Region:Global

Author(s):Dev

Product Code:KRAC8824

Pages:85

Published On:November 2025

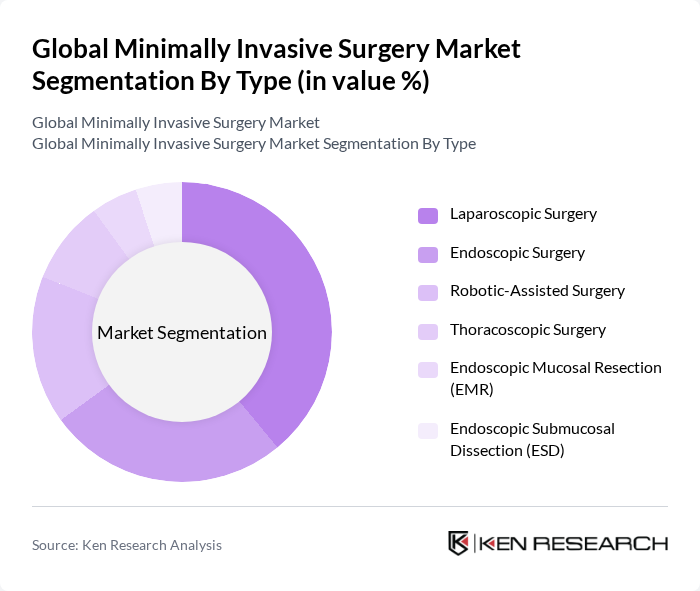

By Type:The market is segmented into various types of minimally invasive surgical procedures, including laparoscopic surgery, endoscopic surgery, robotic-assisted surgery, thoracoscopic surgery, endoscopic mucosal resection (EMR), and endoscopic submucosal dissection (ESD). Among these,laparoscopic surgeryremains the most dominant segment due to its widespread adoption in general surgery, gynecology, and urology, driven by its effectiveness, lower complication rates, and strong patient preference for less invasive options. Robotic-assisted surgery is rapidly gaining share, particularly in urology and oncology, due to precision and improved outcomes .

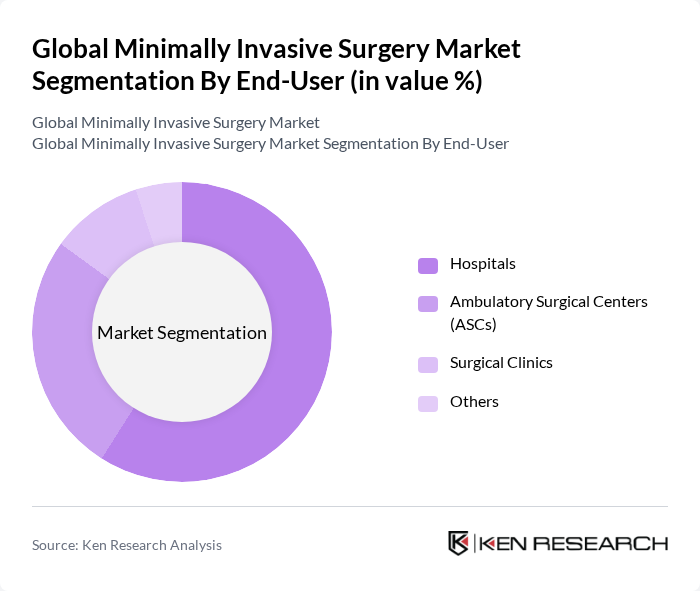

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers (ASCs), surgical clinics, and others.Hospitalsare the leading end-user segment, primarily due to their capacity to handle complex surgeries, access to advanced surgical technologies, and the presence of multidisciplinary teams essential for minimally invasive procedures. Ambulatory surgical centers are also growing rapidly, supported by the shift toward outpatient procedures and cost-efficiency .

The Global Minimally Invasive Surgery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intuitive Surgical, Inc., Medtronic plc, Johnson & Johnson, Stryker Corporation, Boston Scientific Corporation, Olympus Corporation, B. Braun Melsungen AG, Zimmer Biomet Holdings, Inc., CONMED Corporation, Smith & Nephew plc, Hologic, Inc., Abbott Laboratories, Cook Medical LLC, Merit Medical Systems, Inc., and Terumo Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the minimally invasive surgery market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centric care. As healthcare systems continue to prioritize efficiency and improved outcomes, the integration of AI and machine learning into surgical practices is expected to enhance precision and reduce complications. Additionally, the expansion of telemedicine and remote surgical capabilities will likely facilitate access to minimally invasive procedures, particularly in underserved regions, thereby broadening the market's reach and impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Laparoscopic Surgery Endoscopic Surgery Robotic-Assisted Surgery Thoracoscopic Surgery Endoscopic Mucosal Resection (EMR) Endoscopic Submucosal Dissection (ESD) |

| By End-User | Hospitals Ambulatory Surgical Centers (ASCs) Surgical Clinics Others |

| By Procedure Type | Cardiac Surgery Gastrointestinal Surgery Urological Surgery Gynecological Surgery Orthopedic Surgery Spinal Surgery Thoracic Surgery Vascular Surgery Bariatric Surgery Cosmetic Surgery Breast Surgery Joint Replacement Surgery |

| By Region | North America (U.S., Canada) Europe (U.K., Germany, France, Italy, Spain, Rest of EU) Asia-Pacific (Japan, China, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of APAC) Latin America (Brazil, Mexico, Rest of LA) Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of MEA) |

| By Technology | Imaging Systems (X-ray, CT Scanners, MRI Equipment, Ultrasound) Surgical Instruments (Ablation Devices, Electrosurgical Devices) Medical Robotic Systems Monitoring and Visualization Devices Endoscopy Devices |

| By Application | Diagnostic Applications Therapeutic Applications Others |

| By Product Category | Ablation Devices (Radiofrequency, Microwave, Cryoablation) Electrosurgical Devices Medical Robotic Systems Monitoring and Visualization Equipment Endoscopy Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiothoracic Surgery | 100 | Cardiothoracic Surgeons, Surgical Nurses |

| Orthopedic Procedures | 70 | Orthopedic Surgeons, Hospital Administrators |

| Gastrointestinal Surgery | 60 | Gastrointestinal Surgeons, Surgical Technologists |

| Urological Surgery | 50 | Urologists, Medical Device Representatives |

| General Surgery | 65 | General Surgeons, Operating Room Managers |

The Global Minimally Invasive Surgery Market is valued at approximately USD 81.7 billion, reflecting significant growth driven by advancements in surgical technologies and increasing patient preference for minimally invasive procedures.