Region:Europe

Author(s):Shubham

Product Code:KRAB1323

Pages:87

Published On:October 2025

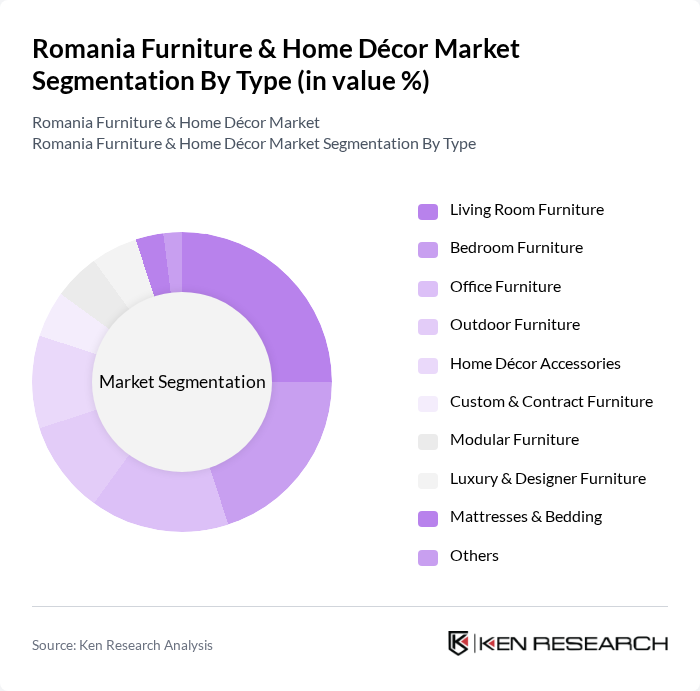

By Type:The market is segmented into various types of furniture and home décor products, including living room furniture, bedroom furniture, office furniture, outdoor furniture, home décor accessories, custom & contract furniture, modular furniture, luxury & designer furniture, mattresses & bedding, and others. Each sub-segment caters to specific consumer needs and preferences, reflecting trends in design, functionality, and material usage. The market is increasingly characterized by demand for modular and multi-functional furniture, as well as sustainable and eco-friendly options .

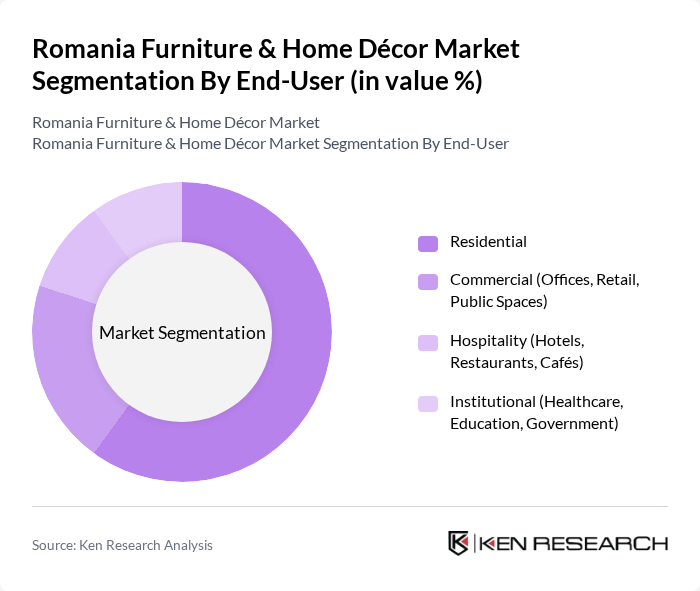

By End-User:The market is segmented by end-user categories, including residential, commercial (offices, retail, public spaces), hospitality (hotels, restaurants, cafés), and institutional (healthcare, education, government). Each segment has distinct requirements and purchasing behaviors, influenced by factors such as space utilization, design preferences, and budget considerations. The residential segment remains dominant, driven by urbanization and rising disposable incomes, while commercial and hospitality segments are increasingly adopting modular and custom solutions .

The Romania Furniture & Home Décor Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Romania, Mobexpert, Elvila, Kika Romania, JYSK Romania, Dedeman, Leroy Merlin, Altex, Bricostore, Casa Rusu, MobilaDalin, MobiLux, Lems, Simex, Sarmexin, Taparo, Aramis Invest, Magda Design, Antares Romania, Solenzara, Erisse, MobiConcept, Targul de Mobila, MobiArt contribute to innovation, geographic expansion, and service delivery in this space .

The Romania furniture and home décor market is poised for continued growth, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize home aesthetics, the demand for innovative and sustainable products will likely rise. Additionally, the integration of technology in furniture design will create new opportunities for manufacturers. Companies that adapt to these trends and focus on e-commerce strategies will be well-positioned to capture market share in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Home Décor Accessories Custom & Contract Furniture Modular Furniture Luxury & Designer Furniture Mattresses & Bedding Others |

| By End-User | Residential Commercial (Offices, Retail, Public Spaces) Hospitality (Hotels, Restaurants, Cafés) Institutional (Healthcare, Education, Government) |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales (B2B/B2C) |

| By Material | Solid Wood Engineered Wood (MDF, Particleboard, Plywood) Metal Plastic & Synthetics Upholstered Bamboo & Alternative Materials |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Modern Traditional Rustic Contemporary Scandinavian Industrial |

| By Functionality | Multi-functional Space-saving Customizable Standard |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Export-Oriented Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Furniture Sales | 100 | Store Managers, Sales Executives |

| Consumer Home Décor Preferences | 120 | Homeowners, Interior Design Enthusiasts |

| Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Market Trends Analysis | 60 | Market Analysts, Trend Forecasters |

| Online Retail Dynamics | 70 | E-commerce Managers, Digital Marketing Specialists |

The Romania Furniture & Home Décor Market is valued at approximately USD 3.8 billion, reflecting a significant growth trend driven by rising disposable incomes, urbanization, and increased interest in home improvement and interior design.