Region:Middle East

Author(s):Dev

Product Code:KRAC3445

Pages:91

Published On:October 2025

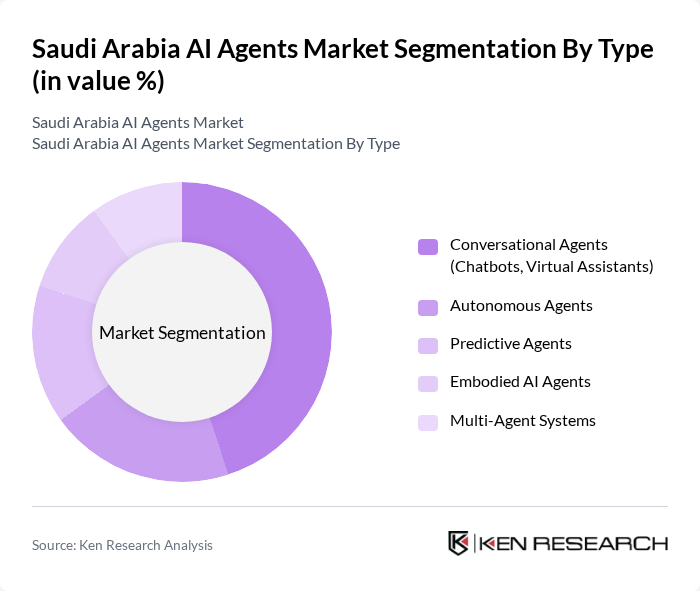

By Type:The AI agents market in Saudi Arabia is segmented into Conversational Agents (Chatbots, Virtual Assistants), Autonomous Agents, Predictive Agents, Embodied AI Agents, and Multi-Agent Systems. Among these, Conversational Agents hold the largest market share, driven by their extensive use in customer service, support, and user engagement across industries. The increasing demand for personalized, round-the-clock interactions is accelerating the deployment of chatbots and virtual assistants in banking, healthcare, and retail.

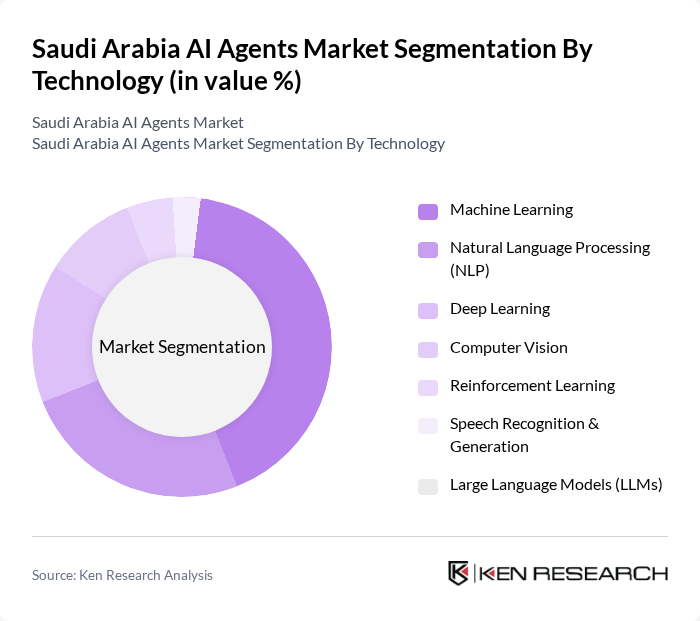

By Technology:The market is segmented by technology into Machine Learning, Natural Language Processing (NLP), Deep Learning, Computer Vision, Reinforcement Learning, Speech Recognition & Generation, and Large Language Models (LLMs). Machine Learning is the dominant technology, accounting for the largest revenue share, as it underpins predictive analytics, customer interaction, and automation. Advances in data availability and algorithmic sophistication are driving adoption, with NLP and Deep Learning also experiencing robust growth due to their roles in conversational AI and complex decision-making.

The Saudi Arabia AI Agents Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA (Mobile Telecommunications Company Saudi Arabia), SAP Saudi Arabia, IBM Saudi Arabia, Microsoft Arabia, Oracle Saudi Arabia, Cisco Systems Saudi Arabia, Huawei Technologies Saudi Arabia Co. Ltd., Accenture Saudi Arabia, Sahara Net, Elm Company, Advanced Electronics Company (AEC), Mozn, Quant Data & Analytics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia AI agents market appears promising, driven by ongoing technological advancements and increasing adoption across various sectors. As businesses continue to seek efficiency and enhanced customer experiences, the integration of AI agents is expected to become more prevalent. Additionally, the government's commitment to fostering innovation through funding and regulatory support will likely create a favorable environment for growth, positioning Saudi Arabia as a regional hub for AI development and deployment.

| Segment | Sub-Segments |

|---|---|

| By Type | Conversational Agents (Chatbots, Virtual Assistants) Autonomous Agents Predictive Agents Embodied AI Agents Multi-Agent Systems |

| By Technology | Machine Learning Natural Language Processing (NLP) Deep Learning Computer Vision Reinforcement Learning Speech Recognition & Generation Large Language Models (LLMs) |

| By End-User | Retail & E-commerce Healthcare Financial Services & Banking Telecommunications Government & Smart Cities Manufacturing Education Transportation & Logistics Energy & Utilities Others |

| By Application | Customer Support & Service Automation Sales and Marketing Automation Data Analysis & Insights Personalization & Recommendation Fraud Detection & Risk Management Process Automation (RPA) Others |

| By Deployment Mode | Cloud-Based On-Premises Edge Computing |

| By Sales Channel | Direct Sales Online Sales Distributors/Partners |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Freemium/Trial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Solutions | 60 | Healthcare Administrators, IT Managers |

| Financial Services AI Applications | 50 | Risk Analysts, Compliance Officers |

| Retail AI Implementations | 45 | Marketing Directors, Operations Managers |

| Manufacturing AI Integration | 40 | Production Managers, Supply Chain Directors |

| AI in Education Sector | 45 | Educational Administrators, IT Coordinators |

The Saudi Arabia AI Agents Market is valued at approximately USD 80 million, reflecting significant growth driven by the adoption of AI technologies across various sectors, including healthcare, finance, and retail.