Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9174

Pages:84

Published On:November 2025

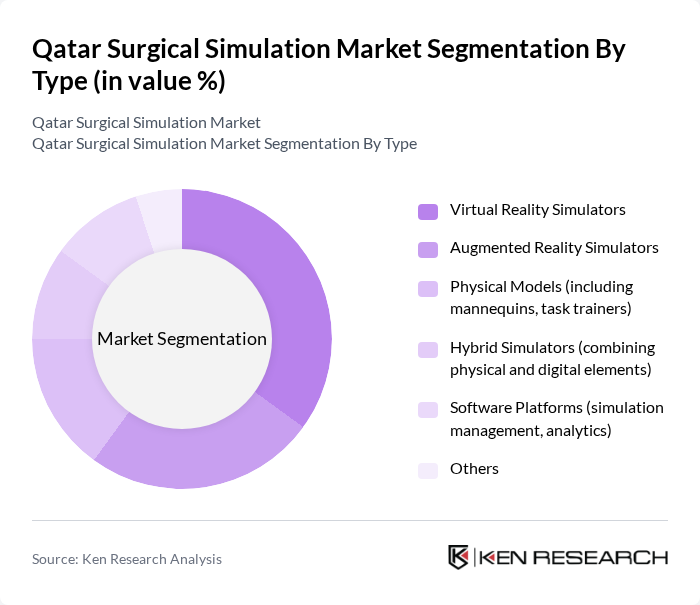

By Type:The market is segmented into various types of surgical simulation technologies, including Virtual Reality Simulators, Augmented Reality Simulators, Physical Models (including mannequins and task trainers), Hybrid Simulators (combining physical and digital elements), Software Platforms (simulation management and analytics), and Others. Among these, Virtual Reality Simulators are gaining significant traction due to their immersive experience, allowing users to practice complex surgical procedures in a risk-free environment. The demand for these simulators is driven by their ability to enhance learning outcomes and provide realistic training scenarios. The adoption of AR and VR technologies is accelerating, supported by investments in digital healthcare transformation and the need for more effective, technology-driven training solutions.

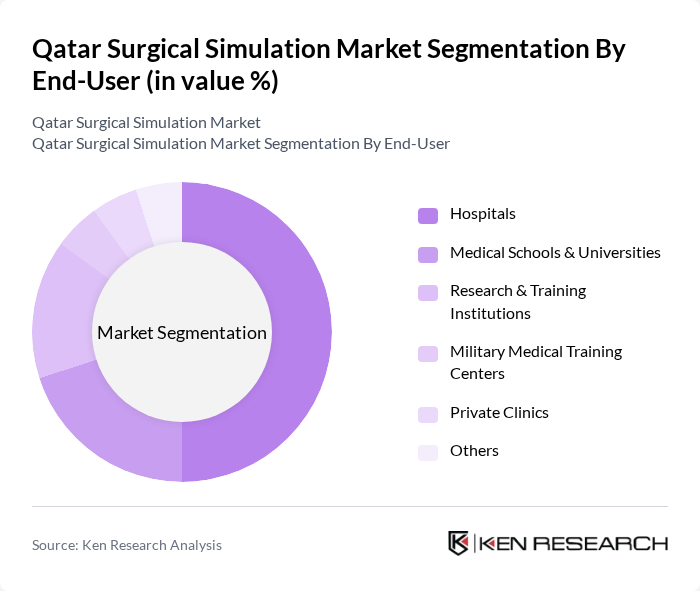

By End-User:The end-user segmentation includes Hospitals, Medical Schools & Universities, Research & Training Institutions, Military Medical Training Centers, Private Clinics, and Others. Hospitals are the leading end-users of surgical simulation technologies, driven by the need for continuous training and skill enhancement of surgical staff. The increasing complexity of surgical procedures and the growing focus on patient safety necessitate the use of advanced simulation tools to ensure that healthcare professionals are adequately prepared for real-life scenarios. Medical schools and universities are also significant adopters, integrating simulation-based curricula to meet regulatory requirements and international accreditation standards.

The Qatar Surgical Simulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Simulab Corporation, CAE Healthcare, MedaPhor Group (now part of Intelligent Ultrasound Group), 3D Systems, Laerdal Medical, Surgical Science Sweden AB, ImmersiveTouch Inc., VRmagic GmbH, Simbionix (now part of 3D Systems), HaptX Inc., Touch Surgery (by Digital Surgery, now part of Medtronic), Medical Realities Ltd., Osso VR Inc., Medtronic plc, Boston Scientific Corporation, Gaumard Scientific Company Inc., Kyoto Kagaku Co., Ltd., Mentice AB, Limbs & Things Ltd., Nasco Healthcare Inc., 3B Scientific GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surgical simulation market in Qatar appears promising, driven by ongoing advancements in medical technology and a growing emphasis on patient safety. As healthcare institutions increasingly recognize the value of simulation-based training, the market is expected to expand significantly. Additionally, the integration of artificial intelligence and virtual reality into surgical simulations will likely enhance training effectiveness, making it more appealing to healthcare professionals. This evolution will create a more skilled workforce, ultimately improving patient care and outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Virtual Reality Simulators Augmented Reality Simulators Physical Models (including mannequins, task trainers) Hybrid Simulators (combining physical and digital elements) Software Platforms (simulation management, analytics) Others |

| By End-User | Hospitals Medical Schools & Universities Research & Training Institutions Military Medical Training Centers Private Clinics Others |

| By Application | Surgical Training & Skill Acquisition Skills Assessment & Certification Procedure Rehearsal & Planning Patient Education & Communication Continuing Medical Education (CME) Others |

| By Technology | Haptic Feedback Technology Motion Tracking & Sensor Technology D Visualization & Imaging Technology Artificial Intelligence & Machine Learning Integration Others |

| By User Experience Level | Novice (medical students, interns) Intermediate (residents, fellows) Advanced (consultants, specialists) Others |

| By Geographic Distribution | Urban Areas (Doha, Al Rayyan, etc.) Rural Areas Others |

| By Funding Source | Government Funding Private Investments Grants and Donations Institutional Budgets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Training Institutions | 60 | Deans, Program Directors, Faculty Members |

| Hospitals and Surgical Centers | 55 | Chief Surgeons, Training Coordinators, Simulation Technicians |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Bodies |

| Medical Equipment Suppliers | 45 | Sales Managers, Product Development Leads |

| Medical Students and Residents | 70 | Medical Students, Surgical Residents, Interns |

The Qatar Surgical Simulation Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing demand for advanced training methodologies in healthcare and the integration of technologies like augmented and virtual reality in medical training.