Region:Middle East

Author(s):Shubham

Product Code:KRAA8806

Pages:99

Published On:November 2025

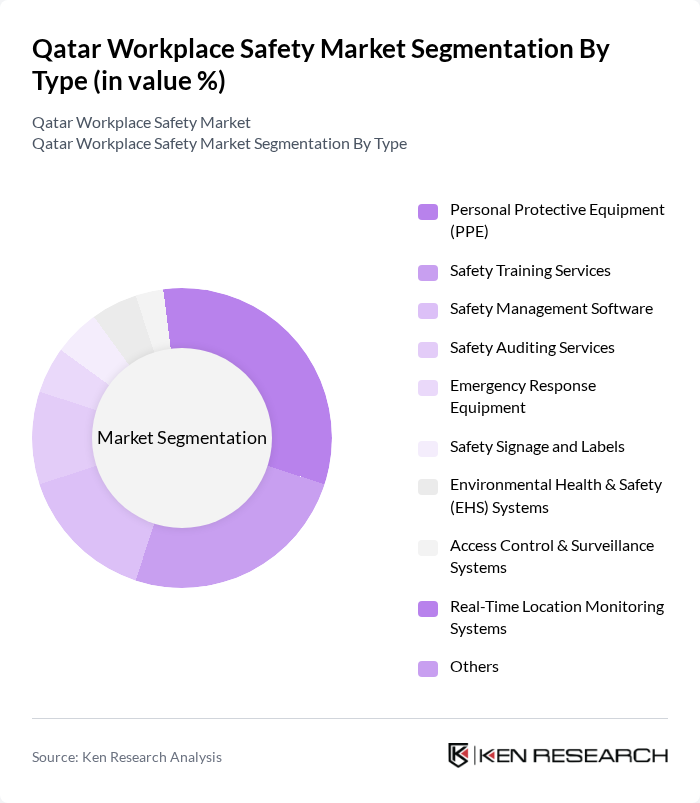

By Type:The market is segmented into various types, including Personal Protective Equipment (PPE), Safety Training Services, Safety Management Software, Safety Auditing Services, Emergency Response Equipment, Safety Signage and Labels, Environmental Health & Safety (EHS) Systems, Access Control & Surveillance Systems, Real-Time Location Monitoring Systems, and Others. Each of these subsegments plays a crucial role in enhancing workplace safety and compliance. The market is witnessing increased adoption of digital safety management platforms, real-time monitoring systems, and advanced PPE, driven by regulatory mandates and technological advancements.

By End-User:The end-user segmentation includes Construction, Manufacturing, Oil and Gas, Healthcare, Transportation and Logistics, Hospitality, Government & Defense, Food & Beverage, Chemicals & Materials, and Others. Each sector has unique safety requirements and regulations that drive the demand for specific safety solutions. Construction and oil & gas remain the largest segments, driven by stringent safety protocols and high-risk operational environments. Healthcare and manufacturing sectors are increasingly investing in advanced safety systems and training to meet regulatory standards and minimize workplace incidents.

The Qatar Workplace Safety Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Safety Products Co., Gulf Safety Equipments Trading Co. WLL, QATAR INTERNATIONAL SAFETY CENTRE (QISC), Al Jazeera Safety Supplies, Doha Industrial Safety Services (DISS), Qatar Industrial Safety Services (QISS), Safety First Qatar, NAFFCO Qatar, SafeTech Qatar, Qatar Safety Training Centre (QSTC), Qatar Occupational Safety Training Center, Qatar Emergency & Safety Services, Qatar Health & Safety Consultancy, Qatar Safety Compliance Solutions, Qatar Safety Innovations contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar workplace safety market appears promising, driven by ongoing regulatory enhancements and a cultural shift towards prioritizing employee safety. As companies increasingly recognize the importance of safety in enhancing productivity, investments in advanced safety technologies and training programs are expected to rise. Furthermore, the integration of smart technologies and data analytics will likely play a pivotal role in shaping safety practices, ensuring a proactive approach to risk management and compliance in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Protective Equipment (PPE) Safety Training Services Safety Management Software Safety Auditing Services Emergency Response Equipment Safety Signage and Labels Environmental Health & Safety (EHS) Systems Access Control & Surveillance Systems Real-Time Location Monitoring Systems Others |

| By End-User | Construction Manufacturing Oil and Gas Healthcare Transportation and Logistics Hospitality Government & Defense Food & Beverage Chemicals & Materials Others |

| By Industry Sector | Public Sector Private Sector Non-Profit Organizations Others |

| By Compliance Level | Mandatory Compliance Voluntary Compliance Industry-Specific Compliance Others |

| By Safety Equipment Type | Fall Protection Equipment Fire Safety Equipment Respiratory Protection Equipment Collective Protection Equipment (e.g., Guardrails, Safety Nets) Detection & Monitoring Devices (e.g., Gas Detectors, Wearables) Others |

| By Training Type | On-Site Training Online Training Certification Programs Emergency Response Drills Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Safety Innovations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Safety Practices | 100 | Site Managers, Safety Officers |

| Manufacturing Sector Compliance | 80 | Production Managers, Quality Assurance Leads |

| Service Sector Safety Training | 70 | HR Managers, Training Coordinators |

| Healthcare Workplace Safety | 50 | Healthcare Administrators, Safety Compliance Officers |

| Oil & Gas Industry Safety Protocols | 90 | Operations Managers, Safety Engineers |

The Qatar Workplace Safety Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by regulatory compliance, increased awareness of safety, and expansion in industries like construction and oil and gas.