Qatar Premium Packaged Bakery Products Retail Market Overview

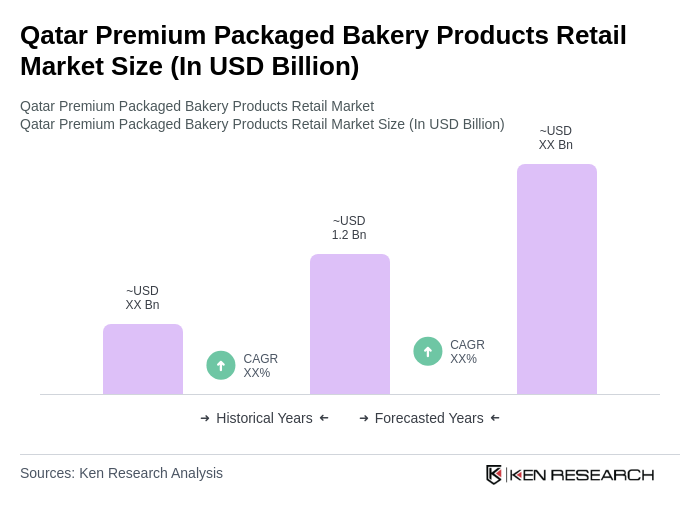

- The Qatar Premium Packaged Bakery Products Retail Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for high-quality, convenient food options, coupled with a rise in disposable income and changing lifestyles that favor ready-to-eat products.

- Doha is the dominant city in this market, attributed to its status as the capital and largest city of Qatar, where a significant portion of the population resides. The concentration of retail outlets and food service providers in urban areas further enhances market accessibility and consumer engagement.

- In 2023, the Qatari government implemented regulations to enhance food safety standards in the bakery sector. This includes mandatory compliance with hygiene practices and labeling requirements, aimed at ensuring consumer safety and promoting transparency in food production.

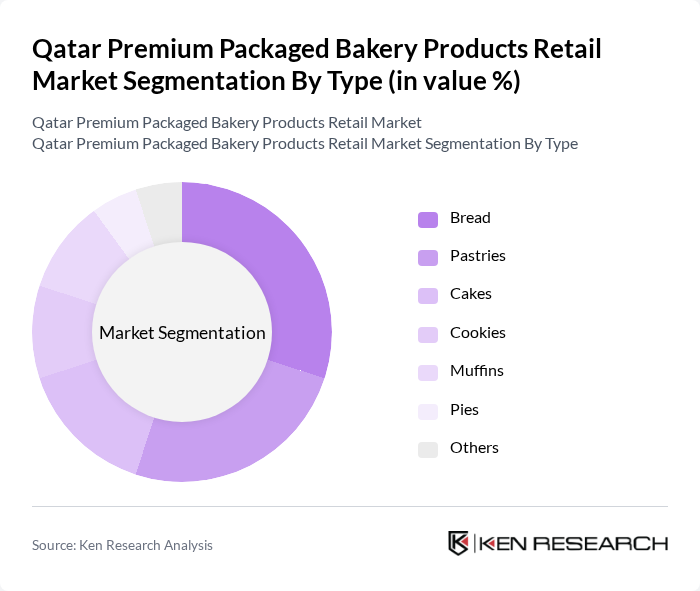

Qatar Premium Packaged Bakery Products Retail Market Segmentation

By Type:The market is segmented into various types of bakery products, including bread, pastries, cakes, cookies, muffins, pies, and others. Among these, bread and pastries are the most popular, driven by their versatility and consumer preference for fresh, ready-to-eat options. The increasing trend of snacking and on-the-go consumption has also contributed to the growth of cookies and muffins, while cakes and pies cater to special occasions and celebrations.

