Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8118

Pages:88

Published On:October 2025

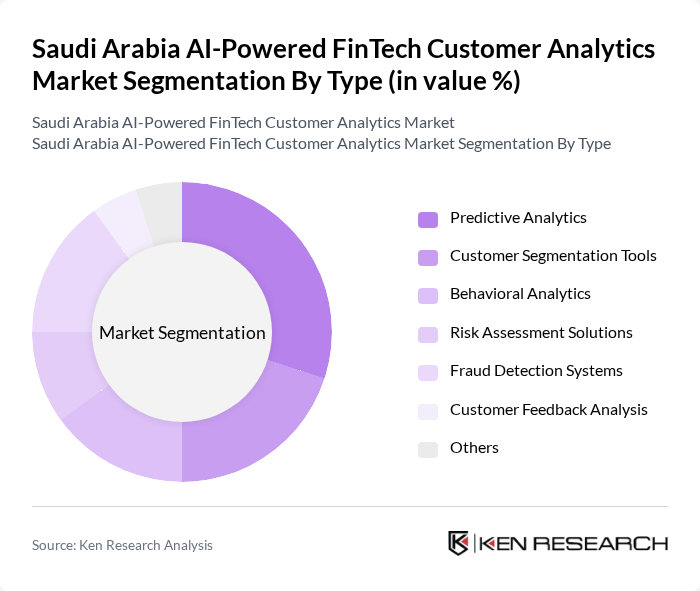

By Type:The market is segmented into various types, including Predictive Analytics, Customer Segmentation Tools, Behavioral Analytics, Risk Assessment Solutions, Fraud Detection Systems, Customer Feedback Analysis, and Others. Each of these sub-segments plays a crucial role in enhancing customer insights and improving service delivery.

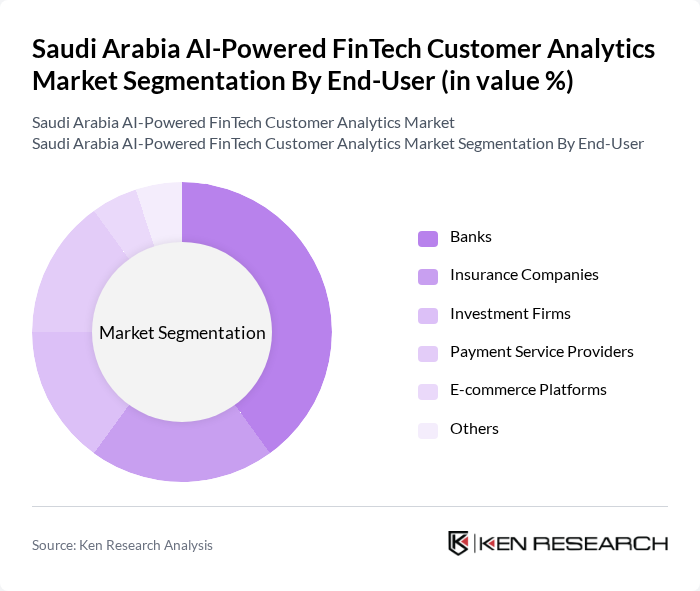

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Service Providers, E-commerce Platforms, and Others. Each segment utilizes AI-powered customer analytics to enhance operational efficiency and customer engagement.

The Saudi Arabia AI-Powered FinTech Customer Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Pay, Tamam Financing, Fawry, NCB Capital, Alinma Bank, Riyad Bank, Al Rajhi Bank, PayTabs, Monsha'at, Zain Cash, Aion Digital, Qarar Financial Services, SABB, Al-Faisal Holding, Bidaya Home Finance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI-powered FinTech customer analytics market in Saudi Arabia appears promising, driven by ongoing technological advancements and increasing consumer expectations. As the government continues to support innovation through regulatory sandboxes, FinTech companies are likely to explore new AI applications. Additionally, the growing emphasis on data-driven decision-making will encourage financial institutions to invest in advanced analytics, enhancing customer experiences and operational efficiencies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Customer Segmentation Tools Behavioral Analytics Risk Assessment Solutions Fraud Detection Systems Customer Feedback Analysis Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Service Providers E-commerce Platforms Others |

| By Application | Customer Retention Strategies Marketing Campaign Optimization Credit Scoring Customer Experience Enhancement Compliance and Reporting Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Resellers and Distributors Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Tiered Pricing Freemium Model Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customer Analytics | 150 | Customer Experience Managers, Data Analysts |

| Investment Services Analytics | 100 | Portfolio Managers, Financial Advisors |

| Insurance Sector Customer Insights | 80 | Underwriting Managers, Claims Analysts |

| Payment Solutions Analytics | 120 | Product Managers, Risk Assessment Officers |

| Wealth Management Customer Profiles | 90 | Client Relationship Managers, Market Researchers |

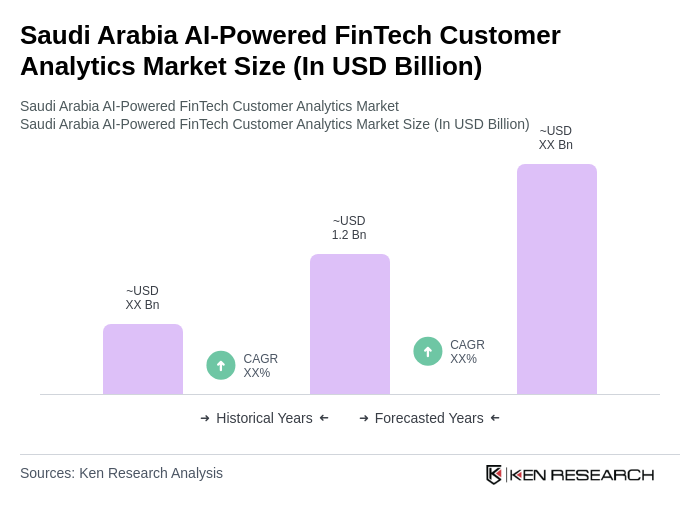

The Saudi Arabia AI-Powered FinTech Customer Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital banking solutions and personalized customer experiences.