Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5828

Pages:84

Published On:December 2025

Market.png)

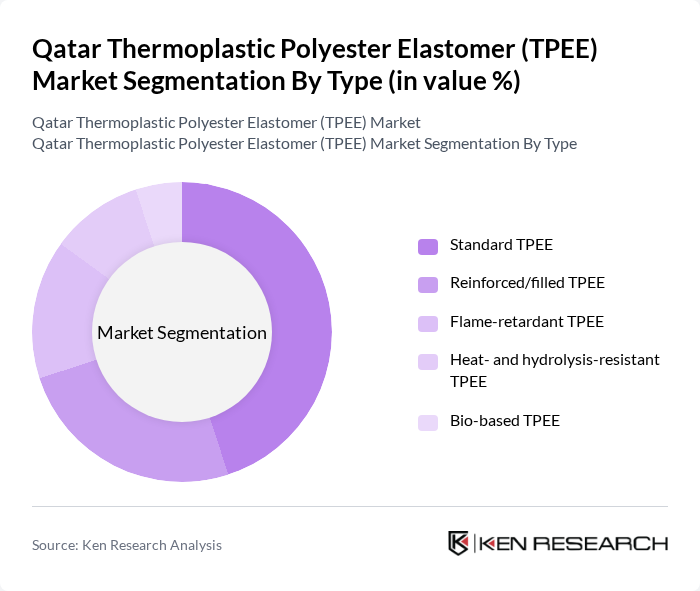

By Type:The TPEE market is segmented into various types, including Standard TPEE, Reinforced/filled TPEE, Flame-retardant TPEE, Heat- and hydrolysis-resistant TPEE, and Bio-based TPEE. Among these, Standard TPEE is the most widely used due to its excellent balance of performance and cost-effectiveness, making it suitable for a broad range of applications. Reinforced/filled TPEE is gaining traction in specialized applications requiring enhanced mechanical properties. The demand for Flame-retardant TPEE is also increasing, driven by stringent safety regulations in industries such as construction and automotive.

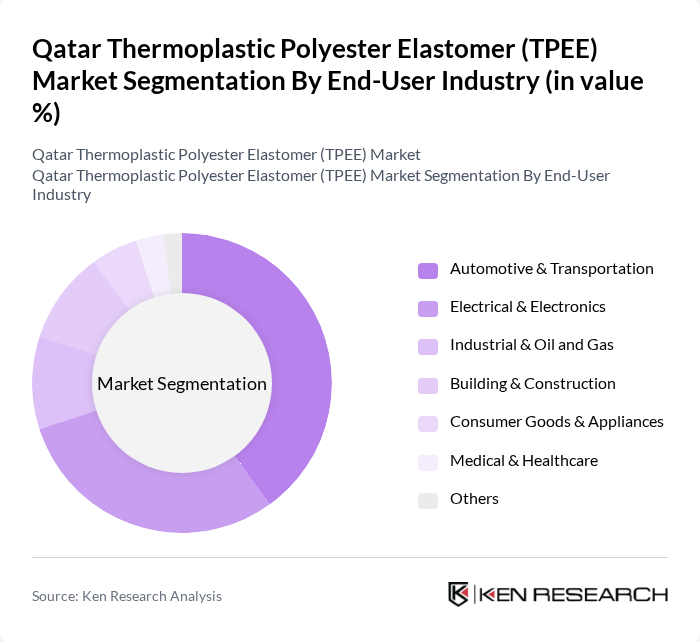

By End-User Industry:The TPEE market serves various end-user industries, including Automotive & Transportation, Electrical & Electronics, Industrial & Oil and Gas, Building & Construction, Consumer Goods & Appliances, Medical & Healthcare, and Others. The Automotive & Transportation sector is the largest consumer of TPEE, driven by the need for lightweight materials that enhance fuel efficiency and reduce emissions. The Electrical & Electronics industry also significantly contributes to market growth, as TPEE is used in wire and cable insulation, connectors, and other components.

The Qatar Thermoplastic Polyester Elastomer (TPEE) Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., Celanese Corporation, SABIC, LG Chem Ltd., Teijin Limited, Toyobo Co., Ltd., Mitsubishi Chemical Group Corporation, BASF SE, Covestro AG, KRAIBURG TPE GmbH & Co. KG, Avient Corporation (formerly PolyOne Corporation), RTP Company, Huntsman Corporation, DSM Engineering Materials (now part of Envalior), and regional distributors and converters active in Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the TPEE market in Qatar appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly practices, TPEE's role in various applications is expected to expand. Moreover, the integration of smart technologies into TPEE products will likely enhance their functionality, catering to evolving consumer demands. The market is poised for growth as manufacturers innovate and adapt to these trends, positioning TPEE as a key material in future applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard TPEE Reinforced/filled TPEE Flame-retardant TPEE Heat- and hydrolysis-resistant TPEE Bio-based TPEE |

| By End-User Industry | Automotive & transportation Electrical & electronics Industrial & oil and gas Building & construction Consumer goods & appliances Medical & healthcare Others |

| By Application | Wire & cable jacketing Automotive boots, bellows & CVJ parts Hoses & tubing Films, sheets & profiles Connectors, plugs & grommets Adhesives & sealants Others |

| By Processing Method | Injection molding Extrusion Blow molding D printing and other advanced processes |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah & Al Khor Rest of Qatar |

| By Distribution Channel | Direct sales to OEMs Regional distributors & traders Global chemical distributors Online and e-tendering platforms |

| By Product Form | Pellets/granules Compounds & masterbatches Sheets & films Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Managers, R&D Engineers |

| Construction Materials | 80 | Procurement Managers, Project Engineers |

| Consumer Goods Packaging | 70 | Brand Managers, Packaging Engineers |

| Medical Devices | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Electronics Manufacturing | 90 | Supply Chain Managers, Production Supervisors |

The Qatar Thermoplastic Polyester Elastomer (TPEE) market is valued at approximately USD 16 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for lightweight and durable materials across various industries, particularly automotive and construction.