Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7304

Pages:93

Published On:December 2025

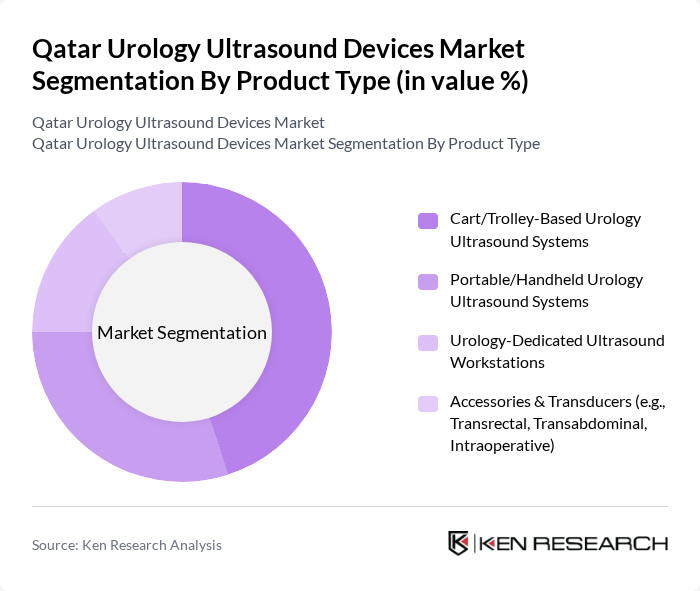

By Product Type:The product type segmentation includes various categories of urology ultrasound devices, each catering to specific needs within the healthcare sector. The dominant sub-segment is the Cart/Trolley-Based Urology Ultrasound Systems, which are widely used in hospitals due to their higher imaging power, advanced Doppler and 3D/4D capabilities, and suitability for high?throughput urology departments. Portable/Handheld Urology Ultrasound Systems are gaining traction for their convenience, bedside use, and role in point?of?care assessment in emergency departments, outpatient urology clinics, and day?surgery centers, reflecting the broader trend toward compact ultrasound solutions. Urology-Dedicated Ultrasound Workstations and Accessories & Transducers, including transrectal, transabdominal, and intraoperative probes, also play crucial roles in enhancing diagnostic accuracy, guiding biopsies and minimally invasive procedures, and improving workflow efficiency.

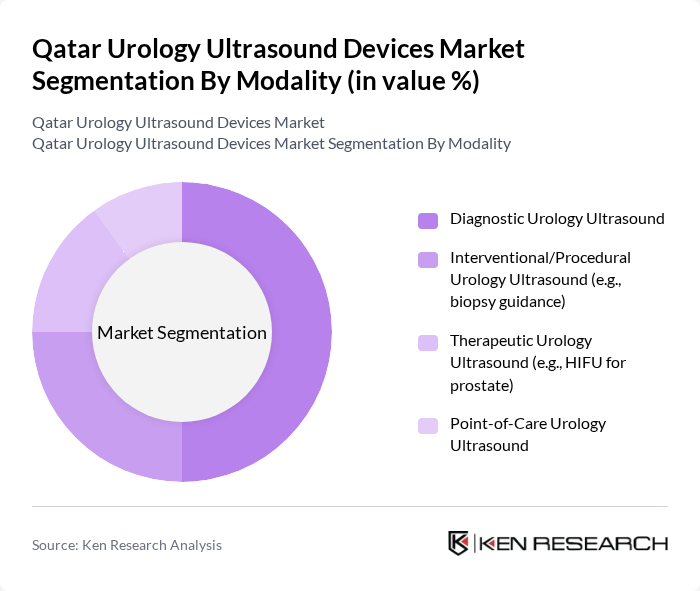

By Modality:The modality segmentation encompasses various applications of urology ultrasound devices, including diagnostic, interventional, therapeutic, and point-of-care modalities. Diagnostic Urology Ultrasound is the leading sub-segment, as it is essential for the initial assessment of urological conditions such as hydronephrosis, bladder outlet obstruction, prostate enlargement, and renal masses, and is widely used as a first?line imaging modality due to its safety and cost?effectiveness. Interventional/Procedural Urology Ultrasound is also significant, particularly for real?time guidance of prostate biopsies, percutaneous nephrostomies, and minimally invasive stone management procedures. Therapeutic Urology Ultrasound, including High-Intensity Focused Ultrasound (HIFU) and other focused energy applications for prostate disease management, is gaining popularity as a minimally invasive option where available, while Point-of-Care Urology Ultrasound is increasingly utilized in emergency, critical care, and outpatient settings for rapid bladder scanning, post?void residual volume assessment, and triage.

