Saudi Arabia Agricultural Films Market Overview

- The Saudi Arabia Agricultural Films Market is valued at USD 185 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of advanced agricultural practices, rising demand for food security, and the need for sustainable farming solutions. The market is also influenced by the growing awareness of the benefits of using agricultural films in enhancing crop yield and protecting plants from adverse weather conditions .

- Key players in this market include Riyadh, Jeddah, and Dammam, which dominate due to their strategic locations, robust agricultural activities, and significant investments in modern farming technologies. These cities serve as hubs for agricultural innovation and distribution, facilitating the growth of the agricultural films market through enhanced accessibility and support for local farmers .

- In 2022, the Saudi Standards, Metrology and Quality Organization (SASO) issued the "Technical Regulation for Biodegradable Plastic Products," mandating compliance with specific biodegradability standards for agricultural films distributed in the Kingdom. This regulation aims to reduce plastic waste in agriculture and encourages farmers to adopt eco-friendly practices, thereby enhancing the overall sustainability of the agricultural sector in the region .

Saudi Arabia Agricultural Films Market Segmentation

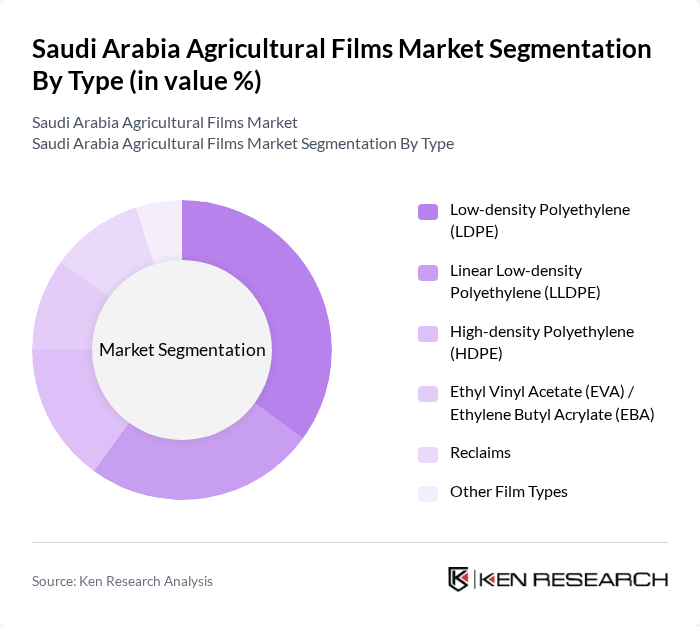

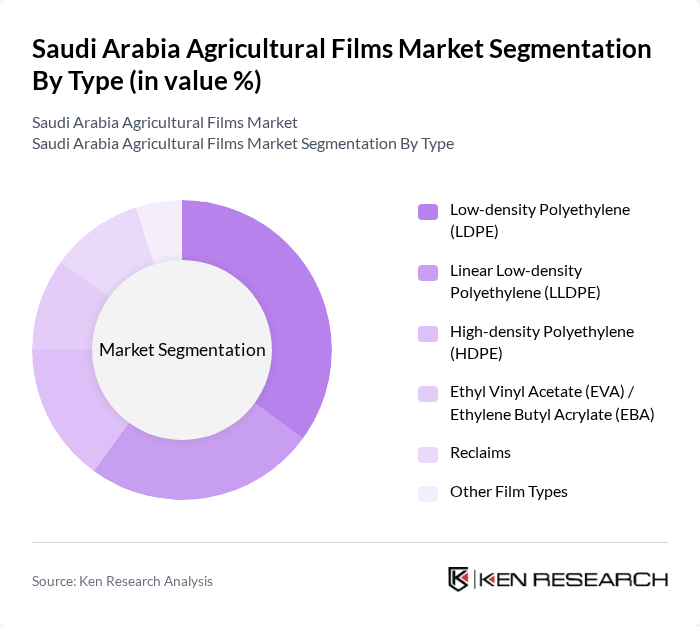

By Type:The market is segmented into various types of agricultural films, including Low-density Polyethylene (LDPE), Linear Low-density Polyethylene (LLDPE), High-density Polyethylene (HDPE), Ethyl Vinyl Acetate (EVA) / Ethylene Butyl Acrylate (EBA), Reclaims, and Other Film Types. Among these, Low-density Polyethylene (LDPE) is the leading sub-segment due to its versatility, cost-effectiveness, and widespread use in mulching and greenhouse applications. The demand for LDPE films is driven by their ability to enhance soil moisture retention and improve crop yields, making them a preferred choice among farmers .

