Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8332

Pages:81

Published On:October 2025

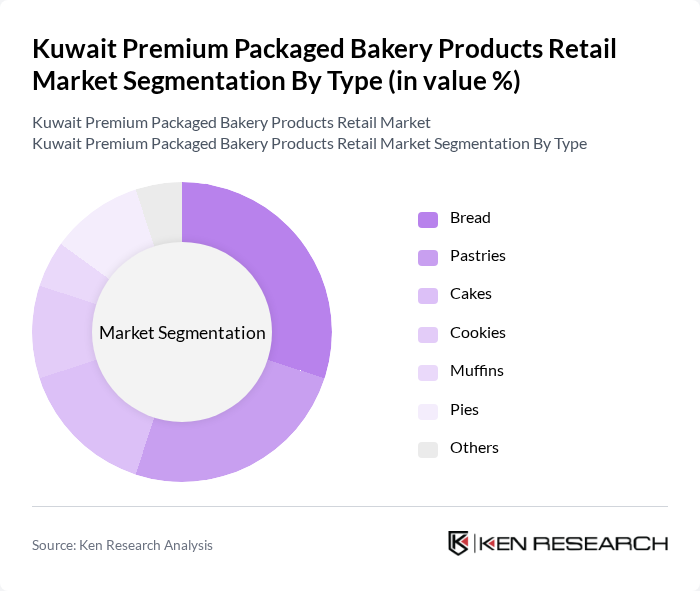

By Type:The market is segmented into various types of bakery products, including bread, pastries, cakes, cookies, muffins, pies, and others. Each sub-segment caters to different consumer preferences and occasions, with bread and pastries being the most popular choices among consumers due to their versatility and convenience. The increasing trend of snacking and on-the-go consumption has further fueled the demand for these products.

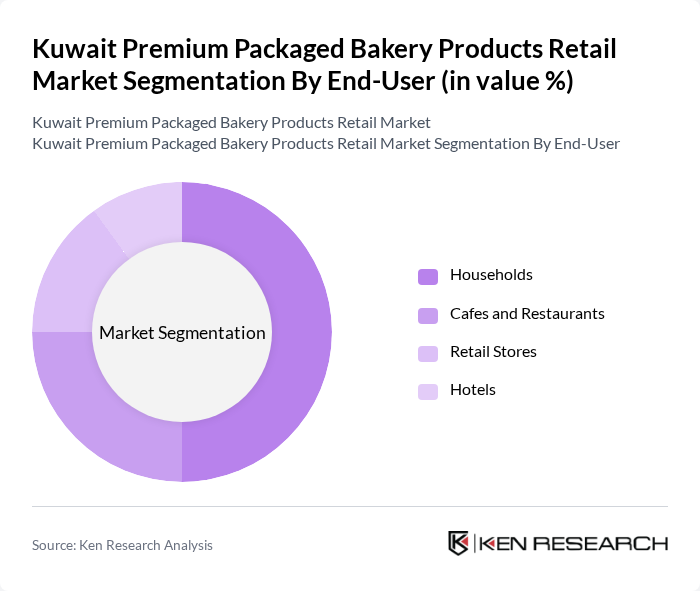

By End-User:The end-user segmentation includes households, cafes and restaurants, retail stores, and hotels. Households represent the largest segment, driven by the increasing trend of home cooking and snacking. Cafes and restaurants also contribute significantly to the market, as they often incorporate premium bakery products into their menus, enhancing the overall dining experience.

The Kuwait Premium Packaged Bakery Products Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Maeda Foodstuff Co., Americana Group, Kuwait Flour Mills & Bakeries Co., Baked by Melissa, Al-Homaizi Foodstuff Co., Al-Jazeera Bakeries, Al-Qurain Bakery, Al-Sultan Foodstuff Co., Al-Mansour Bakery, Al-Bahar Bakery, Al-Muhalab Bakery, Al-Fawaz Bakery, Al-Safwa Bakery, Al-Masafi Bakery, Al-Nasr Bakery contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait premium packaged bakery products market appears promising, driven by evolving consumer preferences and technological advancements. The increasing integration of digital platforms for retailing is expected to enhance consumer engagement and streamline distribution. Furthermore, the focus on health-oriented products will likely lead to innovations in product offerings, catering to the growing demand for nutritious and convenient options. As the market adapts to these trends, it is poised for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Cookies Muffins Pies Others |

| By End-User | Households Cafes and Restaurants Retail Stores Hotels |

| By Sales Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores |

| By Packaging Type | Plastic Packaging Paper Packaging Glass Packaging Metal Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Distribution Mode | Direct Sales Indirect Sales |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bakery Outlets | 150 | Store Managers, Franchise Owners |

| Consumer Preferences in Packaged Bakery | 200 | Regular Consumers, Health-Conscious Shoppers |

| Distribution Channels for Bakery Products | 100 | Logistics Coordinators, Supply Chain Managers |

| Market Trends in Premium Bakery Products | 80 | Product Development Managers, Marketing Executives |

| Impact of E-commerce on Bakery Sales | 90 | eCommerce Managers, Digital Marketing Specialists |

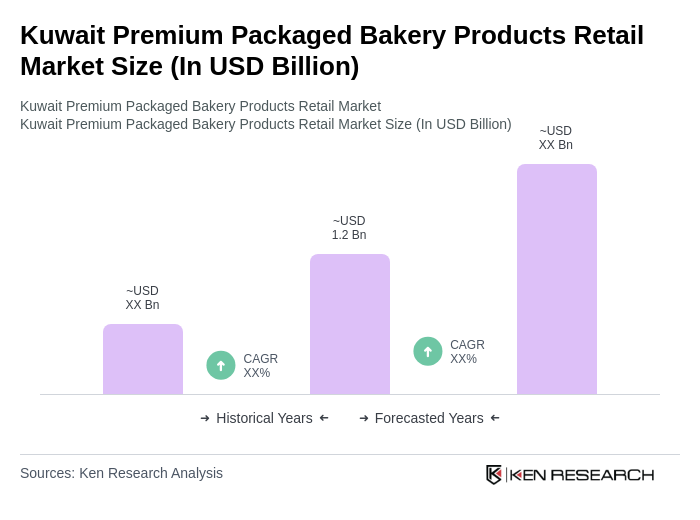

The Kuwait Premium Packaged Bakery Products Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by consumer demand for convenience foods and healthier eating options.