Region:Middle East

Author(s):Shubham

Product Code:KRAD5336

Pages:83

Published On:December 2025

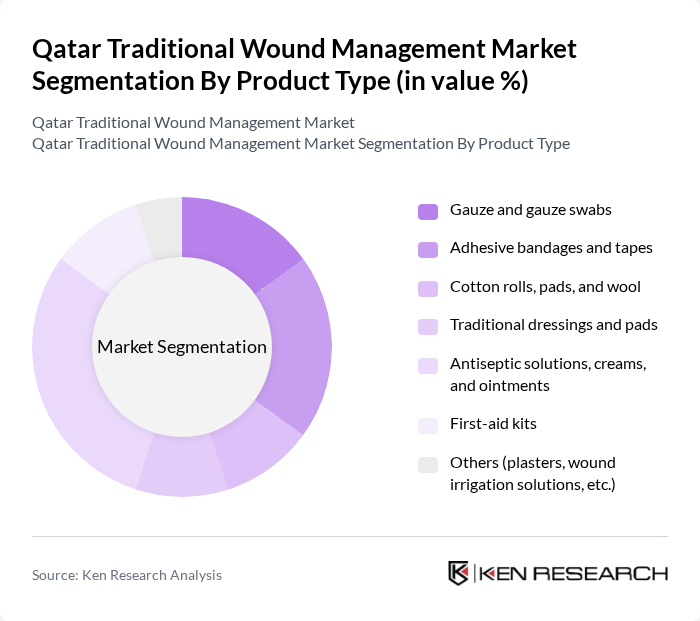

By Product Type:The product type segmentation includes various traditional wound management products that cater to different wound care needs. The subsegments include gauze and gauze swabs, adhesive bandages and tapes, cotton rolls, pads, and wool, traditional dressings and pads, antiseptic solutions, creams, and ointments, first-aid kits, and others such as plasters and wound irrigation solutions. Among these, antiseptic solutions, creams, and ointments are increasingly important due to their essential role in infection prevention, wound bed preparation, and management of minor acute and chronic wounds at hospital and pharmacy levels. Growing awareness of hygiene and infection control, particularly post?surgery and in diabetic patients, together with greater over?the?counter availability in pharmacies and drugstores, is driving demand for these topical products, while gauze, pads, and tapes remain core consumables in institutional settings.

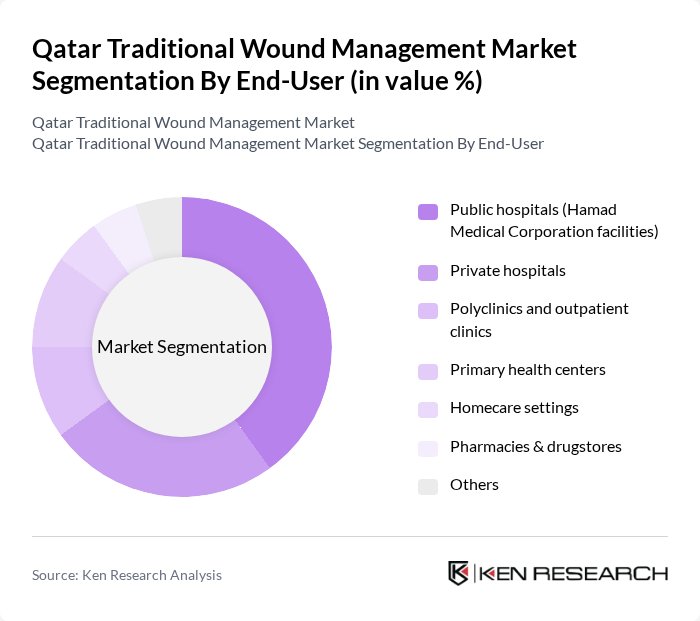

By End-User:The end-user segmentation encompasses various healthcare settings where traditional wound management products are utilized. This includes public hospitals, private hospitals, polyclinics and outpatient clinics, primary health centers, homecare settings, pharmacies and drugstores, and others. Public hospitals, particularly those under Hamad Medical Corporation, dominate the market due to their extensive patient base, the high volume of trauma, surgical, and chronic wound cases managed, and centralized procurement of dressings and related consumables. At the same time, pharmacies and drugstores play a key role in over?the?counter sales of bandages, gauze, and antiseptic preparations, supporting self?care and home?based wound management, while private hospitals and polyclinics contribute through elective surgery and outpatient procedures.

The Qatar Traditional Wound Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew plc, Johnson & Johnson (including Ethicon), 3M Health Care, Medtronic plc, B. Braun Melsungen AG, ConvaTec Group plc, Mölnlycke Health Care AB, Coloplast A/S, Paul Hartmann AG, Medline Industries, LP, Hollister Incorporated, Derma Sciences (Integra LifeSciences), Urgo Medical, Beiersdorf AG (Hansaplast), Local distributors and suppliers (e.g., Naseem Al Rabeeh Medical, Doha Drug Store, and others) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar traditional wound management market appears promising, driven by increasing healthcare investments and a focus on enhancing patient care. With the government aiming to improve healthcare infrastructure, the market is expected to benefit from better access to wound care products. Additionally, the integration of digital health technologies is likely to streamline wound management processes, improving patient outcomes and fostering innovation in treatment methodologies.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gauze and gauze swabs Adhesive bandages and tapes Cotton rolls, pads, and wool Traditional dressings and pads Antiseptic solutions, creams, and ointments First-aid kits Others (plasters, wound irrigation solutions, etc.) |

| By End-User | Public hospitals (Hamad Medical Corporation facilities) Private hospitals Polyclinics and outpatient clinics Primary health centers Homecare settings Pharmacies & drugstores Others |

| By Wound Type | Acute wounds (traumatic and surgical) Burns Diabetic foot ulcers Pressure ulcers Venous and arterial leg ulcers Others |

| By Distribution Channel | Hospital procurement (tenders and bulk purchasing) Community and retail pharmacies Medical and surgical distributors Online pharmacies and e-commerce Supermarkets and hypermarkets Others |

| By Material | Cotton-based products Synthetic fibers (polyester, rayon, etc.) Blended materials Natural and herbal-based products Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor & Al Thakira Al Daayen Others |

| By Product Formulation | Liquid solutions and antiseptics Creams and ointments Gels Sprays Impregnated dressings and pads Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals in Wound Care | 120 | Doctors, Nurses, Wound Care Specialists |

| Pharmacy Managers and Owners | 90 | Pharmacy Managers, Retail Pharmacists |

| Patients Utilizing Traditional Wound Care | 100 | Patients, Caregivers, Community Health Workers |

| Traditional Medicine Practitioners | 70 | Herbalists, Traditional Healers, Alternative Medicine Practitioners |

| Healthcare Policy Makers | 60 | Health Administrators, Policy Analysts, Government Officials |

The Qatar Traditional Wound Management Market is valued at approximately USD 2 million, based on a five-year historical analysis of wound care and dressing categories, driven by factors such as chronic wound prevalence and rising healthcare expenditure.