Region:Middle East

Author(s):Dev

Product Code:KRAB8002

Pages:92

Published On:October 2025

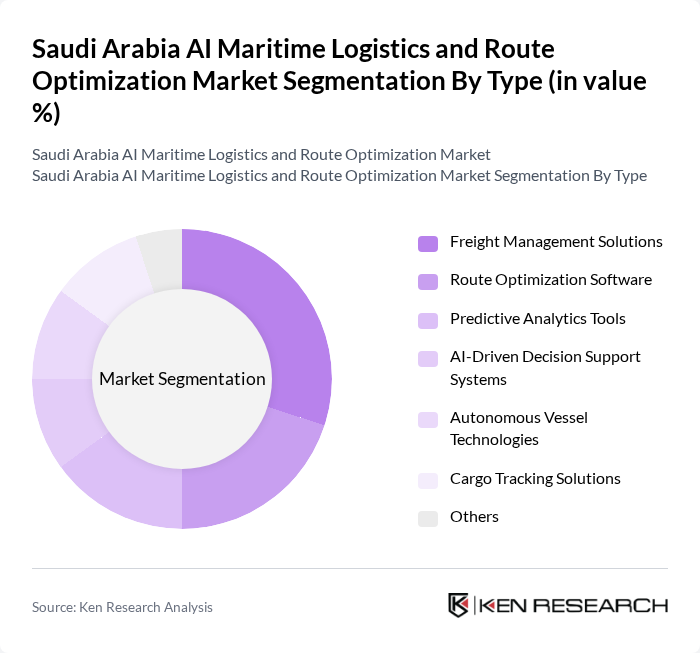

By Type:The market is segmented into various types, including Freight Management Solutions, Route Optimization Software, Predictive Analytics Tools, AI-Driven Decision Support Systems, Autonomous Vessel Technologies, Cargo Tracking Solutions, and Others. Among these, Freight Management Solutions are leading due to their critical role in streamlining shipping processes and enhancing operational efficiency. The increasing complexity of global supply chains has driven demand for these solutions, making them essential for logistics providers.

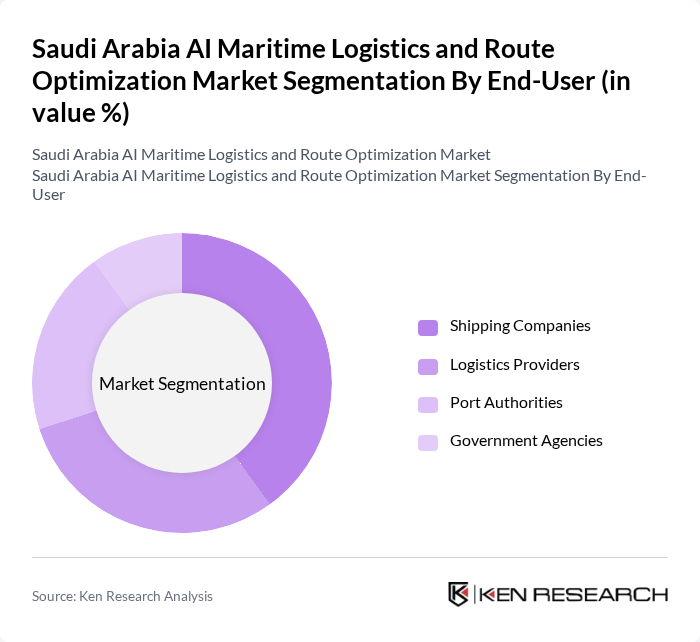

By End-User:The end-user segmentation includes Shipping Companies, Logistics Providers, Port Authorities, and Government Agencies. Shipping Companies are the dominant segment, driven by the need for efficient fleet management and cost reduction. The increasing volume of maritime trade and the necessity for real-time tracking and management of shipping operations have made these companies the primary users of AI maritime logistics solutions.

The Saudi Arabia AI Maritime Logistics and Route Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maersk Line, Hapag-Lloyd AG, CMA CGM Group, Mediterranean Shipping Company (MSC), DP World, Kuehne + Nagel, A.P. Moller-Maersk, ZIM Integrated Shipping Services, Yang Ming Marine Transport Corporation, Evergreen Marine Corporation, Orient Overseas Container Line (OOCL), PIL (Pacific International Lines), XPO Logistics, Sinotrans Limited, Toll Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian AI maritime logistics market appears promising, driven by ongoing advancements in technology and increasing government support. As the demand for efficient shipping solutions continues to rise, companies are likely to invest in AI-driven tools for route optimization and operational efficiency. Additionally, the development of smart ports and enhanced digital infrastructure will facilitate seamless integration of AI technologies, positioning Saudi Arabia as a leader in maritime logistics innovation in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Solutions Route Optimization Software Predictive Analytics Tools AI-Driven Decision Support Systems Autonomous Vessel Technologies Cargo Tracking Solutions Others |

| By End-User | Shipping Companies Logistics Providers Port Authorities Government Agencies |

| By Application | Container Shipping Bulk Shipping Tanker Shipping Passenger Shipping |

| By Distribution Mode | Direct Shipping Third-Party Logistics Freight Forwarding |

| By Technology | Machine Learning Applications Big Data Analytics Cloud Computing Solutions |

| By Investment Source | Private Investments Government Funding International Partnerships |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives for Maritime Investments Grants for Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Maritime Logistics Providers | 100 | Logistics Managers, Operations Directors |

| AI Technology Vendors | 80 | Product Managers, Business Development Executives |

| Port Authority Officials | 60 | Regulatory Officers, Port Operations Managers |

| Shipping Companies | 90 | Fleet Managers, Supply Chain Analysts |

| Consultants in Maritime Logistics | 70 | Industry Analysts, Strategy Consultants |

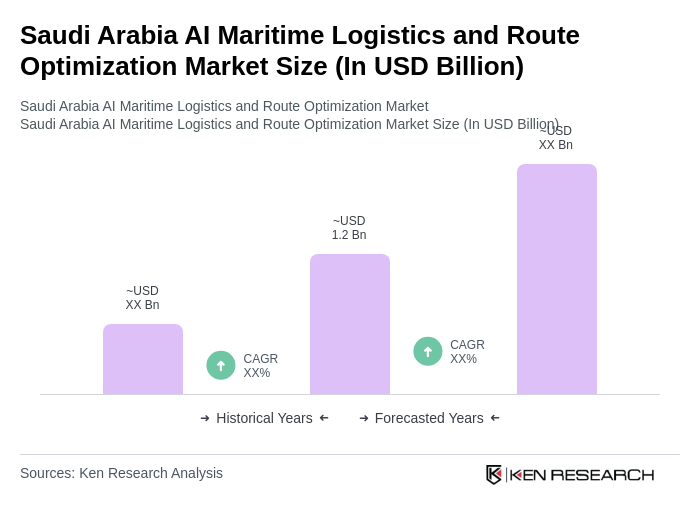

The Saudi Arabia AI Maritime Logistics and Route Optimization Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the adoption of AI technologies in logistics and the increasing demand for optimized shipping routes.