Region:Middle East

Author(s):Rebecca

Product Code:KRAB4145

Pages:83

Published On:October 2025

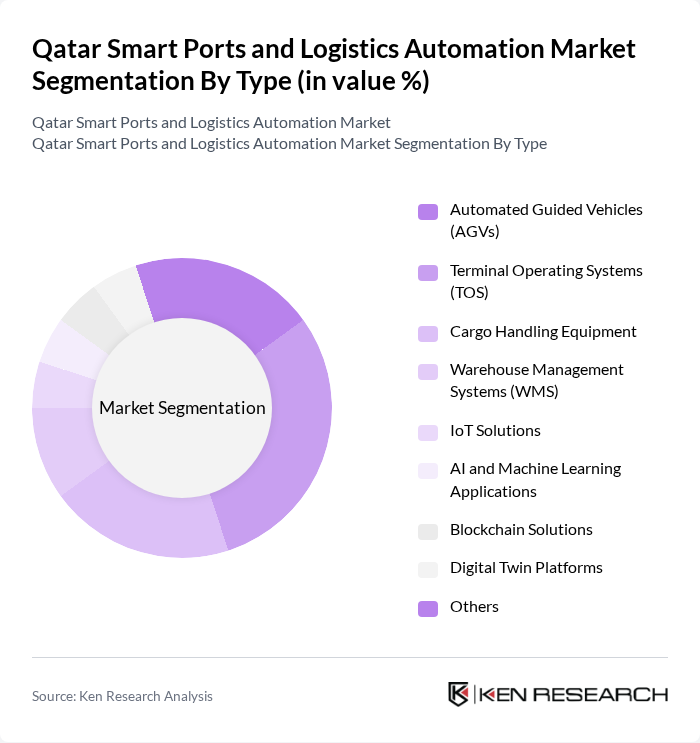

By Type:The market is segmented into Automated Guided Vehicles (AGVs), Terminal Operating Systems (TOS), Cargo Handling Equipment, Warehouse Management Systems (WMS), IoT Solutions, AI and Machine Learning Applications, Blockchain Solutions, Digital Twin Platforms, and Others. Among these, Terminal Operating Systems (TOS) lead the market, driven by their essential role in orchestrating port operations, optimizing scheduling, and integrating with other automation technologies to boost throughput and minimize human error .

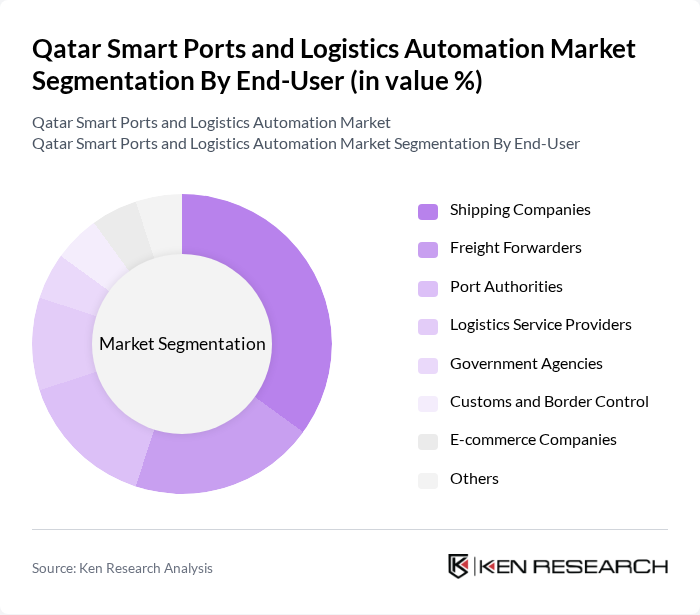

By End-User:The end-user segmentation includes Shipping Companies, Freight Forwarders, Port Authorities, Logistics Service Providers, Government Agencies, Customs and Border Control, E-commerce Companies, and Others. Shipping Companies remain the dominant end-user segment, supported by the increasing volume of international trade and the need for advanced logistics automation to ensure timely and cost-effective cargo movement .

The Qatar Smart Ports and Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mwani Qatar (Qatar Ports Management Company), Milaha (Qatar Navigation Q.P.S.C.), Gulf Warehousing Company (GWC), Qatar Free Zones Authority (QFZA), QTerminals, Qatar Airways Cargo, Kuehne + Nagel, DB Schenker, Agility Logistics, DSV, CEVA Logistics, Bolloré Logistics, PSA International (Qatar Operations), Siemens Qatar, ABB Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Smart Ports and Logistics Automation Market appears promising, driven by ongoing government initiatives and technological advancements. The integration of automation and data analytics is expected to streamline operations, enhancing decision-making processes. Furthermore, the shift towards sustainable logistics practices will likely gain momentum, aligning with global trends. As the market evolves, collaboration between logistics firms and technology providers will be crucial in overcoming challenges and capitalizing on emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Terminal Operating Systems (TOS) Cargo Handling Equipment Warehouse Management Systems (WMS) IoT Solutions AI and Machine Learning Applications Blockchain Solutions Digital Twin Platforms Others |

| By End-User | Shipping Companies Freight Forwarders Port Authorities Logistics Service Providers Government Agencies Customs and Border Control E-commerce Companies Others |

| By Application | Container Handling Bulk Cargo Management Customs Clearance Inventory Management Predictive Maintenance Energy Management Real-Time Asset Tracking Others |

| By Distribution Mode | Direct Sales Online Sales Distributors System Integrators Others |

| By Component | Hardware Software Services Connectivity Solutions Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) Multilateral Development Banks Others |

| By Policy Support | Subsidies Tax Incentives Grants Regulatory Sandboxes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Port Technology Adoption | 60 | Port Managers, IT Directors |

| Logistics Automation Solutions | 50 | Supply Chain Managers, Operations Executives |

| Regulatory Impact on Logistics | 40 | Policy Makers, Compliance Officers |

| Infrastructure Development Projects | 45 | Project Managers, Civil Engineers |

| Market Trends in Shipping and Logistics | 55 | Market Analysts, Business Development Managers |

The Qatar Smart Ports and Logistics Automation Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for efficient logistics solutions and government investments in port infrastructure and modernization.