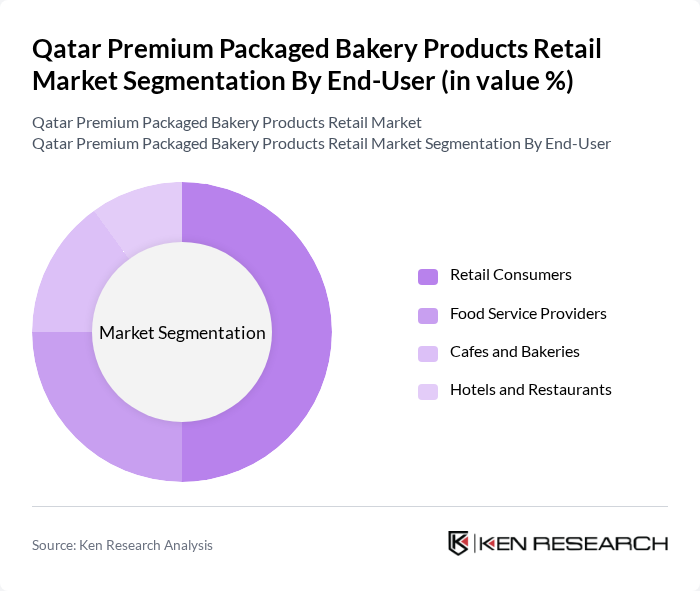

By End-User:The end-user segmentation includes retail consumers, food service providers, cafes and bakeries, and hotels and restaurants. Retail consumers dominate the market due to the increasing trend of home consumption and the convenience of purchasing packaged bakery products. Food service providers, including restaurants and catering services, also contribute significantly to the market, driven by the demand for high-quality baked goods in their offerings.

Qatar Premium Packaged Bakery Products Retail Market Competitive Landscape

The Qatar Premium Packaged Bakery Products Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mufeed Bakery, Qatar Flour Mills, Gourmet Foods Qatar, Doha Bakery, Al Ahlia Bakery, Al Jazeera Foods, Al Rayyan Bakery, Al Waha Bakery, Al Mufeed Sweets, Qatar Breads, Al Mufeed Pastries, Al Mufeed Cookies, Al Mufeed Cakes, Al Mufeed Muffins, Al Mufeed Pies contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Premium Packaged Bakery Products Retail Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Convenience Foods:The demand for convenience foods in Qatar is projected to reach QAR 1.5 billion in future, driven by busy lifestyles and a growing preference for ready-to-eat options. The rise in dual-income households, which accounted for 60% of families in future, further fuels this trend. Additionally, the increasing availability of premium packaged bakery products in supermarkets and convenience stores enhances consumer access, making it easier for them to choose these products over traditional options.

- Rising Health Consciousness Among Consumers:Health consciousness is significantly influencing consumer choices in Qatar, with 45% of consumers actively seeking healthier food options. The market for organic and gluten-free products is expected to grow, with sales projected to reach QAR 300 million in future. This shift is supported by government initiatives promoting healthy eating, as well as increased awareness of nutrition, leading to a higher demand for premium bakery products that align with these health trends.

- Expansion of Retail Distribution Channels:The retail landscape in Qatar is evolving, with the number of supermarkets and hypermarkets increasing by 20% from 2022 to future. This expansion facilitates greater distribution of premium packaged bakery products, making them more accessible to consumers. Additionally, the rise of e-commerce, which saw a 30% increase in online grocery sales in future, allows brands to reach a broader audience, further driving market growth and consumer engagement.

Market Challenges

- Intense Competition Among Local and International Brands:The Qatar premium packaged bakery market is characterized by fierce competition, with over 50 local and international brands vying for market share. This saturation leads to price wars and aggressive marketing strategies, which can erode profit margins. In future, the top five brands accounted for only 35% of the market, indicating a fragmented landscape that challenges new entrants and established players alike.

- Fluctuating Raw Material Prices:The bakery industry in Qatar faces challenges due to fluctuating prices of key raw materials, such as flour and sugar, which saw price increases of 15% in future. These fluctuations are influenced by global supply chain disruptions and local agricultural conditions. As a result, manufacturers must navigate these cost pressures while maintaining product quality and competitive pricing, which can impact overall profitability and market stability.

Qatar Premium Packaged Bakery Products Retail Market Future Outlook

The future of the Qatar premium packaged bakery products market appears promising, driven by evolving consumer preferences and innovative product offerings. As health trends continue to shape purchasing decisions, brands that prioritize quality and sustainability are likely to thrive. Additionally, the integration of technology in retail, such as online shopping and delivery services, will enhance consumer convenience. Companies that adapt to these trends and invest in marketing strategies will be well-positioned to capture a larger share of the growing market.

Market Opportunities

- Introduction of Innovative Product Lines:There is a significant opportunity for brands to introduce innovative product lines, such as plant-based and functional bakery items. With the health food market in Qatar projected to reach QAR 500 million in future, companies that diversify their offerings to include these options can attract health-conscious consumers and gain a competitive edge.

- Expansion into Online Retail Platforms:The rapid growth of e-commerce in Qatar, with online grocery sales expected to exceed QAR 1 billion in future, presents a lucrative opportunity for premium bakery brands. By establishing a strong online presence and leveraging digital marketing strategies, companies can reach a wider audience and enhance customer engagement, driving sales growth in this segment.