Region:Middle East

Author(s):Rebecca

Product Code:KRAB7779

Pages:97

Published On:October 2025

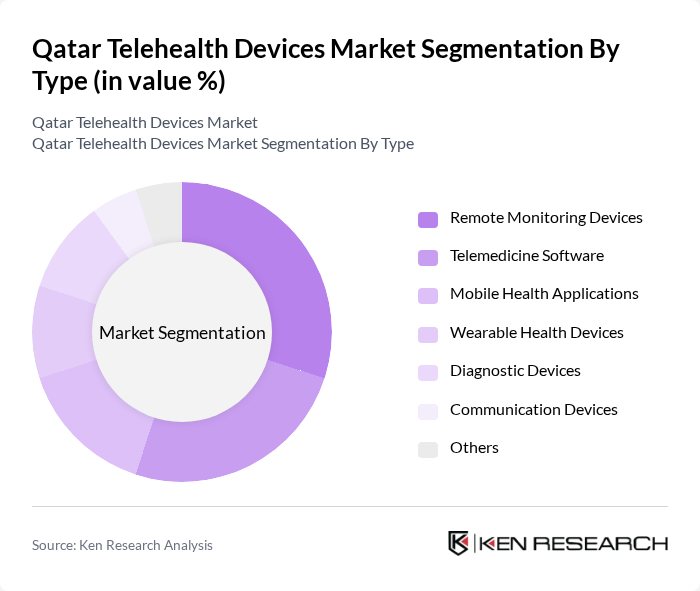

By Type:The telehealth devices market can be segmented into various types, including Remote Monitoring Devices, Telemedicine Software, Mobile Health Applications, Wearable Health Devices, Diagnostic Devices, Communication Devices, and Others. Among these, Remote Monitoring Devices are gaining significant traction due to their ability to provide continuous health data to healthcare providers, enabling timely interventions and better management of chronic diseases. The increasing prevalence of chronic conditions and the need for regular monitoring are driving the demand for these devices.

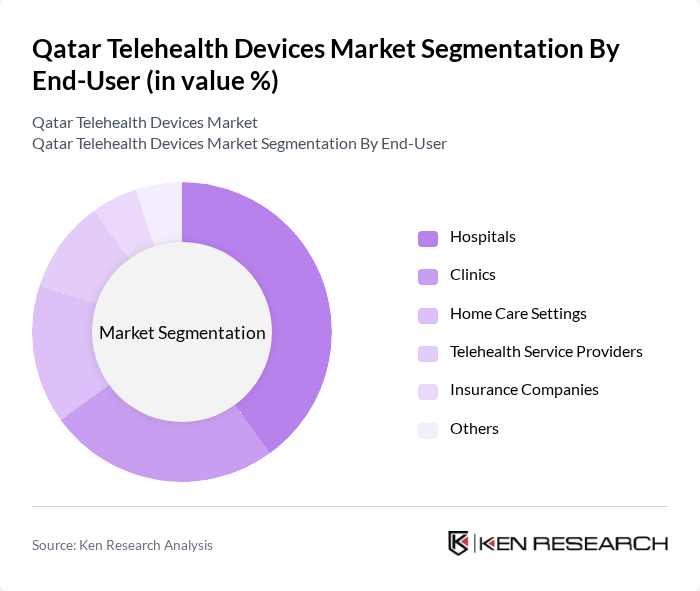

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Settings, Telehealth Service Providers, Insurance Companies, and Others. Hospitals are the leading end-users of telehealth devices, driven by their need to enhance patient care and streamline operations. The integration of telehealth solutions in hospitals allows for improved patient monitoring, reduced readmission rates, and better resource management, making them a critical component of modern healthcare delivery.

The Qatar Telehealth Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Medtronic, Abbott Laboratories, Cerner Corporation, Teladoc Health, Amwell, DarioHealth Corp., OMRON Healthcare, iHealth Labs, Withings, AliveCor, BioTelemetry, Inc., Zio by iRhythm Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telehealth devices market in Qatar appears promising, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence and machine learning into telehealth solutions is expected to enhance patient monitoring and personalized care. Additionally, the government's commitment to expanding telehealth services in rural areas will likely improve access to healthcare, fostering a more inclusive healthcare environment. These trends indicate a robust growth trajectory for the telehealth sector in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Remote Monitoring Devices Telemedicine Software Mobile Health Applications Wearable Health Devices Diagnostic Devices Communication Devices Others |

| By End-User | Hospitals Clinics Home Care Settings Telehealth Service Providers Insurance Companies Others |

| By Application | Chronic Disease Management Mental Health Services Emergency Care Rehabilitation Services Preventive Healthcare Others |

| By Distribution Channel | Online Retail Direct Sales Distributors Healthcare Institutions Others |

| By Pricing Model | Subscription-Based One-Time Purchase Pay-Per-Use Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Others |

| By User Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 150 | Doctors, Clinic Managers, Telehealth Coordinators |

| Patients Utilizing Telehealth | 100 | Patients, Caregivers, Health Advocates |

| Telehealth Device Manufacturers | 80 | Product Managers, R&D Directors, Sales Executives |

| Health Insurance Providers | 70 | Policy Analysts, Claims Managers, Underwriters |

| Regulatory Bodies | 50 | Health Policy Makers, Compliance Officers, Regulatory Analysts |

The Qatar Telehealth Devices Market is valued at approximately USD 150 million, reflecting significant growth driven by the increasing adoption of digital health solutions and a focus on remote patient monitoring.