The Qatar Urology Ultrasound Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Healthcare (Koninklijke Philips N.V.), Canon Medical Systems Corporation, Hitachi, Ltd. (Hitachi Healthcare / Fujifilm Healthcare), Fujifilm Healthcare Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Samsung Medison Co., Ltd., Esaote S.p.A., BK Medical (a GE HealthCare Company), Analogic Corporation (including BK/Pro Focus legacy urology systems), Shenzhen Wisonic Medical Technology Co., Ltd., CHISON Medical Technologies Co., Ltd., Al Faisal Holding – Medical Division (local distributor), Doha Medical Services Co. (local medical equipment distributor) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar urology ultrasound devices market appears promising, driven by ongoing technological innovations and increased healthcare investments. As the government continues to enhance healthcare infrastructure, the adoption of advanced ultrasound technologies is expected to rise. Additionally, the growing trend towards telemedicine and remote diagnostics will likely create new avenues for market expansion, enabling healthcare providers to offer more accessible and efficient services to patients across the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Cart/Trolley-Based Urology Ultrasound Systems Portable/Handheld Urology Ultrasound Systems Urology-Dedicated Ultrasound Workstations Accessories & Transducers (e.g., Transrectal, Transabdominal, Intraoperative) |

| By Modality | Diagnostic Urology Ultrasound Interventional/Procedural Urology Ultrasound (e.g., biopsy guidance) Therapeutic Urology Ultrasound (e.g., HIFU for prostate) Point-of-Care Urology Ultrasound |

| By Clinical Application | Kidney and Upper Urinary Tract Disorders Bladder and Lower Urinary Tract Disorders Prostate and Male Reproductive Disorders Female Pelvic and Urogynecological Disorders Urologic Oncology (e.g., tumor detection and staging) |

| By Technology | D B?Mode Urology Ultrasound D/4D Urology Ultrasound Doppler and Color Flow Urology Ultrasound Fusion Imaging and Elastography in Urology |

| By End-User | Public Hospitals and Urology Departments Private Hospitals and Multispecialty Clinics Specialized Urology and Andrology Clinics Diagnostic Imaging & Day Surgery Centers Academic & Research Institutions |

| By Distribution Channel | Direct Sales by Original Equipment Manufacturers (OEMs) Local Distributors and Importers Group Purchasing via Government & Corporate Tenders Online and Regional E?Procurement Platforms |

| By Region | Doha Al Rayyan Al Wakrah & Al Khor Rest of Qatar |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urology Clinics and Hospitals | 120 | Urologists, Clinic Managers |

| Medical Device Distributors | 80 | Sales Managers, Product Specialists |

| Healthcare Procurement Departments | 70 | Procurement Officers, Supply Chain Managers |

| Regulatory Bodies and Health Authorities | 50 | Policy Makers, Regulatory Affairs Specialists |

| Research Institutions and Universities | 40 | Medical Researchers, Academic Professors |

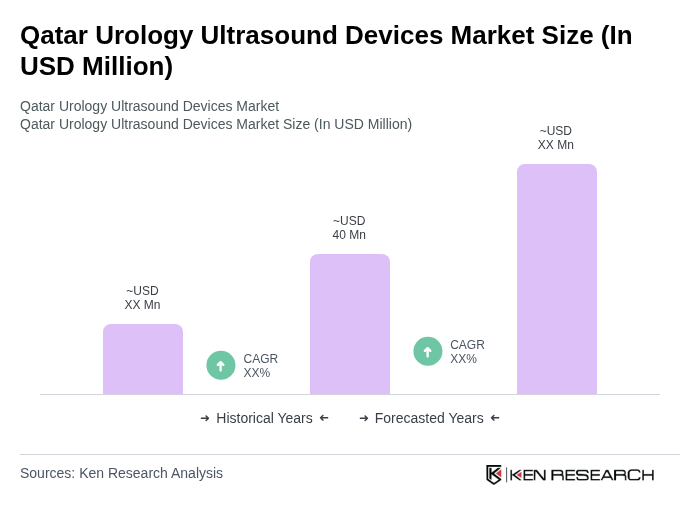

The Qatar Urology Ultrasound Devices Market is valued at approximately USD 40 million, reflecting a historical analysis and alignment with global market trends, driven by the increasing prevalence of urological disorders and advancements in ultrasound technology.