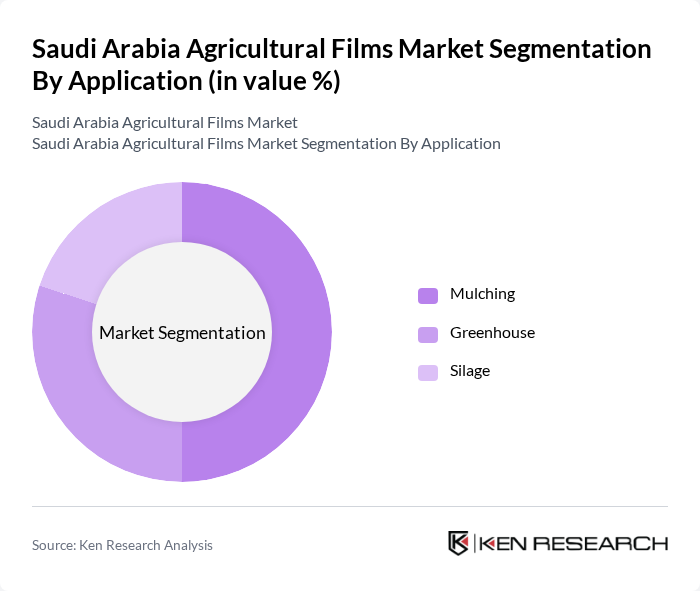

By Application:The agricultural films market is further segmented by application into Mulching, Greenhouse, and Silage. Mulching is the dominant application segment, as it significantly improves soil moisture retention, suppresses weed growth, and enhances crop productivity. The increasing focus on sustainable farming practices and the need for efficient resource management are driving the adoption of mulching films among farmers, making it a critical area of growth in the agricultural films market .

Saudi Arabia Agricultural Films Market Competitive Landscape

The Saudi Arabia Agricultural Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as NAPCO Modern Plastic Products Company (Napco National), Orient Plast Industries, Al-Quds Agri-plastic, Al Sadek Plastics, Sepas Plastik A.?., ?stanbul Sera Plastik Sanayi ve Ticaret Ltd. ?ti., ?leri Plastik Sanayi, Berry Global, Inc., BASF SE, RKW SE, Plastika Kritis S.A., Polifilm GmbH, Coveris Holdings S.A., Tipa Corp., DuPont de Nemours, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

Saudi Arabia Agricultural Films Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Agriculture:The Saudi Arabian agricultural sector is witnessing a significant shift towards sustainable practices, driven by a growing population projected to reach 39 million in future. This increase in demand for food necessitates innovative agricultural solutions, including the use of agricultural films. The government aims to enhance food security, with investments exceeding SAR 1 billion in sustainable agriculture initiatives, thereby boosting the market for agricultural films that support eco-friendly farming practices.

- Government Initiatives for Agricultural Development:The Saudi government has launched various initiatives to modernize agriculture, including the National Agricultural Development Program, which allocates SAR 2.5 billion for agricultural advancements. These initiatives promote the adoption of agricultural films to improve crop yields and resource efficiency. With a focus on enhancing productivity, the government aims to increase the agricultural sector's contribution to GDP, which was approximately SAR 50 billion in future, further driving demand for agricultural films.

- Technological Advancements in Film Production:The agricultural films market is benefiting from technological innovations, such as the development of high-performance films that enhance crop protection and yield. In future, the production capacity of advanced agricultural films is expected to increase by 15%, driven by investments in R&D, which reached SAR 500 million in future. These advancements not only improve the efficiency of agricultural practices but also align with the global trend towards smart farming technologies, further propelling market growth.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to the adoption of agricultural films in Saudi Arabia is the high initial investment required. Farmers face costs averaging SAR 10,000 per hectare for implementing advanced agricultural film solutions. This financial burden can deter smallholder farmers, who represent approximately 60% of the agricultural sector, from adopting these technologies, thereby limiting market penetration and growth potential in the region.

- Limited Awareness Among Farmers:Despite the benefits of agricultural films, there remains a substantial knowledge gap among farmers regarding their advantages and applications. Approximately 40% of farmers in Saudi Arabia lack awareness of modern agricultural practices, including the use of films. This limited understanding hampers the adoption of innovative solutions, which is crucial for enhancing productivity and sustainability in the agricultural sector, thus posing a challenge to market growth.

Saudi Arabia Agricultural Films Market Future Outlook

The future of the Saudi Arabian agricultural films market appears promising, driven by increasing government support and technological advancements. As the agricultural sector continues to modernize, the demand for innovative solutions will rise, particularly in greenhouse farming and precision agriculture. The focus on sustainability will further encourage the development of biodegradable films, aligning with global environmental trends. Overall, the market is poised for growth, with significant opportunities for innovation and collaboration in the coming years.

Market Opportunities

- Expansion of Greenhouse Farming:The expansion of greenhouse farming in Saudi Arabia presents a significant opportunity for agricultural films. With the government targeting a 20% increase in greenhouse area in future, the demand for specialized films that enhance crop growth and protect against environmental factors is expected to rise, creating a lucrative market segment for manufacturers.

- Development of Biodegradable Films:The growing environmental concerns regarding plastic waste have led to an increased interest in biodegradable agricultural films. With the global biodegradable film market projected to reach SAR 1.2 billion in future, Saudi Arabia can capitalize on this trend by investing in the development and production of eco-friendly alternatives, appealing to environmentally conscious consumers and farmers alike.