Region:Middle East

Author(s):Dev

Product Code:KRAC4744

Pages:90

Published On:October 2025

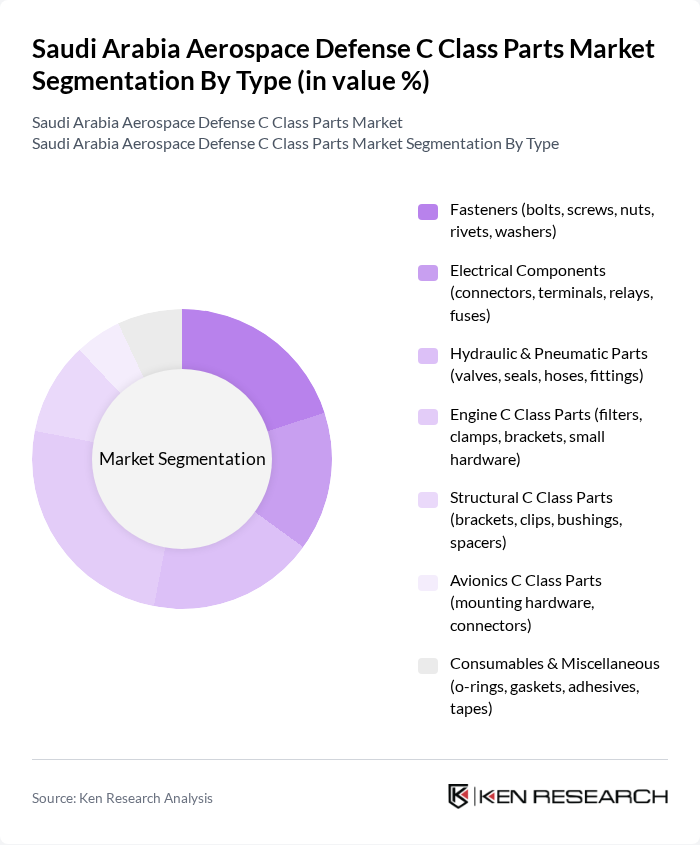

By Type:The market is segmented into various types of C Class parts, including fasteners, electrical components, hydraulic and pneumatic parts, engine parts, structural parts, avionics parts, and consumables. Each subsegment is essential for the reliability, safety, and performance of aerospace systems, with engine parts and fasteners being particularly critical for maintenance and operational efficiency .

The Engine C Class Parts segment leads the market, reflecting the high demand for aircraft engine maintenance and upgrades. This segment includes components such as filters, clamps, and brackets, which are vital for engine reliability and safety. The ongoing trend of retrofitting older aircraft with advanced engine parts, coupled with increased MRO (maintenance, repair, and overhaul) activity, continues to drive growth in this segment as operators prioritize operational efficiency and cost reduction .

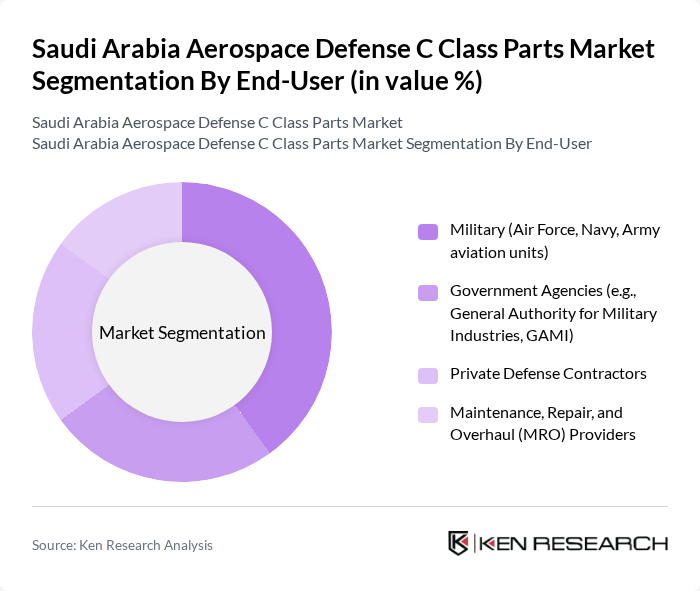

By End-User:The market is segmented by end-users, including military, government agencies, private defense contractors, and maintenance, repair, and overhaul (MRO) providers. Each end-user group has distinct procurement requirements and plays a significant role in shaping overall market demand for C Class parts .

