Region:Middle East

Author(s):Dev

Product Code:KRAD5100

Pages:99

Published On:December 2025

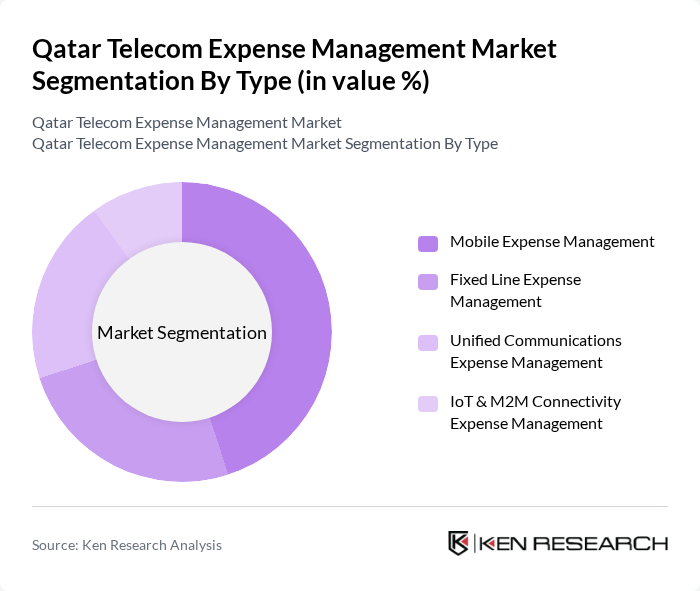

By Type:The segmentation by type includes Mobile Expense Management, Fixed Line Expense Management, Unified Communications Expense Management, and IoT & M2M Connectivity Expense Management. Among these, Mobile Expense Management is currently the leading sub-segment, driven by the increasing reliance on smartphones, tablets, and mobile broadband for business operations, field work, and hybrid workforces. Organizations are focusing on managing mobile voice and data usage, roaming charges, device inventories, and security policies to control costs and improve productivity, often through automated invoice validation and usage analytics. The demand for mobile expense management solutions is further fueled by the growing trend of remote and hybrid work, the rollout of high-speed 5G and fiber connectivity in Qatar, and enterprises’ increasing use of mobile collaboration and cloud applications.

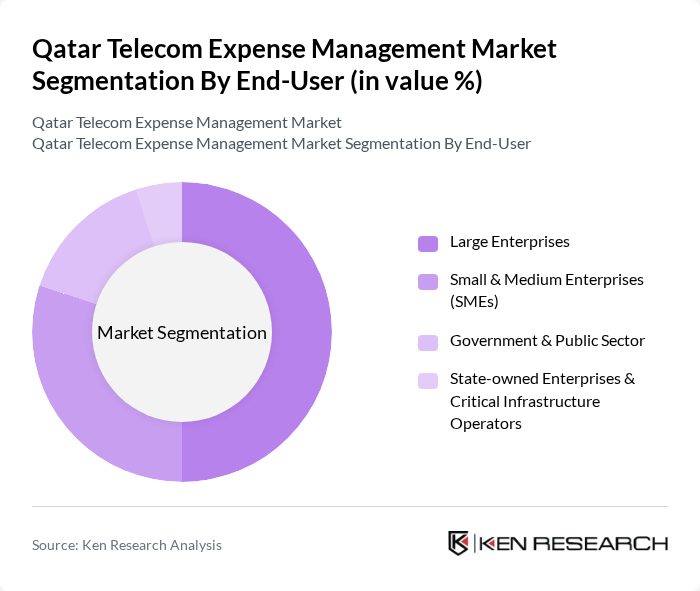

By End-User:The end-user segmentation includes Large Enterprises, Small & Medium Enterprises (SMEs), Government & Public Sector, and State-owned Enterprises & Critical Infrastructure Operators. Large Enterprises dominate this segment due to their extensive telecom needs, multi-site operations, and higher spending capacity, which require centralized visibility over fixed, mobile, data, and cloud communications spend. These organizations are increasingly adopting telecom expense management solutions to streamline their operations, identify billing discrepancies, optimize tariff plans, and enhance efficiency through automation and analytics. The growing trend of digital transformation, including unified communications, cloud migration, and 5G-enabled applications among large enterprises and critical infrastructure operators in Qatar, is also contributing to the increased adoption of these solutions.

