader audience, ensuring sustained growth in this competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Lounge Furniture Dining Sets Umbrellas and Shade Structures Fire Pits and Heaters Accessories (Cushions, Covers, etc.) Eco-Friendly Furniture Others |

| By End-User | Residential Commercial Hospitality Government & Utilities |

| By Sales Channel | Direct Retail Online Retail Showrooms Distributors |

| By Material | Wood Metal Plastic Fabric Rattan |

| By Design Style | Modern Traditional Rustic Contemporary |

| By Price Range | Budget Mid-Range Premium |

| By Brand Preference | Local Brands International Brands Luxury Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Outdoor Furniture Purchasers | 120 | Homeowners, Interior Designers |

| Retail Boutique Managers | 80 | Store Managers, Sales Executives |

| Landscape Architects and Designers | 60 | Design Professionals, Project Managers |

| Market Trend Analysts | 40 | Industry Analysts, Market Researchers |

| Consumers Interested in Outdoor Living | 100 | Potential Buyers, Lifestyle Influencers |

The UAE Premium Outdoor Furniture Boutiques Retail Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by rising demand for high-quality outdoor living spaces and increasing disposable income among consumers.