The Military segment remains the largest end-user, supported by robust government defense budgets and ongoing modernization initiatives. Investments in advanced aerospace technologies and the strategic imperative of maintaining operational readiness have resulted in sustained demand for C Class parts among military aviation units. Government agencies and MRO providers also contribute significantly, reflecting the comprehensive approach to defense capability enhancement and lifecycle management .

The Saudi Arabia Aerospace Defense C Class Parts Market features a dynamic mix of regional and international players. Leading companies such as Boeing, Lockheed Martin, Northrop Grumman, RTX Corporation (formerly Raytheon Technologies), Airbus, Thales Group, BAE Systems, Safran, General Dynamics, Leonardo S.p.A., Rolls-Royce, Honeywell Aerospace, L3Harris Technologies, Textron, Elbit Systems, Saudi Arabian Military Industries (SAMI), Advanced Electronics Company (AEC), Middle East Propulsion Company (MEPC), Alsalam Aerospace Industries, and Aircraft Accessories & Components Company (AACC) drive innovation, geographic expansion, and service delivery in this sector .

The future of the Saudi Arabia Aerospace Defense C Class Parts market appears promising, driven by increased defense spending and strategic partnerships. As the government focuses on enhancing local manufacturing capabilities, the demand for advanced aerospace components is expected to rise. Additionally, the integration of digital technologies and sustainable practices will shape the industry landscape. Emphasis on innovation and collaboration with global firms is likely to position Saudi Arabia as a key player in the aerospace defense sector, fostering growth and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Fasteners (bolts, screws, nuts, rivets, washers) Electrical Components (connectors, terminals, relays, fuses) Hydraulic & Pneumatic Parts (valves, seals, hoses, fittings) Engine C Class Parts (filters, clamps, brackets, small hardware) Structural C Class Parts (brackets, clips, bushings, spacers) Avionics C Class Parts (mounting hardware, connectors) Consumables & Miscellaneous (o-rings, gaskets, adhesives, tapes) |

| By End-User | Military (Air Force, Navy, Army aviation units) Government Agencies (e.g., General Authority for Military Industries, GAMI) Private Defense Contractors Maintenance, Repair, and Overhaul (MRO) Providers |

| By Component | Airframe C Class Parts Engine C Class Parts Landing Gear C Class Parts Control Surface C Class Parts |

| By Sales Channel | Direct Sales (OEMs, Tier 1 suppliers) Distributors (local and international) Online Sales Platforms |

| By Distribution Mode | Domestic Distribution International Imports |

| By Price Range | Low-End (standardized, high-volume parts) Mid-Range (specialized, moderate-volume parts) High-End (custom, low-volume, high-spec parts) |

| By Application | Military Aircraft Commercial Aircraft UAVs (Unmanned Aerial Vehicles) Spacecraft & Satellites |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Component Manufacturers | 60 | Production Managers, Quality Assurance Leads |

| Defense Procurement Agencies | 50 | Procurement Officers, Contract Managers |

| Military Aircraft Maintenance Units | 40 | Maintenance Supervisors, Technical Officers |

| Research and Development Departments | 40 | R&D Managers, Aerospace Engineers |

| Supply Chain and Logistics Providers | 45 | Logistics Coordinators, Supply Chain Analysts |

The Saudi Arabia Aerospace Defense C Class Parts Market is valued at approximately USD 1.1 billion, driven by increased defense spending and a focus on local manufacturing to enhance national security and economic diversification.