The Qatar Telecom Expense Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo Qatar Q.P.S.C. (Ooredoo Group), Vodafone Qatar P.Q.S.C., Qatar National Broadband Network (Qnbn), MEEZA QSTP-LLC, Gulf Bridge International Q.S.C. (GBI), Malomatia Q.S.C., Qatar Data Center (QDC) & Local Colocation Providers, Cisco Systems Qatar LLC, Microsoft Qatar W.L.L., Huawei Technologies Qatar W.L.L., Ericsson Qatar W.L.L., Tata Communications Limited (Regional TEM & Managed Services), Sakon Inc., Calero-MDSL, Cass Information Systems, Inc. (Cass Telecom Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar telecom expense management market appears promising, driven by technological advancements and increasing digitalization. As businesses continue to embrace automation and artificial intelligence, the demand for sophisticated expense management solutions is expected to rise. Furthermore, the expansion of 5G networks will create new opportunities for telecom providers to enhance service offerings, necessitating robust expense management strategies to optimize costs and improve operational efficiency in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Expense Management Fixed Line Expense Management Unified Communications Expense Management IoT & M2M Connectivity Expense Management |

| By End-User | Large Enterprises Small & Medium Enterprises (SMEs) Government & Public Sector State-owned Enterprises & Critical Infrastructure Operators |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Oil, Gas & Energy Government, Defense & Public Services Transportation, Logistics & Smart Cities Retail, Hospitality & Entertainment Healthcare & Education |

| By Deployment Model | On-Premises Cloud-Based (SaaS) Hybrid |

| By Region | Doha Al Rayyan Al Wakrah & Al Daayen Umm Salal, Al Khor & Other Municipalities |

| By Service Type | TEM Consulting & Audit Services Managed Telecom Expense Services Implementation, Integration & Support Optimization & Analytics Services |

| By Pricing Model | Subscription-Based (Per User / Per Line) Pay-As-You-Go / Usage-Based Outcome- / Savings-Based Pricing Enterprise License & Custom SLAs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Telecom Expense Management | 120 | CFOs, Finance Managers |

| Telecom Expense Management Software Providers | 75 | Product Managers, Sales Directors |

| IT Management in Large Corporations | 90 | IT Managers, Procurement Officers |

| Telecom Service Providers | 65 | Business Development Managers, Account Executives |

| Industry Experts and Consultants | 45 | Market Analysts, Telecom Consultants |

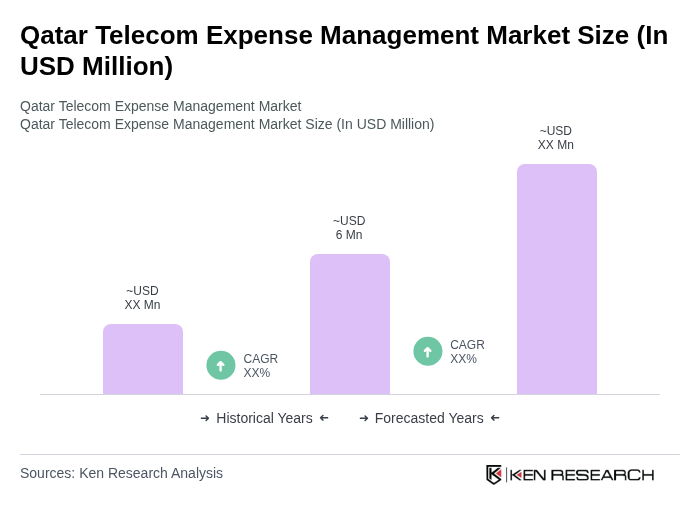

The Qatar Telecom Expense Management Market is valued at approximately USD 6 million, reflecting its growth driven by the increasing complexity of telecom services and the need for organizations to optimize their telecom expenses.