Region:Asia

Author(s):Geetanshi

Product Code:KRAB5767

Pages:82

Published On:October 2025

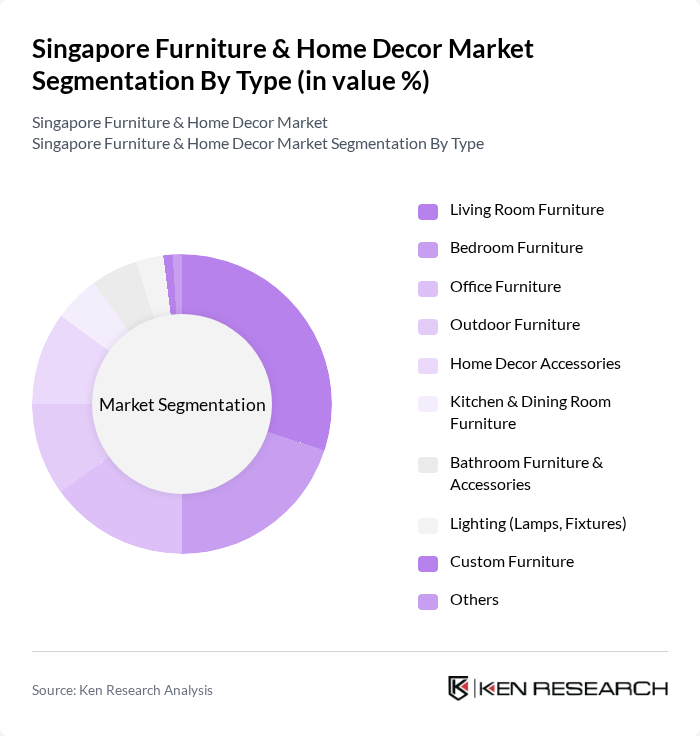

By Type:The market is segmented into various types of furniture and decor items, including living room furniture, bedroom furniture, office furniture, outdoor furniture, home decor accessories, kitchen & dining room furniture, bathroom furniture & accessories, lighting (lamps, fixtures), custom furniture, and others. Among these, living room furniture and home decor accessories are particularly popular, driven by their essential role in enhancing the visual appeal and comfort of homes. The market is also witnessing increased demand for modular, space-saving, and multifunctional furniture, reflecting urban living trends and the growing adoption of hybrid work arrangements .

By End-User:The market is segmented by end-user into residential, commercial (offices, retail, etc.), hospitality (hotels, serviced apartments), and government & institutional. The residential segment dominates, fueled by a growing trend of home renovations, the rise of hybrid work, and the increasing importance of interior design among homeowners. The commercial and hospitality segments are also expanding, supported by ongoing real estate development and refurbishment activities .

The Singapore Furniture & Home Decor Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Singapore, Courts Singapore, Star Furniture Group, Scanteak, HipVan, Castlery, Naiise, FortyTwo, Home & Decor Singapore, MUJI Singapore, Comfort Furniture, The Furniture Mall, Cellini, Lifestorey, and The Green Collective SG contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore furniture and home decor market is poised for significant transformation in the coming years, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture will rise. Additionally, sustainability will play a crucial role, with consumers increasingly favoring eco-friendly products. Retailers are expected to leverage technology, enhancing online shopping experiences and integrating smart home solutions, positioning themselves to meet the changing needs of consumers effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Home Decor Accessories Kitchen & Dining Room Furniture Bathroom Furniture & Accessories Lighting (Lamps, Fixtures) Custom Furniture Others |

| By End-User | Residential Commercial (Offices, Retail, etc.) Hospitality (Hotels, Serviced Apartments) Government & Institutional |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Specialty Stores |

| By Price Range | Budget Mid-Range Premium |

| By Material | Wood Metal Plastic Fabric Glass Eco-friendly/Recycled Materials |

| By Design Style | Modern Traditional Contemporary Rustic Minimalist |

| By Functionality | Multi-functional Space-saving Ergonomic Smart/Connected Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 60 | Homeowners, Interior Designers |

| Home Decor Trends | 50 | Retail Managers, Home Decor Influencers |

| Online Furniture Shopping Behavior | 45 | eCommerce Shoppers, Digital Marketing Experts |

| Consumer Preferences in Home Accessories | 40 | Interior Decorators, Trend Analysts |

| Impact of Sustainability on Purchasing Decisions | 40 | Eco-conscious Consumers, Sustainability Advocates |

The Singapore Furniture & Home Decor Market is valued at approximately USD 2.2 billion, driven by urbanization, rising disposable incomes, and a growing trend towards home improvement and interior design.